Stocks For The Long Run – J. Siegel

Affiliate link – Read the book here

From the very preface, the author states several key ideas of his work: stocks outperform all other financial assets, simply because they carry higher risk. And, among stocks, those that pay significant dividends and have low P/Es (Price to Earnings) perform better than growth stocks. He adds that equity investors must absolutely have a strategy of geographical diversification, given that a significant part of global growth will occur in Asia within 20 years.

Part 1 – Stock returns: past, present, and future

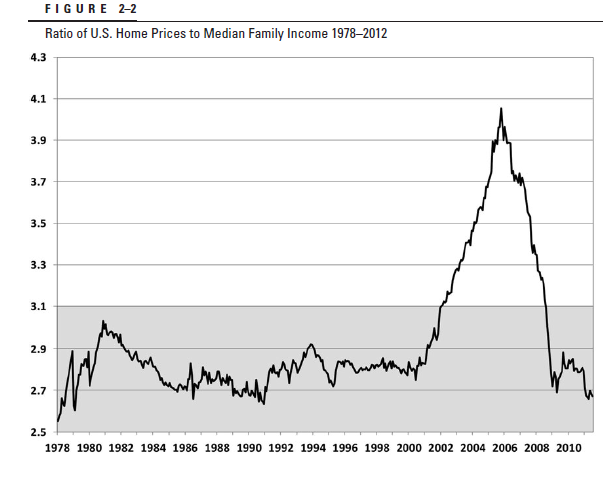

The author also traces the evolution of the markets by analyzing the major financial crises of 1929, 2001, and 2008. He recalls the role of the Fed (the US central bank) as a lender of last resort to limit the effects of the crisis: after letting Lehman Brothers fail, the insurer AIG was saved thanks to a massive loan. This crisis was caused by the explosion of the subprime bubble (toxic mortgage loans that had been widely disseminated into the global economy), triggering a real estate crisis, then a financial one, and finally, an economic one. The following chart (housing prices relative to median income) shows how inflated the housing bubble had become.

Page 28 of the 2014 edition

The Fed’s action limited the effects of the financial crisis compared to the situation in 1929. During the financial crisis, assets behaved in an ‘interesting’ way, in that US and international stocks all moved in the same direction at the same time. Only gold and long-term US bonds served as safe havens. At the end of the crisis, the outlook is worrying for the United States: a significant public deficit, massive money creation, and a slow return to growth.

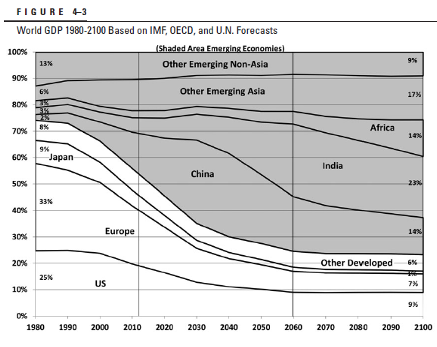

Two strategic issues are particularly highlighted by the author: the aging of the global population and the emergence of China, India, and Asia as a whole. He considers the question in these terms: will the young populations of developing countries be able to produce the goods for the aging populations of developed countries? And will these young people be rich enough to buy the assets of seniors in rich countries who will absolutely need to finance their retirements? The figure below indicates the potential shift in wealth production by the horizon of 2100, showing that the transfer of economic power will occur by the end of the century.

Page 65 of the 2014 edition

Part II/ The verdict of history

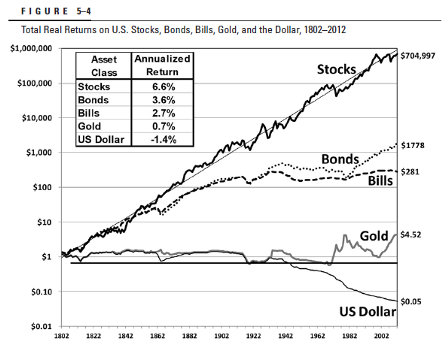

The verdict is clear: after adjusting for inflation, stocks have delivered an average real return of 6.6%. Stocks therefore protect against inflation and constitute the most profitable asset in the long term, regardless of the political, economic, and financial context. And over the long term (15 to 20 years), stocks are less risky (the standard deviation is lower).

Page 82 of the 2014 edition

The author’s observations run counter to the dominant theory, known as “modern portfolio theory,” whose teachings indicate that a portfolio of financial assets should include several asset classes to reduce total portfolio risk. Indeed, in his analysis, Professor Siegel proves that, over a longer holding period, concentrating the portfolio on stocks reduces risk. He draws particularly insightful conclusions regarding portfolio construction. Furthermore, his statistical analyses challenge the so-called “random walk” theory, which states that stock price movements follow a “random walk” and therefore could not be predictable.

The author then analyzes stock indices. The S&P 500, created in the 1960s, is sectorized according to the GICS classification comprising 10 sectors. While the weight of each sector changes significantly, no correlation is established between the size of the sector and the performance of companies within each sector. For example, the weight of the energy sector has decreased, while the performance of oil companies has been better than average. As for the original companies (present from the index’s creation), they have experienced better performance than companies added to the index, quite simply because the latter experienced significant price increases before joining the index, which hampered shareholder return on investment due to a high acquisition cost.

What are the sources of value creation for the shareholder? They are profits, which can be distributed (dividends), reinvested in the business, or used to buy back company shares, thus leading to a rise in the share price (potential capital gain). To measure value, the best method for evaluating a stock remains based on the value of future dividends (more reliable than retained earnings).

How to evaluate market value? Several indicators are used but are all limited if taken in isolation, especially as historical conditions can change considerably. What are these indicators: the P/E ratio (Price to Earnings), the earnings yield, and the dividend yield (compared to the bond yield). And what are the best investments? The determinant of performance is to buy quality stocks at a reasonable price, and not necessarily those with the highest growth. Furthermore, in the long term, stocks paying higher dividends offer better results. This observation is confirmed by the analysis of long-term stock market statistics.

The author also advises investors to add a touch of international diversification to their portfolio, to limit the risk inherent in the domestic market on which investors often tend to focus too much. The share of the United States and other developed economies in global market capitalization is expected to decline, due to the emergence of developing economies. A diversified portfolio must therefore take this reality into account, while keeping in mind that countries with the highest growth do not always offer the best returns (stock prices there are often already too high).

III/ How the economic environment impacts stocks

Several lessons:

- Among the major environmental changes, the abandonment of the gold standard for currencies and inflation constituted the main evolutions;

- The accommodative policies of central banks are very favorable to the rise of financial markets;

- Stocks constitute the best protection against the deleterious effect of inflation on the purchasing power of financial assets, at least in the long term.

- Economic cycles and major events (September 11, 2001, for example) have major effects, even though these events are not predictable. But major events represent only a small proportion of major stock market movements.

Once again, a long-term perspective helps protect against various short-term risks.

IV/ Stocks fluctuations in the long run

The appearance and rise of ETFs, the development of futures and options have transformed the market. ETFs seem to have increased the liquidity of the global equity market. As for market volatility, it is expressed mainly during the major stock market crashes: 1929, 1987, the flash crash of 2010, etc. Market movements can be particularly violent because market actors behave according to crowd psychology, which involves major changes in opinion—and therefore in price.

Technical analysis is often debated, but no fixed method is able to provide convincing results over the long term. However, to beat the market, there are calendar anomalies that deserve study. The January effect is simple: small caps outperform during this month compared to large caps. During the following 11 months, the performance is lower. The September effect, for its part, consists of a structural underperformance of stocks compared to other months.

Psychological factors are also extremely important, hence the emergence of behavioral finance. This science studies the main biases of investors: herd behavior in rising trends, panic, a poor relationship with financial loss, etc.

V/ Building wealth through stocks

The goal of many financiers is to beat the market, meaning to have a performance superior to the indices (the S&P 500 in general). Funds experience the greatest difficulty in beating the market. This observation undoubtedly explains the success of passive investing through ETFs. But these strategies also have perverse effects: thus, companies entering the S&P 500 have experienced a sharp price increase, which implies inherently lower returns on investment in the future.

On an individual level, how then to build a stock investment portfolio? The author states several principles:

1/ Have expectations in line with history (the historical returns of the stock market): buy companies with a P/E of 15 and anticipate returns on investment of around 6% to 7% after adjusting for inflation;

2/ If your investment horizon is the long term, invest the largest proportion of your portfolio in stocks;

3/ The largest part of your portfolio must be invested in low-cost index ETFs;

4/ At least one third of your portfolio must be invested in international stocks;

5/ Your portfolio should contain a maximum of value companies (low P/E and high dividend yield) because these stocks outperform high-growth stocks;

6/ In case of violent market movements, sit tight for a while and re-read the beginning of the book about long-term results.

In general, avoid trading and engaging in high stock turnover with the aim of beating the market. The psychological dimension is central, but the fundamentals remain the most important elements: in the long term, stocks represent the best way to build wealth.

Comments

- This is a fundamental book that every investor should read one day to improve their knowledge – it’s worth buying!;

- It is a fascinating work because it is very well-documented and very practical;

- It is a reference for comparing the performance of different financial assets;

- An intermediate level (in economics and finance) is required to read it and understand its meaning.