Still an accidental high yielder?

Jul 29, 2025

Reminder : bought in Q1

Here’s a quick update on ICADE, following the release of its H1 2025 financial results.

As a reminder, I personally own 485 shares of the company, purchased at €20.50, in march 2025 with a very long-term outlook.

I/ Investor experience since purchase in march 2025 : volatility, high yield, huge discount

Two things were certain: volatility and high yield. As always, the classic combination: high yield, high risk. First, let’s look at volatility: the price has fluctuated between 18.50 euros and 24.50 euros since the beginning of the year. Volatility has certainly been a factor. But one thing is clear: the property company’s difficulties are already priced in (see chart below for the stock price on July 25, 2025).

Source: Google finance

The high yield is certainly delivering. Unfortunately, I missed the March dividend as I was only able to purchase a few days after the ex-dividend date, but I did catch the July one.

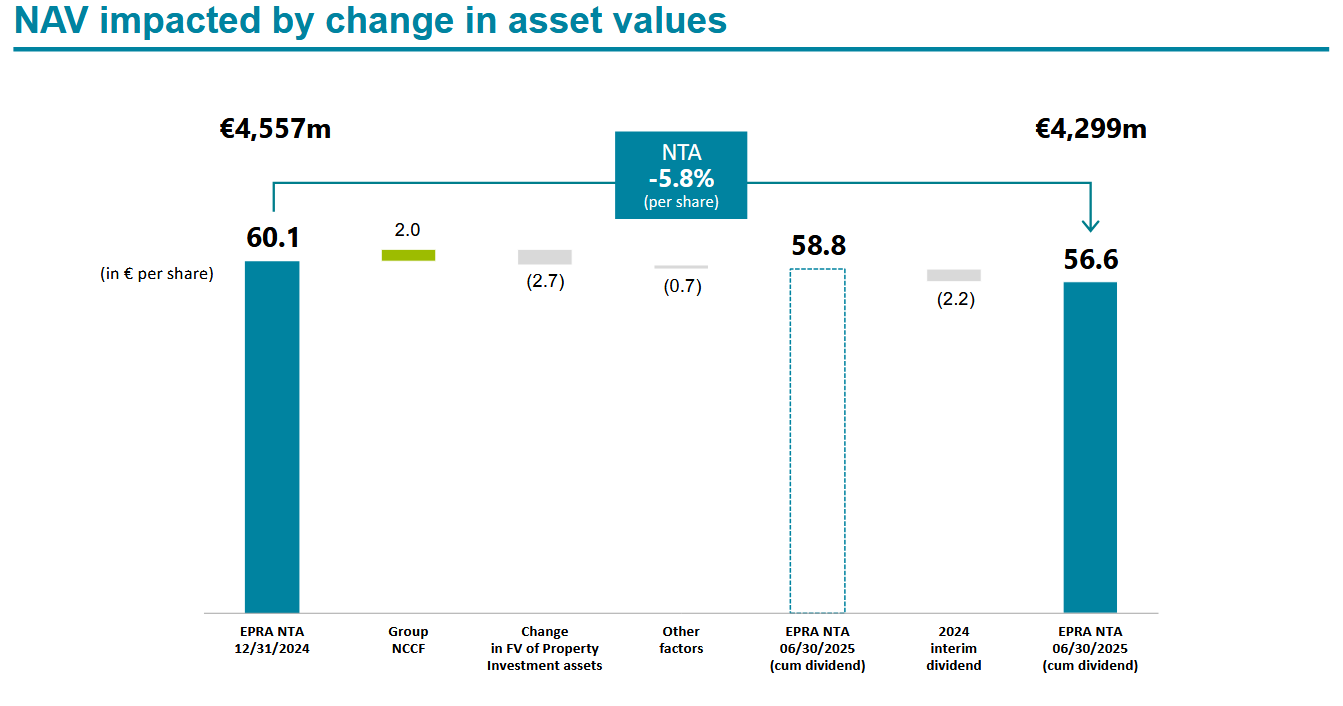

The discount, still enormous, has narrowed, moving from 66% to 61%. To be precise: Icade’s stock traded at a significant discount of approximately 61.31% as of June 30, 2025, based on its closing price of €21.90 against an EPRA NRV per share of €56.6.

My feeling at this stage is that the stock continues its journey and that the initial diagnosis remains sound: an unloved, deeply discounted stock with a high yield and good long-term prospects. This is the very definition of an accidental high-yielder. But we will now examine the financial and operational aspects to see if this thesis holds up.

II/ Recent Operational Changes: Executing the ReShapE Plan

Icade is actively engaged in a strategic repositioning, dubbed “ReShapE,” aimed at diversifying its portfolio towards more resilient segments and divesting non-strategic assets. This involves several key operational shifts observed in H1 2025.

Firstly, the company is actively diversifying its portfolio. This includes significant moves into student housing, evidenced by a partnership with Cardinal Campus and plans for approximately 750 new beds by 2028, with one project already slated for a Q1 2026 construction start.

The light industrial property segment is also showing success, with improved occupancy rates reaching 89.5% and its 21,000 m² portfolio now fully leased. Icade is also strategically transforming commercial zones, notably acquiring 11 former Casino sites for €32 million, earmarked for substantial mixed-use redevelopment including 3,500 residential units and over 50,000 m² of commercial space. Furthermore, the company is targeting data centers, with a project near Paris already 100% pre-leased for a Q2 2026 delivery.

Secondly, Icade is actively pursuing its strategy of repositioning and asset disposals. Over €100 million in non-strategic and core office assets were divested in H1 2025, including the Nancy University Hospital (€55 million) and a portfolio of five B&B hotels (€36 million).

Source: Google finance

The ongoing divestment of its healthcare business (Icade Santé) continues, with a reduction in its Praemia Healthcare exposure and the commercialization of its Italian portfolio. This aggressive disposal of non-strategic and mature assets is not merely about generating liquidity but fundamentally aims to enhance the overall quality and strategic focus of Icade’s portfolio, aligning it with its “ReShapE” criteria for centrality and service quality.

Source: Google finance

Finally, it’s worth noting that the French office market is still in recovery, and we may not have seen the bottom yet. The leasing market is still slightly declining. In essence, the market’s true bottom is yet to be found. However, without this factor, the price wouldn’t be so low, nor the yield so high.

Source: Google finance

This is reflected in the accounts. While some other French and European property companies are in a slightly better position, this suggests to me that Icade will catch up in the coming months. The property company has already strengthened its leasing activity: Solid rental activity (c. 79,000 sq.m of new leases and renewals) and improved financial occupancy rate for well-positioned offices and light industrial.

Source: ICADE

So now, let’s deep dive into accounts.

III/ Key Financial Indicators paradoxically offer a glimmer of hope

Source: ICADE

As of June 30, 2025, several metrics stand out.

Rental Activity Performance: Icade’s Investment Property segment reported gross rental income of €178.3 million, a 5.1% decrease (4.3% like-for-like), primarily due to tenant departures and negative rent reversion. Despite this, leasing activity remained robust, with 79,000 m² of new leases and renewals signed, generating €20 million in annualized rents. The overall financial occupancy rate slightly declined to 83.6%, but well-positioned offices saw an improvement to 88.8%, and light industrial assets reached 89.5% occupancy. The portfolio value (excluding transfer taxes) saw a moderate decline of 3.1% to €6,203.0 million.

Source: ICADE

Property Development Performance: The Property Development division’s economic revenue decreased by 14.0% to €501.1 million, largely due to a significant 38.7% drop in commercial revenues following major project completions and fewer new contracts. Residential revenues also saw a 7.4% decline. However, the net margin on property operations significantly improved by 72.8% to €72.1 million, with the margin rate doubling to 14.5%. Order intake volume remained stable at 2,116 units, but its value decreased by 7.9% to €495.6 million, impacted by the end of the Pinel tax incentive for individual investors. The order book stood at €1.7 billion, down 3.2% from year-end 2024.

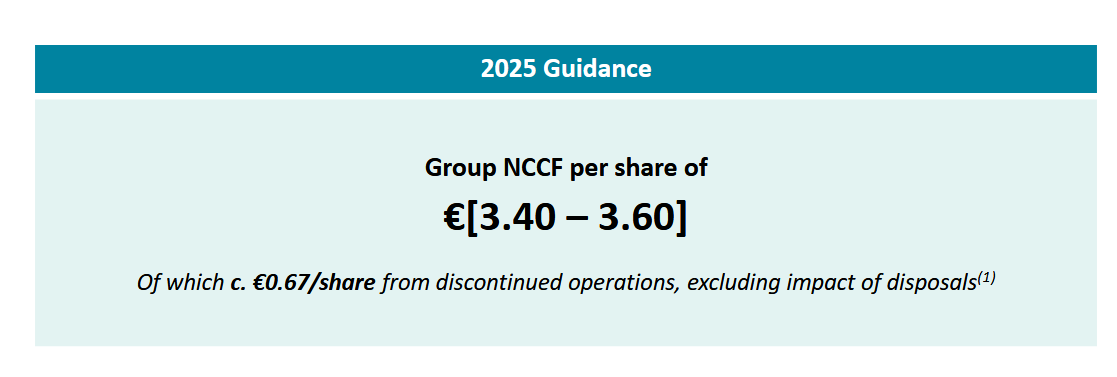

Consolidated Financial Results: At the consolidated level, Icade’s Group Net Current Cash Flow (NCCF) decreased by 8.8% to €154.1 million (€2.03 per share) for H1 2025. However, NCCF from strategic activities showed more resilience, declining by only 1.7% to €109.3 million (€1.44 per share). The net loss attributable to the Group significantly narrowed by 49.2% to (€91.7) million, largely due to a substantial increase in EBITDA to €144.8 million, driven by provision reversals. The EPRA Net Tangible Assets (NTA) per share decreased by 5.8% to €56.6. Regarding the balance sheet, the Loan-to-Value (LTV) ratio increased to 38.1% (including duties), and the EPRA LTV (excluding duties) rose to 47.1%. The Interest Coverage Ratio (ICR) sharply declined from 14.5x to 7.4x, indicating a reduced capacity to cover interest charges. Despite these shifts, all banking covenants were comfortably met, and the company maintains a very strong liquidity position of over €2.8 billion, sufficient to cover debt payments until 2029.

Investment takeaway: an accidental high yielder — short-term pain, long-term (potential) gain

The investor experience with Icade since March 2025 has indeed been characterized by volatility, a high yield, and a substantial discount. This situation, while presenting “short-term pain” in terms of share price fluctuations, is precisely what defines an “accidental high-yielder.” The high yield acts as a significant compensation for this short-term discomfort.

Our analysis of the operational resilience and the key financial indicators, despite current market headwinds, confirms the initial thesis: Icade possesses solid underlying assets and a management team working to navigate the challenging real estate cycle. This combination suggests a strong potential for “long-term gain” driven by future capital appreciation as the market eventually re-rates the company closer to its intrinsic asset value.

Source: ICADE

My risky personal bet:

- getting paid (10%+ in july 2025 for me) to wait

- 3.1 euros dividend projection – 85% of CFNC, 15% dividend yield for current share price)

- long term potential capital gain (60% discount).

The original article below remains a valuable read for further context (available on archives).

REITs: At the Crossroads of Major Economic and Societal Trends

REITs are at the heart of several major transformations, particularly in Europe, where regulatory pressures are intense. Here are the key trends shaping the market:

Thanks for reading! Subscribe for free to receive new posts and support my work.

- Energy transition: France’s stringent environmental regulations (RE2020, mandatory building energy audits) and growing tenant demand for sustainable properties are driving up costs for both existing buildings and new developments.

- Remote work’s impact: The demand for office space is shrinking as companies downsize their footprint. At the same time, office needs are shifting toward more flexible, hybrid-friendly designs.

- Market polarization: Offices that fail to meet ESG and accessibility criteria are struggling to find tenants, while prime properties remain resilient—creating a bifurcated market.

Icade’s Strategy: A Major Business Model Overhaul

A Quick Overview

Icade is a French REIT (SIIC – Société d’Investissement Immobilier Cotée), meaning it must distribute a large share of its earnings as dividends for tax reasons. It benefits from two major institutional shareholders: Crédit Agricole (a leading international bank) and Caisse des Dépôts et Consignations (a financial arm of the French state), which provide stability and support.

Source : https://www.icade.fr/finance/actionnaires

Icade has recently divested from healthcare assets to refocus on offices, business premises, student housing, and data centers. It’s also implemented a major strategic shift through its ReShapE 2024-2028 plan, which aims to:

- Refocus on prime office assets by selling or upgrading underperforming properties while investing in high-quality projects.

- Diversify revenue streams by expanding into high-growth segments like business premises, student housing, and data centers.

- Develop future-proof urban solutions for sustainable, mixed-use developments, as seen in flagship projects like the Athletes’ Village and Estérel Nord.

Case Study: Estérel Nord, a Blueprint for Icade’s Strategy

Located in Rungis, Estérel Nord exemplifies Icade’s new approach:

- Adapting the portfolio: Converting four outdated office buildings into a 38,400 m² mixed-use district with 600 housing units and 11,000 m² of business space.

- Diversifying asset classes: Adding coliving spaces, commercial units, and a daycare center to increase resilience.

- Sustainability-first development: Prioritizing refurbishment over demolition and expanding green spaces by 31%.

Village des athlètes : jeux olympiques de Paris. Source : https://www.icade.fr/projets

It’s a strong example of Icade’s shift toward a more adaptable and ESG-aligned model. But what does this mean for investors?

Investment Case: Is Icade a Good High-Income Play?

Mixed Fundamentals, But a Deep Discount

Icade faces a portfolio repositioning challenge:

- 86% of its offices are “well-positioned,” showing 5.3% rental income growth in 2024.

- 14% of offices need repositioning, with rental income from these assets declining 10.9% in 2024.

Its property development segment is also struggling due to higher interest rates and softer demand.

Financial Snapshot (2024)

- Stable rental income: €369.2M (+1.4% YoY), driven by indexation and strong office assets.

- Development revenue under pressure: €1,214.8M (-6.1% YoY), reflecting slower project sales.

- Group Net Current Cash Flow: €301.8M (€3.98 per share), slightly down from 2023.

- NAV per share: €60.1, declining in line with the broader real estate market.

Stock Price Collapse = A 66% NAV Discount

Icade’s stock has plunged back to 2001 levels since interest rates started rising. While this reflects real challenges, it has also led to a steep discount.

Source : www.investing.com

Dividend Outlook: Still Double-Digit Yields

With 2024 FFO at €3.98 per share and a 2025 CFNC forecast of €3.40-€3.60 per share, the dividend is set to decrease. A conservative €3.1 per share payout would still imply a 15% dividend yield at today’s price (€20.54 as of March 14, 2025). Even for 2024, the remaining €2.15 per share distribution equates to a 10.4% yield.

Source : https://dividendesaristocrates.com/euronext-paris/dividendes-icade

Investment Takeaways

- Not the best horse, but one that can finish the race

- A bet on mean reversion, with a huge 66% discount

- Attractive dividend yield: Even with a cut, it should stay above 10%

Final Thoughts

Icade is a high-risk, high-reward opportunity in European real estate.

The fundamentals are challenging, but the stock’s deep discount and double-digit dividend make it a compelling contrarian bet.

My take : I currently hold a small position and am looking to add more in the coming days at this price (around 20 euros). Let’s collect our dividends while mean reversion plays out !

And we all love Paris :

Source : https://www.icade.fr/activites/fonciere

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.