Until Now

Aug 26, 2025

Three months ago, we analyzed JEPQ to understand how this ETF works. I recommend revisiting the first article (First article on JEPQ) for those unfamiliar with this product. It appears complex, but it really isn’t. Simply put, the product promises more income, fewer capital gains, and smaller drawdowns. In exchange, it accepts lower total returns. Still, this ETF remains controversial despite the clarity of its promise. Now, two questions arise: Is the controversy justified? And have the results since 2023 lived up to the initial expectations?

I/ JEPQ: Did the Risky Bet of 2023 Pay Off in 2025? A Deep Dive into the Debates

A. Timeline of the Debate: From 2023 Optimism to Growing Doubts

In 2023, JEPQ launched as an intriguing hybrid for investors. Its distinctive strategy—combining high monthly income with Nasdaq 100 exposure—was celebrated by optimists as ideal for a rising market with muted volatility. Advocates maintained that its actively managed covered-call strategy would outperform rivals like QYLD, offering a superior risk-reward balance compared to pure growth ETFs. Enthusiasm was strong at that stage.

(Source: Bloomberg)

However, as the year progressed, doubts emerged. Analysts contended the strategy had structural weaknesses, questioning whether JEPQ could truly fulfill its long-term promises. The main critique centered on its “capped upside, uncapped downside” profile, which, combined with historically low volatility, made it unattractive both for growth seekers and income-focused investors. Critics also pointed to design flaws, especially since other covered-call ETFs sometimes delivered stronger returns. On Seeking Alpha, critical articles have surged recently (between May 22 and June 30, 2025), coinciding with the fund’s rising popularity.

Source: https://seekingalpha.com/symbol/JEPQ/analysis

B. The Arguments: A Clash of Views

The debate extended beyond performance metrics to fundamental investment philosophy. Some believe the concept itself is flawed. Others say it may not endure.

Debate 1 – Risk of NAV Erosion: Pessimists flagged that the strategy might be oversimplified. They warned that selling options on a volatile index like the Nasdaq 100 could lead to long-term capital decay. Citing cases such as the TSLY ETF, they suggested JEPQ’s holdings could suffer steep drawdowns that option premiums wouldn’t fully compensate, ultimately eroding the fund’s NAV. By contrast, optimists see JEPQ as one of the few covered-call ETFs offering both income and some potential for capital gains.

Source: Portfolio Visualizer

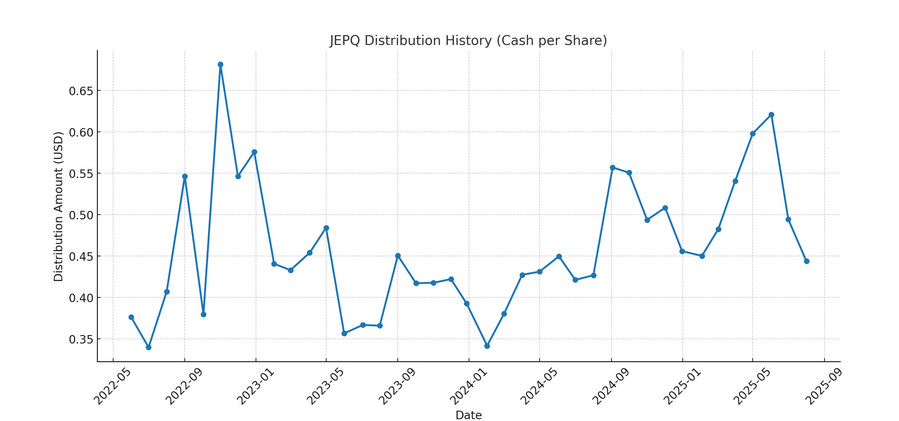

Debate 2 – Income Volatility: Another point raised was that market conditions were unfavorable for the fund. Pessimists noted that the historically low VIX (implied volatility) depressed the premiums JEPQ collected, directly impacting its monthly payouts. This made its yield less compelling relative to its previous performance and associated risks. Simply put, it became an income tool reliant on volatility spikes, creating unreliable income—a critical flaw for income investors.

Source: Portfolio Visualizer

Debate 3 – The Hybrid Approach: Supporters praised JEPQ’s use of Structured Notes (ELNs) to generate high income without entirely sacrificing growth. They viewed it as reconciling the traditionally opposing goals of high income and capital appreciation. The fund promised the “best of both worlds”: a substantial monthly income while allowing participation in Nasdaq 100 gains. Among seasoned income investors, this debate is mostly settled: opting for income means accepting capped upside.

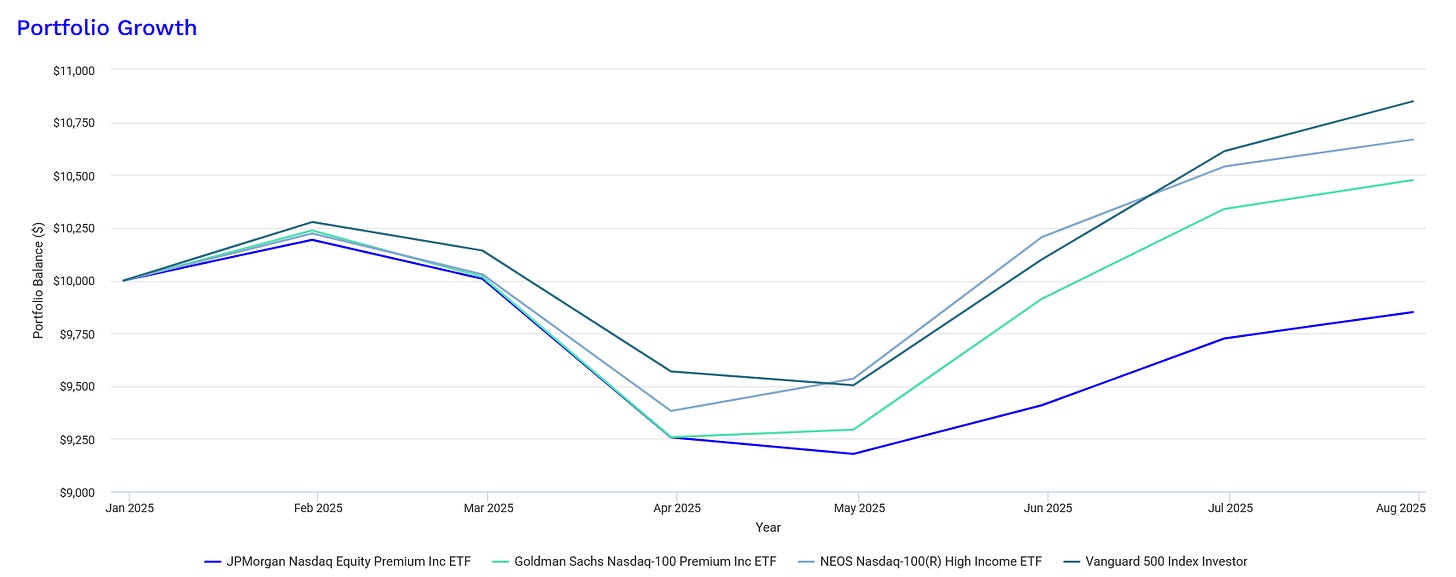

Debate 4 – Superior ETF Alternatives: Critics argued that for nearly all investors, better choices exist. For those focused on long-term growth, the uncapped upside of QQQ is clearly superior. For pure income seekers, funds like SVOL or GPIQ offer higher and steadier yields. Many remain skeptical, believing JEPQ’s promise is illusory since investors end up sacrificing growth relative to QQQ and yield relative to specialized income funds. This debate intensifies as covered call ETFs attract more inflows. Yet ultimately, investors want to see whether the theory proves out in actual performance.

II. The Verdict So Far: August 2025

The market performance ultimately settles theoretical debates—and here, the facts are clear.

A. The Facts: Outstanding Performance

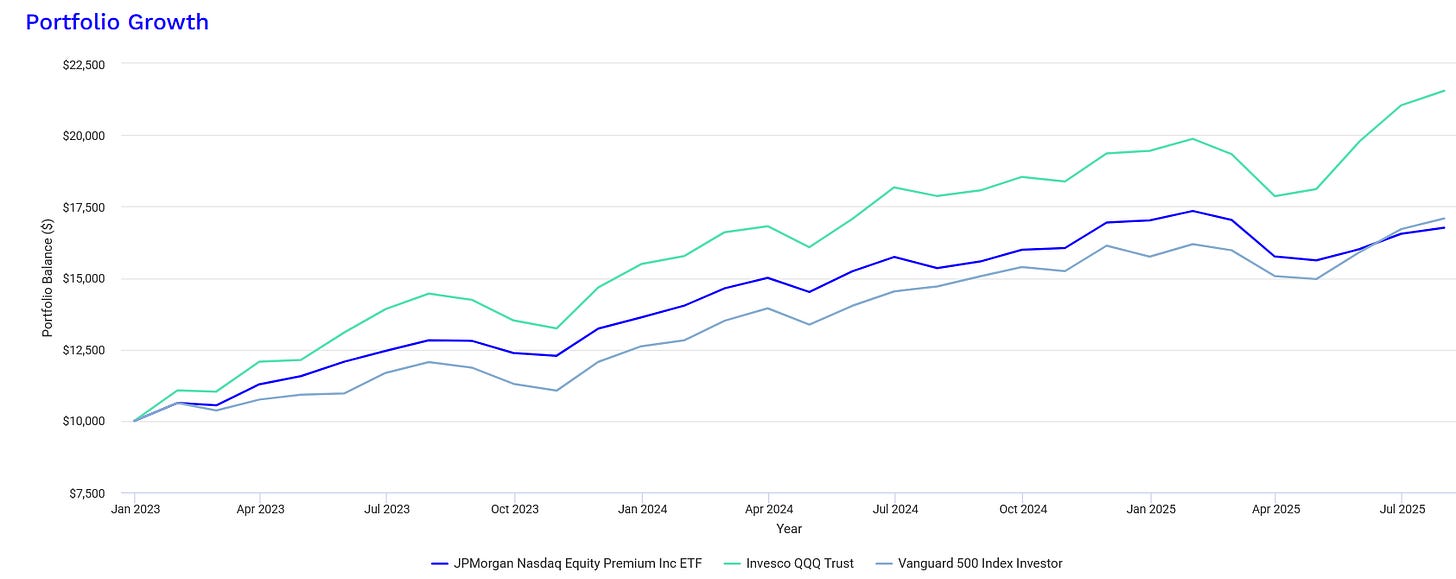

Despite warnings, JEPQ’s real-world results have supported the bullish case—at least short term. It avoided fears of a “Volmageddon 2.0” collapse and delivered strong returns: +24.89% total return in 2024 and +5.67% in the first half of 2025.

Debate 1 – NAV erosion: No signs of NAV erosion yet, though vigilance continues.

Source: Portfolio Visualizer

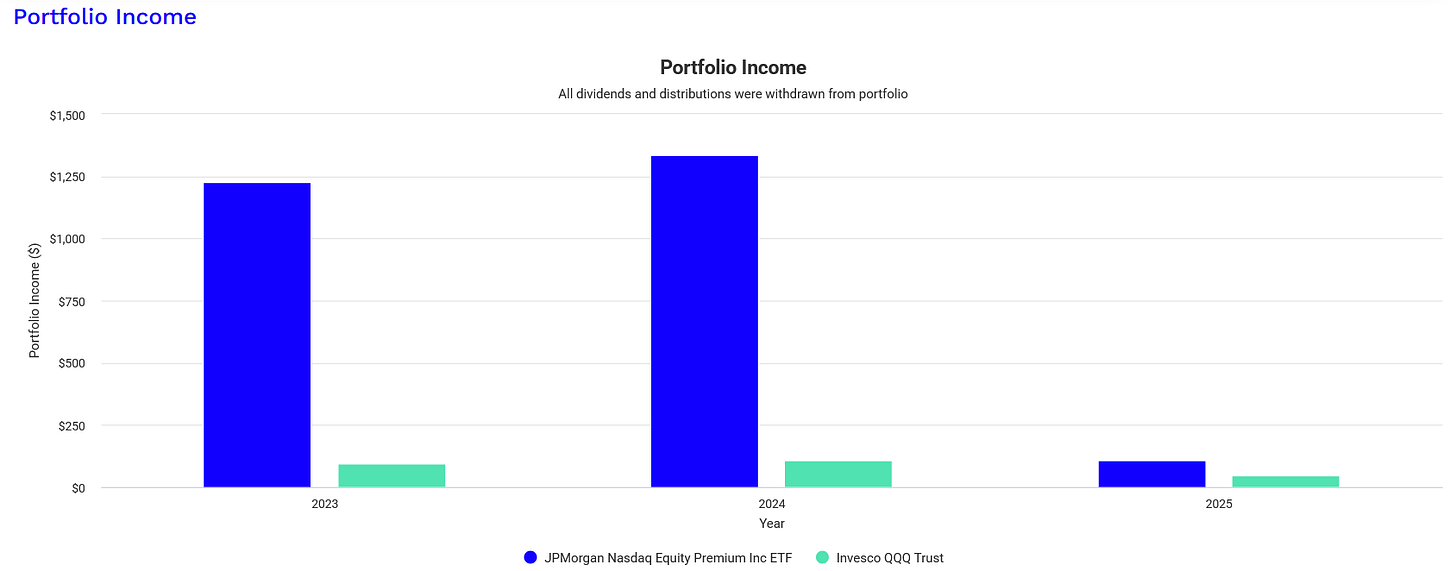

Debate 2 – Income volatility: Annual income appears steady.

Source: Portfolio Visualizer

Monthly income experiences larger swings.

Source: Portfolio Visualizer

Debate 3 – Hybrid strategy: Short-term success, with positive capital gains and income, though bear market impact remains to be tested.

Source: Portfolio Visualizer

Debate 4 – ETF alternatives: Competitors are too new for firm conclusions. JEPQ trails somewhat but it’s early. Also, UCITS versions from rivals are not yet widely available. Further observation is needed.

Source: Portfolio Visualizer

In brief, the fund has consistently generated meaningful income, delivering monthly dividends translating to about an 11.13% yield in 2024, roughly $6.18 per share annually. The income stream remained stable or even grew during this period, backing JEPQ’s claim of combining capital growth and attractive yield. These figures prove JEPQ navigated volatility well while producing solid returns and high income. While not conclusive, the results are convincing enough for now.

B. JEPQ: A Niche Income Solution

JEPQ’s story is of a fund thriving in favorable conditions, overcoming theoretical risks and critics’ warnings. It demonstrates that its distinctive strategy can be highly effective.

Yet, the core lesson holds: JEPQ is a specialized tool for a specific investor profile, not a universal fix. The fundamental trade-off remains. Investors must prioritize:

- For pure long-term growth, Nasdaq 100 (QQQ) remains the clear choice.

- For high-yield income optimization, specialized funds like SVOL may fit better.

JEPQ represents a middle path—a successful compromise. It showed growth ETFs can provide meaningful, regular income, but investors decide if this fits their portfolio balance.

For my personal income focus, a double-digit income investment with some capital gain potential is essential. I keep in mind the risks: the product hasn’t yet proven itself over a full market cycle and remains relatively young.

Investment Takeaway

It’s a controversial investment but, so far, it has lived up to its promises and delivered double-digit income. It suits me by providing exposure to the world’s leading Nasdaq tech names. I benefit from both income and moderate capital gains.

There are still points to explore in the next update: the risk of options market saturation (which could reduce income) and product complexity risks—topics for later.

For now, I’m enjoying the double-digit yield and maintaining my long-term position. This ETF is the largest holding in my portfolio. I reinvest its dividends into other income-generating sectors and strategies. I also look forward to seeing how it performs in a bear market.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone. Double digit dividend.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.