The Best Pacific International Case

Jul 22, 2025

I initially became interested in Nameson Holdings as I was looking for high dividend opportunities in Asia outside the tech, energy, or REIT sectors (see last week’s article). This company belongs to the discretionary consumption sector. It supplies elastic bands and lace to lingerie and sportswear companies. As always, there’s a mystery—or rather, a dilemma: a 12% yield on a Chinese small cap – is it the opportunity of a lifetime or a trap? Such a high yield, often associated with high risk, piques curiosity and warrants analysis. Let’s dive in and see whether this yield is sustainable and “deserves” to be included in my Pipart Global Income portfolio.

Source: http://www.bestpacific.com/uploads/20250325_IR%20PPT_FY2024(Print).pdf

I/ A Successful Global Business in a Discretionary Market

A/ Strengths of a B2B Player

1/ BPI’s Job: Crafting Core Elastic Textiles for Global Apparel

Best Pacific International Holdings Limited (Stock code: 2111.HK) is a B2B player, a global manufacturer and supplier of elastic textile materials—including fabrics, webbing, and lace—primarily for the lingerie and sportswear industries. It benefits from a kind of niche leadership: recognized leader in its niche (manufacturing high-quality elastic fabrics and lace), with technical expertise that is difficult to replicate in the short term.

Source: http://www.bestpacific.com/uploads/20250325_IR%20PPT_FY2024(Print).pdf

For those who want to see what elastic webbing looks like:

All of this is very interesting, but already one concern deserves attention: the cyclical nature of the business—and therefore of profits and dividends. Still, let’s stay focused on the business itself, because the answer is often found there. And indeed, the first important nuance is that B2B model stability is currently a strength, as the company is less directly exposed to the whims of end consumers than direct-to-consumer brands.

2/ Core Strengths: Driving Force of BPI’s Global Reach

Regarding clients, Best Pacific has established client relationships: long-standing partnerships with major international lingerie and sportswear brands. The names of the client companies are never explicitly disclosed, but one can imagine brands like Victoria’s Secret, Uniqlo, Calvin Klein, etc.

Its innovation capability is very strong: investments in R&D to develop new materials and technologies. Best Pacific International stands out for its strong innovation efforts, allocating substantial resources to developing high value-added technical textiles. This commitment to product differentiation allows the company to attract and retain major global brands and escape pure price competition. However, the textile industry remains extremely cost-sensitive, and innovation alone is not enough to protect margins—especially against low-cost competitors. Best Pacific’s long-term competitiveness relies on maintaining technological leadership while rigorously managing costs. In the end, innovation is a key asset, but continuous operational efficiency is essential to support growth and profitability. In truth, I believe this is still a market primarily driven by cost competitiveness and economies of scale.

Let’s now turn to the financials to understand the business cycle, profitability, and potential sustainability of earnings. Revenue and net income are indeed cyclical—as expected from the sector—but profitability is rising.

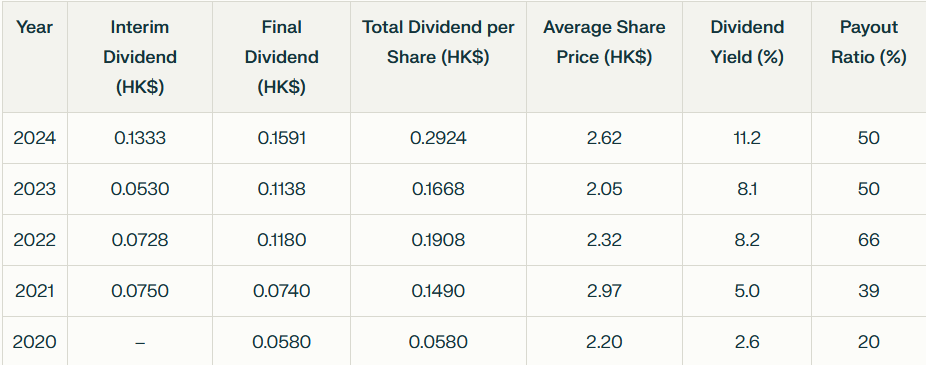

In summary, Best Pacific International’s management recently emphasized strong FY2024 results, achieving a 20.5% revenue increase to HK$5,061m and a 75% net profit surge to HK$608m, with net margins expanding from 8.3% to 11.7% due to disciplined cost control and improved gross margins. The sportswear elastic fabric segment delivered standout growth of 28.7% to HK$2,805m, driven by robust demand and a competitive edge in synthetic apparel markets. Optimized production processes and better capacity utilization further strengthened profitability. A 75% dividend hike to HK 29.24c underscores the company’s robust free cash flow and commitment to shareholders. These strengths highlight a company with accelerating top-line momentum, improving profitability, strong segment leadership, and shareholder-aligned capital allocation. That’s true, but there are still risks to consider.

B/ Business Risks: The Ongoing Battle for Stability

1/ Operational and Market Risks

Reliance on Major Clients

Best Pacific International heavily depends on a small group of key clients, which poses a significant risk, though this concentration may be less severe compared to other players in the sector. The loss of one or two major clients could materially disrupt revenue streams, as these clients likely account for a substantial portion of sales. This vulnerability underscores the need for diversification to mitigate potential impacts on financial stability.

Dependence on Discretionary Consumption Market

Operating in the apparel sector, Best Pacific is exposed to the volatility of non-essential consumer spending. Economic downturns, shifts in consumer confidence, or changes in fashion trends can significantly reduce demand for sportswear and elastic fabrics, making the company sensitive to macroeconomic cycles and regional market fluctuations.

Raw Material Volatility

The company faces risks from price fluctuations in raw materials, such as synthetic fibers and chemicals, which are critical to its production. Sudden spikes in costs or supply chain disruptions could compress margins, particularly if the company cannot pass these costs onto customers in a competitive market.

2/ Competitive and Investment Risks

Competitive Pressure

The textile industry, especially in Asia, is fiercely competitive, with numerous players vying for market share. Best Pacific must continuously innovate and maintain cost efficiency to stay ahead, as pricing pressures and technological advancements from rivals could erode its market position. Best Pacific International positions itself as a mid-sized player in the global textile industry, with a revenue of approximately US$550 million, operating within a competitive landscape that ranges from sector giants generating over US$10 billion in annual revenues (such as Shenzhou International or Weiqiao Textile) to smaller, more specialized players with revenues below US$500 million.

Low Free Float and Investor Considerations

Additionally, the company’s very low free float is a critical factor, signaling limited liquidity and inherent risks for investors. This characteristic requires a cautious approach, as it may suit those willing to take calculated risks. I plan to allocate a small portion of the portfolio to this stock, as it remains a rewarding asset despite its low liquidity, where minority shareholders may have less influence.

However, this comes with clear strengths: a “family-run” business often exhibits greater long-term stability, and, paradoxically, the interests of management and shareholders are closely aligned. This dynamic warrants close monitoring, as the market may lack the depth to align the stock price with its intrinsic value. Herein lies perhaps the most compelling opportunity for savvy investors.

This is, therefore, a high-risk investment opportunity where the expected return must balance the inherent volatility, in line with the high yield / high risk principle.

II/ The Income Investor’s Perspective

A/ Encouraging Results for Shareholders but High Yield = High Risk – A 12% Yield Opportunity?

1/ A good Total Return since IPO in 2014

Between May 2014 and July 2025, Best Pacific (2111.HK) delivered a total return of +124.7% with dividends reinvested, resulting in a CAGR of 7.52%. Notably, 52.5% of this gain came directly from dividends. In comparison, the Hang Seng Index achieved a negative price return over the past decade, with a 10-year CAGR of approximately -0.28%. Even including dividends, total return for the Index remained flat to mildly positive—at best delivering a 0–1% annualized gain over the same period. This is a respectable performance and makes me think it’s a potentially interesting long-term investment, provided it is bought opportunistically and doesn’t occupy too large a share of the portfolio.

2/ Is This 12% Yield an Exceptional Yield or a Trend?

Best Pacific International’s dividend yield has climbed to over 11% (based on the average annual share price) and 12% (based on recent price) in 2024, among the highest in the Hong Kong market. This reflects both rising payouts and a share price that has lagged behind earnings growth. With a payout ratio around 50%, dividends are well covered, suggesting discipline and financial prudence. However, the group operates in a cyclical sector (textiles, apparel), which could expose it to earnings volatility. Despite strong cash flow and regular semi-annual payments, future dividends remain sensitive to demand fluctuations, and management has shown readiness to adjust distributions if needed.

The low P/E (7.5x) and P/B (0.9x) ratios indicate the market may be discounting the stock due to these risks and its low free float, which limits liquidity and increases volatility. This compelling valuation, combined with the high yield, presents an intriguing opportunity for risk-tolerant investors, but the potential for price-value misalignment and competitive pressures in the textile sector demands rigorous due diligence. These factors highlight a company with strong fundamentals yet significant risks, aligning with the high yield/high risk thesis. Let’s now consider whether macro risks change this analysis.

B/ Macro Risks: Geopolitics, Cost Competitiveness, Currency Risk

1/ Political Risks: An Unavoidable Weight on Operations

Beyond the company’s internal challenges, Best Pacific International, like any major player rooted in the Chinese manufacturing landscape, is inextricably tied to the broader political chessboard. The specter of Chinese macroeconomics, from the lingering effects of past zero-COVID policies to the efficacy of new stimulus measures, directly dictates the domestic demand for their products and the overall stability of their operational environment. A slowing economy means potentially fewer orders from local brands or even a ripple effect on international clients sourcing from the region. This isn’t just about economic cycles; it’s about the fundamental health of the production space in which Best Pacific operates, influencing everything from consumer spending power to the confidence of their business partners.

Perhaps even more concerning are the geopolitical tensions. The ongoing US-China trade war, the imposition of tariffs, and the ever-present threat of escalation around Taiwan aren’t just headlines; they’re direct threats to Best Pacific’s supply chains and market access. These aren’t hypothetical risks; they are real-world pressures that can disrupt material flow, increase export costs, and push international clients to seek safer havens outside China. Furthermore, the government regulation risk, explicitly cited by the company, perfectly aligns with these macro trends. Sudden policy shifts in industrial or social spheres – be it new environmental mandates or changes in labor laws – can impose unexpected costs and operational adjustments, forcing Best Pacific to pivot rapidly or face penalties, sometimes with very little warning.

2/ Financial Risks: The Shifting Sands of Competitiveness and Currency

When we delve into the financial landscape, cost competitiveness emerges as a critical macro risk for Best Pacific. Their entire business model has historically leveraged China’s manufacturing advantages, but the question is stark: Is this cost advantage sustainable? As wages in China steadily rise, and countries like Vietnam and India increasingly offer competitive alternatives, Best Pacific faces an uphill battle to maintain its pricing edge. Best Pacific’s core textile manufacturing is centered in Dongguan, China, complemented by overseas operations in Vietnam, reflecting a strategic regional diversification common in the textile industry.The explicit mention of “fluctuations in the prices or shortage in supply of principal raw materials” in their own report underscores this vulnerability, directly impacting their profitability. This isn’t just about operational efficiency; it’s about the fundamental economics of where their production is located and their ability to source effectively in a volatile global market.

Concurrently, currency risk (FX) looms large. While the Hong Kong Dollar’s peg to the USD offers some stability for international transactions, Best Pacific’s revenues and costs are denominated in various currencies. Fluctuations against the Yuan, or other currencies of their diverse client base and supplier network, can erode margins and introduce unwelcome volatility into their financial results – a risk they clearly acknowledge. For a company dealing with international trade, managing these currency exposures is a constant challenge, and significant shifts can directly impact their reported earnings, regardless of underlying operational performance.

Investment Takeaway

Best Pacific International’s 12% yield perfectly embodies our high yield / high risk philosophy. It’s an investment that promises volatility but strategically fits into our portfolio. Its HKD listing offers welcome stability compared to other Asian currencies, and crucially, it represents a valuable diversification opportunity in the discretionary consumer sector, where we previously had no position. In short, a small allocation is justified to capture this yield potential, with full awareness of the associated risks. But it is not for te faint hearted. It is a potentially volatile investment (share price and dividend). This is ok for me.

Coming Soon on Pipart Global Income Following this in-depth analysis, we’re continuing our exploration of yield opportunities in Asia. We’ll turn our attention to Stella International (HKG:1836). This will be a chance to deepen our sectoral and geographical diversification, all while refining our average 10% China yield strategy.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.