Betting on the Chinese High Education Market?

Sep 09, 2025

In my relentless search for yield across sectors and currencies, I often venture into high-risk, high-reward territories that many income investors avoid. China, despite its well-documented challenges of transparency and volatility, remains an impossible market to ignore for those seeking asymmetric opportunities. Today, I’m analyzing a controversial play: a private education company offering a seemingly unsustainable 10% dividend yield amid collapsing profits. This isn’t a stable income pick—it’s a high-conviction speculation on a deep-value turnaround story, where the market’s panic may have created a rare opportunity. Let’s determine whether this is rational investing or reckless yield-chasing.

I/ Bottom-up approach: an Education firm in full expansion

A/ A 22-year-old small cap in full growth

Edvantage Group Holdings (0382.HK) is a leading private higher education and vocational training provider in China’s Greater Bay Area — spanning Guangdong, Hong Kong, and Macau. . Founded in 2003 and publicly listed on the Hong Kong Stock Exchange since 2019, the Group is now moving beyond its home market, accelerating an international strategy that raises both opportunities and execution challenges. As shown below, the company has opened many schools since 2003.

Source: Edvantage Group

With nearly 96,000 students in 2024, Edvantage differentiates itself through a diversified portfolio—ranging from higher education and vocational programs to non-formal learning—while integrating technologies such as artificial intelligence. This approach reflects its ambition to align training with industry demand, but also puts pressure on maintaining quality at scale as the network expands across nine institutions in China, Australia, and Singapore. The challenge is clear: maintaining quality while managing growth and meeting the industrial sector’s demand for skills.

Source: Edvantage Group

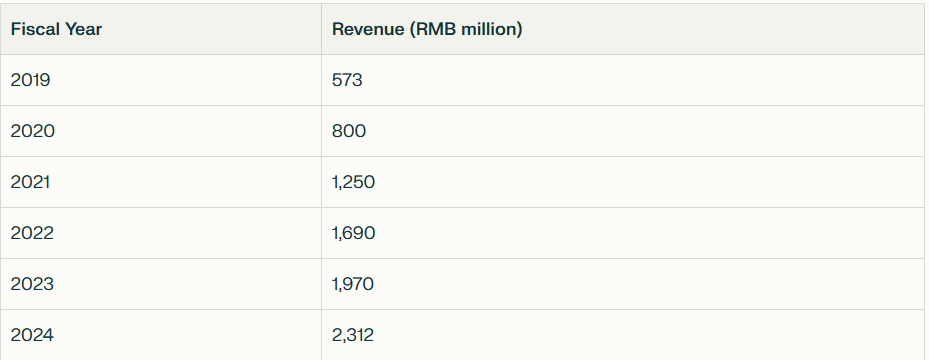

Over the past several years, Edvantage has demonstrated strong and consistent revenue growth. Revenues grew from RMB 573M in FY2016 to RMB 2.31B in FY2024 — an impressive +22% CAGR over eight years, outperforming most peers in China’s private education sector. This shows robust organic growth driven by increased student enrollment, strategic acquisitions, and expansion into international markets. While keeping a balanced 30% dividend payout ratio, Edvantage reinvests heavily in campus expansion, industry partnerships, and global collaborations—working with players like ByteDance, Huawei, and JD.com to deliver job-ready skills. ESG commitments further support its positioning, from rural revitalization programs to sustainable practices.

Source: Edvantage Group

With a mission to develop innovative, application-oriented talent and a vision to become a global education brand, Edvantage is well aligned with China’s national policies on vocational training and internationalization. This alignment with national policy is a tailwind, but the financial execution remains the ultimate test. So, how profitable is this expanding empire?

Source: Edvantage Group

The question now is whether this early-stage global push can translate into long-term value without diluting its competitive edge at home and maintain good financial results.

B/ A profitable company

In H1 2025, revenue rose +7.5% YoY to RMB 1.25B, supported by higher enrollments and tuition fees. However, profitability came under pressure: gross profit dropped 16.5% and net profit fell 28% to RMB 244 million, hit by rising costs from campus expansion, faculty hiring, and digital initiatives. Adjusted net profit declined by 25.3%, reflecting the same trend.

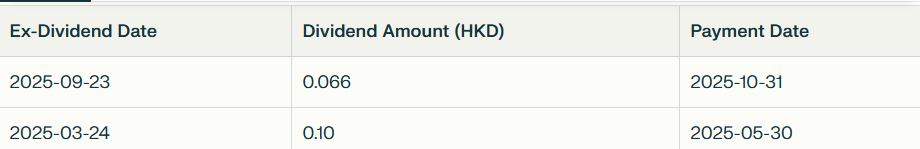

Despite falling profits, Edvantage maintained an interim dividend of HKD 6.6 cents/share, keeping its 30% payout ratio intact. But under this policy, a prolonged profit decline would mechanically force dividend cuts — making execution on growth critical. On the balance sheet, liquidity remains solid with RMB 1.86 billion in cash, but bank borrowings climbed to RMB 1.9 billion, increasing financial leverage as growth capex accelerates. The underlying tension is clear—sustain rapid expansion while protecting margins, balance sheet stability, and shareholder returns.

1. Revenue Quality

Edvantage generates the bulk of its revenue from recurring tuition fees, providing a relatively stable and predictable cash flow. That said, short-term programs, ancillary services, and industry partnerships contribute a smaller, more variable portion, creating some year-to-year volatility.

- Average revenue per student has risen steadily in recent years, boosted by fee increases at premium campuses and the Group’s international expansion into Australia and Singapore.

- This mix gives Edvantage a resilient revenue base, but the company remains heavily dependent on the Chinese market, which is subject to regulatory shifts and demographic trends.

2. Cost Analysis

The recent margin compression stems from two main drivers:

- Fixed investments: aggressive campus expansion and international growth. These costs are front-loaded and are expected to be absorbed as student enrollment rises.

- Structural pressures: rising teacher salaries and technology investments in digitalization and AI-driven learning platforms. These are persistent costs that could maintain downward pressure on margins.

Implication: Margin recovery will rely on both scaling student numbers efficiently and tight operational cost management, making execution a critical factor for long-term profitability.

3. Edvantage’s financial health reflects both resilience and emerging challenges. The net profit margin for the six months ended 28 February 2025 was approximately 19.5% (RMB 244 million ÷ RMB 1.25 billion), down from 25% in FY 2023, driven by rising costs from campus expansion and digital initiatives. Return on equity (ROE) is estimated at 12%, based on annualized net profit and shareholder equity of ~RMB 2 billion, indicating solid but declining efficiency in generating returns. The debt-to-equity ratio, calculated at ~0.6x (RMB 1.9 billion in borrowings ÷ RMB 3.2 billion in total equity), reflects moderate leverage but highlights increased borrowing to fund growth. Free cash flow, estimated at RMB 400 million for H1 2025, sufficiently covers the interim dividend of HKD 6.6 cents per share (RMB 90 million total), supporting the 10% yield. However, a further 20% profit decline could push net profit below RMB 600 million annually, risking a dividend cut under the 30% payout policy. These metrics underscore the need for tight cost control and enrollment growth to sustain profitability and dividends.

4. Relative Valuation

At 4.5x P/E and a 10% forward yield, Edvantage trades at crisis-level valuations — far below peers like China East Education (6.8x P/E), Lincoln (15.2x), or Strategic Education (18.5x). For income-focused investors, this mispricing could represent a rare asymmetric opportunity. Its 22-24% revenue CAGR (2016-2024) surpasses all peers, though regulatory risks in China and margin pressures warrant caution. Compared to stable U.S. peers, Edvantage’s high yield and growth potential make it attractive for income-focused investors willing to navigate its risks.

Takeaway: Edvantage combines solid growth, attractive yield, and operational scale, but investors must weigh this against regulatory, cost, and macro risks.

II/ Top-down approach

A/ Is it a volatile bond ?

Not exactly… First, Edvantage Group’s shareholding structure is marked by a strong family presence, which can be a significant strength. Debo Education Investments Holdings Ltd., the majority shareholder with over 71% of the equity, is jointly owned by Mr. Liu Yung Chau and Mrs. Chen Yuan Rita, fostering a long-term vision and stable governance. This entrenched family ownership underscores a high level of commitment to the company’s success, aligning strategic decisions closely with shareholder interests. Meanwhile, the remaining shares are held by public investors and institutions, providing liquidity but still allowing the founding family to guide the company’s direction.

Since its IPO in July 2019, an investment of HKD 10,000 in Edvantage Group Holdings has generated a disappointing total return. The share price has fallen from HKD 2.85 at IPO to HKD 1.63 today, representing a loss of roughly 40% on the stock alone, while total dividends received over the period amount to approximately HKD 1,225. This brings the overall total return to around –30.5%. Such underwhelming performance underscores a well-known pattern: IPOs rarely reward early buyers with long-term gains, as initial hype often inflates prices beyond sustainable levels. However, with the stock now trading significantly below its IPO price, this could represent an attractive entry point for income-focused investors seeking stable dividends, provided they are willing to accept the inherent risks and uncertainty of a post-IPO recovery.

Source: Yahoo Finance

Edvantage Group Holdings Limited maintains a clearly defined dividend policy, targeting a payout ratio of approximately 30% of net profits. This approach has been consistently applied, including for the fiscal year ended 31 August 2024 and the interim period ending 28 February 2025. The board emphasizes that this policy strikes a balance between rewarding shareholders and retaining sufficient capital to fund ongoing investments and growth initiatives. While actual dividend amounts have shown an upward trend, the company cautions that future increases may not be linear and will depend heavily on its profitability trajectory, which remains a key strategic consideration.

B/ The great uncertainties I live with

Political Risk in China: Government Regulation of Private Education

China’s tightened education regulations since 2021, notably the Double Reduction Policy, have disrupted the sector, causing a 25% revenue drop for New Oriental Education in FY 2021 (Bloomberg, 2022). For Edvantage, non-formal learning programs (~10% of FY 2024 revenue, RMB 231 million) are most vulnerable. A similar restriction could cut revenue by 10% (RMB 231 million) in a base case, reducing net profit by ~RMB 45 million and risking a 15% dividend cut (HKD 0.025 per share) under the 30% payout policy. In a worst-case scenario, a 20% revenue hit (RMB 462 million) could slash profits by RMB 90 million, potentially halving the 10% yield to ~HKD 0.08 per share. Edvantage’s focus on policy-aligned vocational training and partnerships with Huawei and JD.com mitigates this risk, but regulatory uncertainty remains a critical hurdle.

Currency Risk: Impact of the Hong Kong Dollar

While Edvantage earns the majority of its revenue in RMB, its listing and dividend payments in Hong Kong dollar expose it to exchange rate fluctuations. The interplay between the RMB and HKD can cause volatility in reported earnings and dividend values. Active currency risk management is required to mitigate impacts on financials and shareholder returns.

Risks Related to International Expansion

Edvantage’s footprint beyond China (which is very low right now) into markets such as Australia, Singapore, and the Middle East exposes the Group to intense competition and diverse regulatory regimes. Integrating acquisitions and new campuses across varying cultural and operational contexts presents operational challenges. These may pressure profitability and require sustained capital investment to establish and protect market positions.

These risks highlight the delicate balance Edvantage must maintain between pursuing aggressive growth and managing uncertainties inherent in its operating environment. Flexibility and strategic foresight are essential for sustainable value creation amidst evolving internal and external challenges.

Investment Takeaway: A High-Conviction, High-Yield Speculation

I am initiating a small, observational position in Edvantage at HKD 1.63. This is not a defensive income play but a high-risk, high-conviction speculation on a deep value turnaround story, where a 10% forward dividend yield (based on an expected annual payout of HKD 0.1666) compensates me for the risk while I wait for the thesis to unfold.

My decision rests on three pillars:

- Deep Value & Market Overreaction: The crisis-level P/E of 4.5x prices in a permanent decline, arguably overpenalizing the stock for short-term pains while ignoring its resilient, policy-aligned core business and impressive historical growth.

- Investment, Not Dilapidation: I interpret the alarming 28% profit drop not as a model failure, but as the necessary cost of future growth. The expansion costs are front-loaded investments. If execution succeeds, current margins represent a cyclical low, not a structural one.

- The Yield as a Dynamic Margin of Safety: The 10% dividend provides a tangible return during the wait. This buffer significantly reduces the downside risk of permanent capital impairment.

In essence, I am buying the long-term vision at a distressed price, collecting a premium yield for my patience, and betting on management’s ability to execute. The risks are severe, but the asymmetric payoff potential—where the downside is protected by a high yield and the upside could be substantial on a successful turnaround—warrants a small, calculated position.

What’s your take on Edvantage? Is the 10% yield enough to compensate for the Chinese regulatory risk and the profit crunch? Let me know in the comments.

Next week, we’ll pivot to a less risky, high-income investment for contrast. Subscribe to ensure you don’t miss it and to discover all my favorite income assets.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.