The Psychology, Demographics, and Global Rise of Dividend Seekers

Aug 14, 2025

They’re older. They’re everywhere. And they’re quietly moving trillions.

In 2025, one ETF — JPMorgan’s JEPI — crossed $41 billion in assets. Its sibling JEPQ hit $29 billion. In China, dividend funds pulled in the equivalent of $6 billion in a single year. From New York to Tokyo, money is flowing into products that promise one thing: regular cash in your pocket.

Now picture this: a 68-year-old retiree, coffee in hand, watching dividends drop into his account every month. For him, those payments are worth more than a soaring capital curve. They’re not just income. They’re security, discipline, and peace of mind.

Every year, millions of investors make the same choice — prioritizing dividends over capital gains. This defies classical economic theory. But it’s not irrational. It’s human.

After years without doing a deep literature dive, I decided to seek both academic and market answers to a simple question: Who really are the income investors — and why do they invest this way?

I. Demographics: Growing in Number, Older, Not Necessarily Wealthier or More Educated

If you want to understand income investors, the obvious starting point is to look at who they are — and more importantly, how many they are. And here’s the thing: they’re not a niche group lurking in obscure corners of the market. They’re a growing global force, reshaping product design and capital flows.

A. Quantifying the Population: Insights from Market Data

Since there is no global register of “income investors,” their presence is often inferred through market activity and product demand.

1/ The Exploding Supply of Income Products as a Key Indicator

A primary indicator of their growing numbers is the booming market for public income products. Consider the capital flows into funds like JPMorgan’s JEPI (JPMorgan Equity Premium Income ETF) and JEPQ (JPMorgan Nasdaq Equity Premium Income ETF) in the USA. JEPI reached approximately $41 billion in AUM by July 2025, and JEPQ around $29 billion. Their European UCITS equivalents, launched in late 2024, have also collected substantial sums, indicating significant international demand. Dividend funds in China (e.g., CNY 42 billion, or ~$6 billion USD, by the end of 2023, showing a steep rise) and global dividend-focused ETFs (experiencing inflows of $23.7 billion in H1 2025, the highest in 3 years) continue to gather significant assets. This widespread collection of funds confirms a massive demand for income-oriented products.

2/ Measuring the Invisible: Proxies and Surveys

Beyond market flows into income-specific products, national household surveys, taxation data, and regional investment patterns offer robust and verifiable means to quantify this elusive population, providing crucial insights into investor behavior across regions.

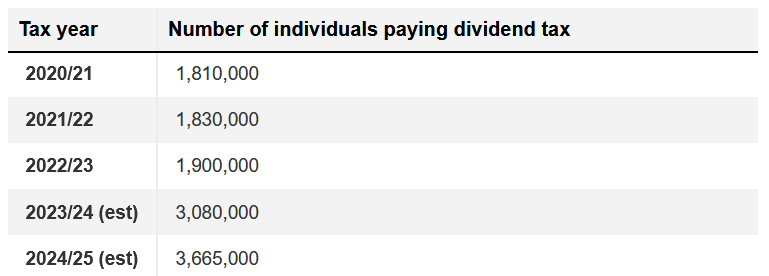

Comprehensive studies from leading financial authorities directly capture the stated objectives and investment habits of millions worldwide. For instance, reports from the Federal Reserve (US) and Vanguard’s How America Saves series consistently reveal a significant segment of investors prioritizing income generation and wealth preservation over pure capital appreciation. In Europe, the FCA’s Financial Lives Survey 2024 (UK) similarly describes profiles of individuals whose financial stability relies heavily on regular distributions, with the lowering of the dividend allowance in the UK in 2024/25 notably bringing a record 3.7 million people into dividend tax, signaling a massive and active base of dividend recipients.

This pattern of income-seeking behavior is also observed in Asia, particularly in markets with aging saver bases like Japan and Korea, where deep listed real estate markets (REITs) play a significant role in providing distributive products. While less precise for hard numbers, the vibrant online communities dedicated to dividend investing (e.g., popular subreddits with millions of subscribers) serve as a global qualitative indicator of this engaged audience, reflecting a widespread, expressed interest in predictable income streams. Income investors are growing in numbers, but who are they?

B. Demographic Characteristics: Older, Not Richer

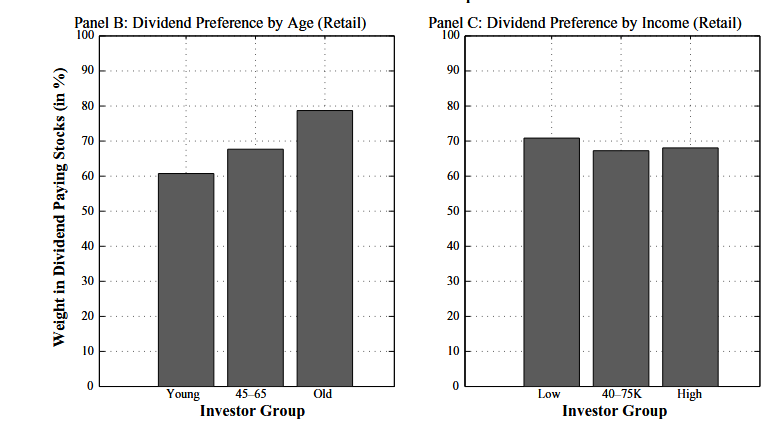

Empirical studies confirm that demographic characteristics significantly influence investors’ dividend preferences.

1/ Age and Dividend Preferences: A Clear Link

The global aging trend, with increasing proportions of individuals aged 65 and over in the US, EU, and Asia-Pacific, directly fuels the demand for income-generating investments. Older investors tend to favor dividend-paying stocks more. A study by Graham and Harvey (2001) shows that older investors allocate a larger proportion of their portfolios to high-dividend stocks. This preference is even stronger among those with lower incomes, suggesting that dividends serve as a crucial source of current income for this group. Another study by Weisbenner (2005) indicates that companies located in communities with a higher proportion of people aged 65 and over are more likely to pay dividends, highlighting the importance of local preferences among senior investors. The proportion of income investors demonstrably grows with age, retirement, and longevity uncertainty.

Source: Journal of finance – https://people.duke.edu/~jgraham/website/DivClientele_JF_Final.pdf

2/ Income & Socioeconomic Status: An Observed Divergence

A notable divergence exists when examining investment preferences across socioeconomic strata. Investors with low or moderate incomes, often driven by a greater need for regular cash flows, demonstrably show a stronger preference for dividends. Research indicates that these individuals allocate a larger portion of their portfolios to high-dividend stocks. Conversely, high-income investors or those with advanced education levels (e.g., PhD holders) tend to prioritize capital growth. For instance, a study on the Pakistan Stock Exchange specifically found that PhD holders exhibited significantly lower preferences for cash dividends compared to individuals with only a secondary education. This observed inverse relationship, highlighted in academic findings, suggests that financial security and educational background can significantly shape an investor’s fundamental preference for either direct income or asset appreciation. However, such correlations are complex and often subject to specific market, psychological and cultural contexts.

3/ Gender and Marital Status (Mixed Findings)

Studies on the influence of gender on dividend preferences are mixed. Some research suggests that men prefer dividends more than women, while other studies find no significant difference. For example, a study conducted in Islamabad indicates that gender has no significant effect on investors’ dividend preferences. Regarding marital status, a study by Khan et al. (2024) finds that married investors exhibit a slightly lower preference for cash dividends compared to single investors. Actually, no preference has been identified for women or men.

II. Psychology: The Unique Mindset of Income Investors

Numbers alone can’t explain this phenomenon. To really understand income investors, we need to step inside their minds. Why, in a world where economists say “just sell shares if you need cash,” do millions still prefer the drip of dividends?

The answer lies at the intersection of behavioral quirks, emotional comfort, and the way we mentally separate money into “income” and “capital.”

1/ The “Dividend Puzzle” Revisited

Economists have long grappled with the dividend puzzle: in theory, dividends should be irrelevant. As Modigliani & Miller (1961) argued, an investor can simply generate their own income by selling a portion of their shares. Yet, companies persistently continue to pay them, and investors consistently seek them out. Various explanations have been put forward to account for this divergence, including tax considerations, the signalling effect of a company’s financial health, or simply the psychological comfort derived from a regular “paycheck” without diminishing the invested capital. As Fischer Black (1976) observed, it remains an enigma with numerous partial explanations, none of which have curtailed the practice of distributions. Actually, maybe mainstream economists are just wrong. But it remains an enigma for them. Not for us.

Credit: https://fr.pinterest.com/Katpitalist/

2/ Behavioral Finance Insights — Mental Accounting

Mental accounting (Thaler, Shefrin & Statman) profoundly explains the dividend preference. Investors mentally separate capital (“the tree”) from income (“the fruit”). Selling shares feels like cutting into the tree, but spending dividends feels like picking fruit — preserving the asset while enjoying the harvest. This regular, guilt-free cash flow provides comfort in volatile markets, though it can tempt some into chasing unsustainably high yields.

3/ Psychological Comfort & Discipline

Dividends provide a powerful sense of financial security and discipline, helping investors avoid the aversion to losses or the reluctance to sell shares, especially during market downturns. They offer a stable income stream without the emotional burden of active portfolio management or asset liquidation. As one retired teacher from the UK, 72 years old, aptly puts it: “I never want to sell shares — it feels like eating my seed corn. Dividends are my paycheck.”

All these psychological elements are paramount to understand. Because, let us always remember, they influence our behavior during a crash (which will inevitably happen). Dividends serve as a psychological protection and improve the long-term performance of a portfolio. Not to mention that reinvesting dividends during a crash significantly increases long-term performance. Everything is about time perspective.

III. Perspectives on Income Investing: There Won’t Be Sufficient Space for Everyone

So we know who income investors are, and we’ve seen why they think the way they do. But what’s next for them?

The landscape is expanding — but not infinitely. From dividend aristocrats to REITs to covered-call ETFs, the supply of yield-friendly products is booming. The challenge is whether these products can keep delivering in a world where demand is accelerating faster than the opportunities themselves.

A. The Landscape of Income Investing and Preferred Vehicles Could Be Saturated

The market offers a range of financial products tailored to the income investor’s preferences for regular cash flow:

- Dividend Stocks: Especially those with high yields or a history of consistent dividend growth.

- Covered-Call / Buy-Write Strategies (e.g., JEPI/JEPQ): These ETFs monetize option premiums to generate monthly income, often at the cost of capping upside potential.

- Real Estate Investment Trusts (REITs): These publicly traded companies own, operate, or finance income-producing real estate, offering regular distributions from rental income.

- Bonds: Including investment-grade bonds for stability or high-yield bonds for greater income (with higher risk).

- Multi-Asset Income Funds: Designed to diversify income sources across different asset classes.

- Insurance Products: Such as annuities and “protected income” plans, particularly popular in US retirement plans, with 92% of survey respondents expressing interest in protected lifetime income solutions in one American Century study.

However, this market is not infinitely scalable, and flagship products accessible to the general public risk reaching saturation. Take Asia’s REIT market, for example: its growth has been massive. If price pressure persists, yields will inevitably fall. The real challenge isn’t the number of income products available, but finding enough diversified opportunities to deliver adequate yields for an aging population.

B. Income Investor Main Challenges for Next Decades

While income investing addresses specific investor needs, it also presents distinct challenges and points of debate within the financial community.

1/ Yield Traps and Yield Chasing

A common consideration is the risk of being drawn to unusually high yields without proper due diligence, which can indicate underlying company distress, potentially leading to capital loss or dividend cuts. Prioritizing quality and valuation over “naked yield” often outperforms. Some CEFs (Closed End Funds) and mREITs are yield traps; investors have to deep dive into accounts and dividend policies.

2/ The Total Return Debate — Growth Investors Have Long Claimed Victory

Focusing too rigidly on yield can hurt overall returns (capital gains + dividends) versus a growth-oriented or balanced approach. Strategies that cap upside, like covered calls, require accepting this trade-off. Institutional research (e.g., Vanguard) often promotes total-return optimization with programmed decumulation to avoid sector concentration and dividend traps. For years, this view has dominated — leaving income investors constantly challenged, and sometimes mocked.

3/ Geographical Differences and Global Perspective

The income investing landscape varies by region. In the US, “premium income” (JEPI/JEPQ) and “dividend growth” (SCHD, VIG) ETFs are highly popular. The UK and Europe have a strong dividend/REITs culture but face increasing tax pressure (e.g., the UK’s reduced dividend allowance) and are seeing the rise of UCITS versions of premium income strategies. Asia-Pacific features deep listed real estate markets and an aging saver base (Japan, Korea), emphasizing distributive products. But in a monetary system undergoing restructuring and destabilization, investors will need to develop the skills to achieve broad global diversification.

Intellectual Takeaway: Choose Your Side

We’ve looked at the demographics. We’ve explored the psychology. We’ve assessed the market landscape. The conclusion is clear: income investors are not a passing fad — they’re a structural force in modern markets.

The income investor population is far from a niche; it is a large, growing, and distinct segment of the financial world, driven by deep-seated demographic shifts, ingrained psychological preferences, and pragmatic needs that often defy pure economic theory. Income investors are older, have a different investment psychology, and may be more numerous among low and middle-income investors. Beyond these generalities, we know little about them.

What we do know is that they are insufficiently studied, supported, and educated. And this, while the world is aging and the need for passive income is set to explode. This is where the profound challenge for our financial future lies. In a rapidly aging world, planning for reliable passive income isn’t optional — it’s essential for a dignified retirement and sustained financial independence.

With the world’s over-65 population set to double by 2050, the question is not whether income investing will grow, but whether markets can keep pace with this surging demand for sustainable income without compromising future yields. Pipart Global Income offers insights, strategies, and analysis to help you build and protect that income, so you can live retirement with confidence and peace of mind. Imagine your retirement with monthly income arriving like clockwork — Pipart Global Income shows you how.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.