C for Currency – Currency Diversification and the Investor’s Stance

Historically, modern monetary systems have always featured a dominant currency, corresponding to the major economic and financial power of the era. Today, the US dollar is unequivocally the central currency of the global monetary system, serving as the primary unit of exchange and benchmark for nations. Previously, the British Pound Sterling held this role until the UK’s influence waned, ceding dominance to the United States. While a deep dive into historical and geopolitical intricacies isn’t necessary, understanding the broad global mechanisms is indispensable.

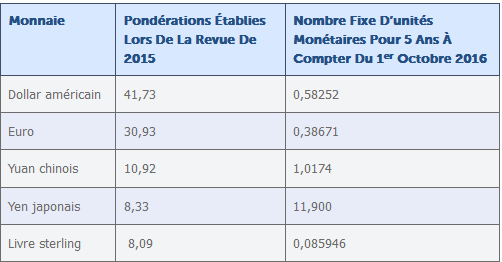

Firstly, it’s crucial to recall that the IMF (International Monetary Fund) established a currency basket called Special Drawing Rights (SDR), composed of the world’s major currencies, which it uses as an operational tool. Examining the composition of this basket is, once again, highly instructive.

Source: IMFhttps://www.imf.org/fr/About/Factsheets/Sheets/2016/08/01/14/51/Special-Drawing-Right-SDR

Utilizing this mix of currencies for passive investment would help secure income by mitigating risk tied to a single currency. However, this approach has clear limitations: it would concentrate investments almost exclusively in developed nations (89%) and the 11% allocation to the Chinese Renminbi does not fully capture the economic role of emerging markets.

Therefore, the question of currency exposure is central for investors targeting passive income, as they must hedge against the risk of fluctuation in various currency values—including their home currency. The first half of 2022 served as a stark example of the risk of seeing one’s domestic currency lose 20% of its value in mere months. Prudent income diversification would have allowed a foresighted investor to benefit from this situation, seeing their income stream increase in relative value.

While the SDR basket shows that a few currencies dominate the global system, it is useful to highlight other currencies deserving particular attention:

- The Swiss Franc (CHF), for its reassuring stability;

- The Canadian Dollar (CAD) and Australian Dollar (AUD), which offer diversification while remaining within the broader “dollar” sphere;

- The Hong Kong Dollar (HKD) and Singapore Dollar (SGD), which facilitate investment in Asia while circumventing the direct challenges of investing in mainland China.

Finally, other currencies provide access to high-potential regions but carry an elevated risk profile. Historically, this included the Brazilian Real (BRL) and the Russian Ruble (RUB) (prior to economic sanctions related to the conflict in Ukraine). These currencies are typically highly volatile and susceptible to inflation. Nonetheless, they hold interest as gateways to promising growth markets. Conversely, some currencies are considered safe havens during crises. This group includes the Swiss Franc (CHF), the Japanese Yen (JPY), the US Dollar (USD), and the Norwegian Krone (NOK).

Key Takeaways:

- The US Dollar is the dominant global currency; it is illusory to expect to generate a reliable passive income stream without holding a significant portion of assets in it.

- The IMF’s SDR basket defines a group of major currencies that is essential to understand and advantageous to hold.

- Certain currencies act as safe havens; holding them is beneficial during periods of economic crisis.

- Other diversification currencies are useful either for accessing different markets or for enabling more “offensive” and speculative strategies.