I for Portfolio Internationalization

What degree of portfolio internationalization is needed to face monetary instability and capture global growth?

A Brief History of Global Growth and Diversification Prospects

High levels of global economic growth do not automatically imply exceptional performance levels in those countries’ markets. Conversely, economic zones in stagnation or recession offer little chance for your investments to prosper. It is therefore essential to strive to capture the maximum potential of global growth through your investments, especially since developed economies—and Europe in particular—have experienced a period of moderate to low growth for many years.

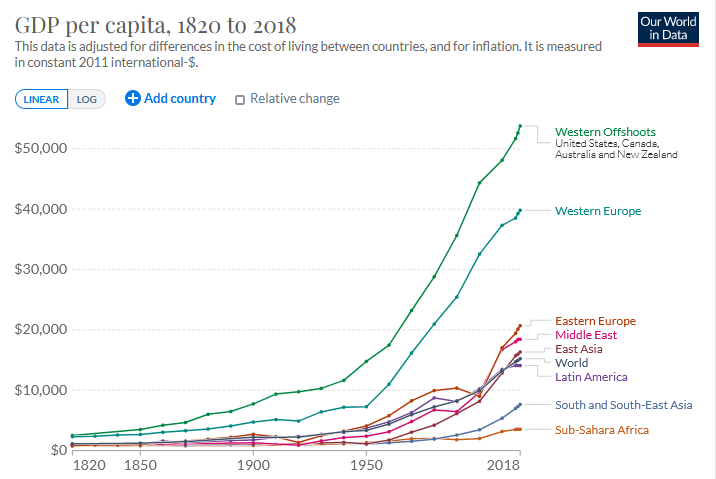

As with financial assets, it is useful to observe the long-term trends and performance of different economic zones. Over two centuries, the results are, once again, impressive. Western nations largely dominated the economic sphere during this period, and while other country groups saw significant rises late in the period, they still lag considerably.

[Source: GDP per capita worldwide from 1820 to 2018; Our World in Datahttps://ourworldindata.org/economic-growth

This chart is interesting because it helps us better understand the current structure of stock markets. Indeed, the most “classic” and structured financial markets are those of developed countries: North America, Europe, and Japan. There is, therefore, a clear relationship between the level of GDP growth and the development of financial markets in these countries.

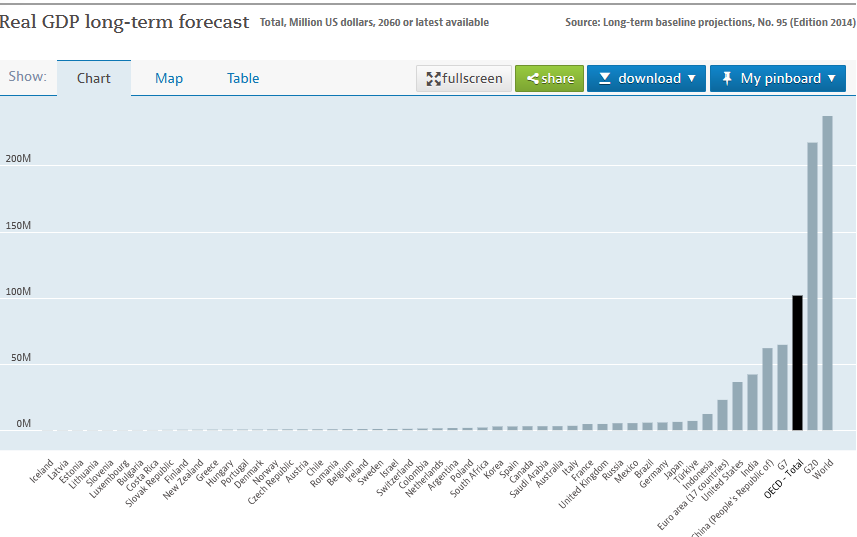

The financial markets of emerging countries are less developed, but it is reasonable to think that a catch-up growth phenomenon will likely occur—compensating at least partially for the delay—implying that their financial markets hold growth potential. The prospects for the BRICS nations (Brazil, Russia, India, China, and South Africa) seem positive, on the express condition that their economic systems remain stable and secure for investors. What do international economic institutions think of this outlook? The chart and map below show quite clearly which countries are projected to contribute most significantly to global GDP by 2060.

Source: OECD GDP forecasts to 2060: https://data.oecd.org/gdp/gdp-long-term-forecast.htm

The contribution of emerging countries to global GDP will be essential, and India, China, Brazil, and Indonesia immediately stand out as zones where it will be indispensable to invest to capture economic growth potential—and thus passive income. A strategy of investing solely in developed zones would therefore have the major limitation of not incorporating major historical trends. The map below clearly shows that wealth creation will be distributed across numerous geographical zones, and every investor should keep these forecasters’ works in mind.

[Source: OECD GDP forecasts to 2060: https://data.oecd.org/gdp/gdp-long-term-forecast.htm

As in many situations, an investor can have an investment thesis (an idea), but they also need an investment vehicle (an asset to buy) to derive income from it. Regarding international diversification, many opinions are often expressed, which can lead to total confusion.

For example, some will claim that buying French companies like Air Liquide or L’Oréal is sufficient to benefit from international growth. This argument is relevant but limits your ability to profit from global shifts to just a few business sectors. Others will mention ETFs, which allow for good global diversification without having to manage the investments directly. Again, this is a perfectly valid perspective, with the exception that many ETFs do not distribute income (they are accumulation ETFs). Finally, others will say that buying McDonald’s or Coca-Cola allows you to invest worldwide. Once more, this is a pertinent argument, but in this case, your portfolio would be overexposed to the US dollar and the risk associated with that currency’s fluctuations. Because, indeed, investing in different geographical zones also means investing in different currencies.