JEPG – Monthly, Boring, Global 8 % income

Sep 16, 2025

Stuck behind the UCITS barrier? European investors hunting for yield often find themselves locked out of the world’s best income funds. But one ETF—JEPG—offers a rare gateway to a global ~8% yield. Does it deliver? That’s the question we’re tackling this week. Following our analysis of a riskier Chinese small cap, we’re deep diving into the JP Morgan Global Equity Premium Income ETF (JEPG). This ETF offers a ‘boring’, monthly income from covered calls on a global portfolio, targeting a theoretical 7-9% yield. Let’s put its theory, practice, and real-world income potential under the microscope.

Reminder: UCITS, a European regulatory framework, restricts access to many global funds but ensures investor protection, making JEPG a rare high-yield option.

I/ Theory: the 8% yield promise

A/ The Fund’s Stated Aim

Therefore, the ETF’s main aim is to provide income, with capital appreciation as a secondary goal. It is actively managed and uses physical replication (it buys and holds stocks). The ETF holds equities directly, rather than more complex financial instruments.

Source: JP Morgan Site

The Core Investment (Equities): The fund invests at least two-thirds of its money in a basket of company stocks from 27 countries in developed markets, including in emerging markets. This is the foundation that allows the investment to grow over the long term.

The Income Strategy (Options): To generate regular, immediate income, the fund constantly sells “call options” on individual stocks or indices. In exchange for this sale, it collects premiums. However, this technique comes at a cost: if the stock market rises very sharply, these gains will be limited because the options sold will force the fund to give up a portion of the upside.

So JEPG promises lower volatility, global 8% income and a good bottom-up research.

Source: JP Morgan Site

Source: JP Morgan Site

B/ Covered Calls – How It Works

A covered call fund like JEPG buys a global portfolio of stocks (similar to those in its reference benchmark) and sells call options on a related index or stocks to earn a payment called a premium. Selling a call means signing a contract that gives the buyer the right to purchase the underlying assets of the index at a set price (the strike price) before a specific date (the expiration).

The fund pockets the premium right away, and this cash is a key component of the high monthly income distributed to investors. If the index stays below the strike price at expiration, the fund keeps its stock portfolio and the premium; if the index exceeds the strike price, the fund must deliver the equivalent value of the gain to the option buyer, thus capping its potential upside on that portion of the portfolio.

Covered call funds aim to generate high monthly income by selling call options on their equity holdings. This strategy reduces volatility but caps upside potential during strong rallies. These funds perform best in volatile markets, have higher fees than passive ETFs, and may create tax complexity. They are income tools, not core growth investments.

C/ Promise vs. Reality: What You Actually Get

JEPG’s theory is a trade-off: it aims to provide a high, steady income (~8%) for an average fee (0.35%) and lower volatility by systematically selling out of the market call options on its global stock portfolio. This strategy mechanically converts potential capital growth into immediate cash flow, making it an attractive income tool. However, the promised yield is not a guarantee but a target, and it comes at the direct cost of capping upside potential, meaning the fund will lag behind in strong, sustained bull markets. Investors are essentially swapping unlimited growth potential for enhanced yield.

This is the theory—but how does it play out in practice?

II/ Facts: Income is Here, But Underperformance in a Bull Market is Too

A/ Total Return: Positive, But Lagging the Benchmark

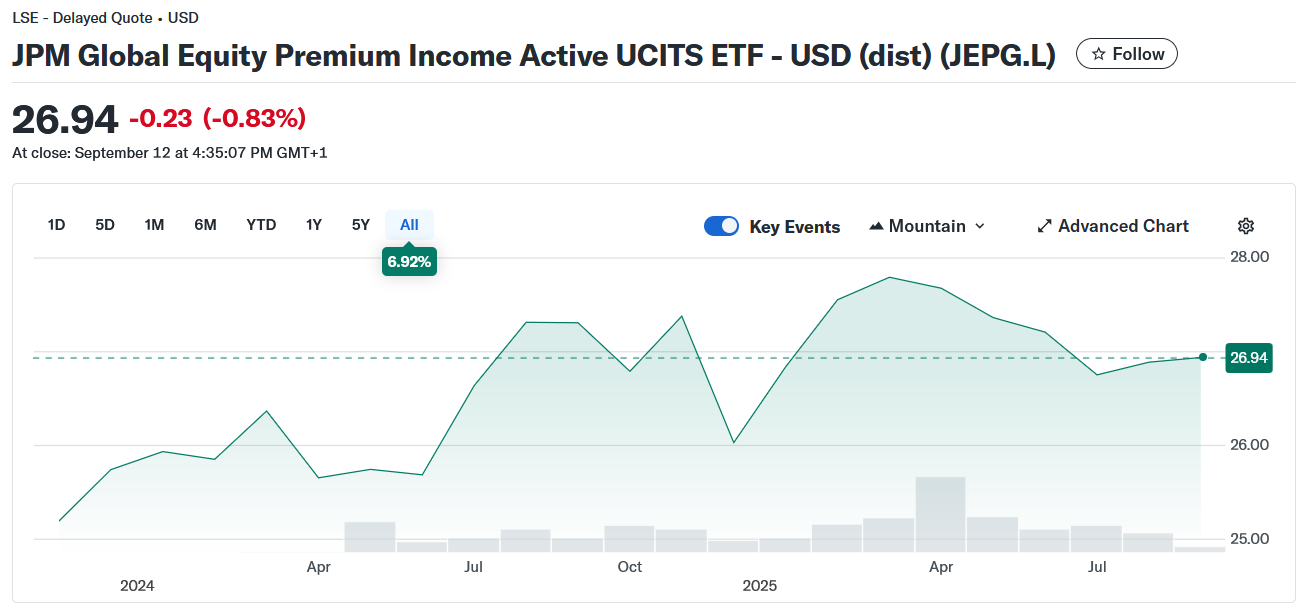

Since launch (November 2023), JEPG’s total return stands at 20.7%, while its benchmark delivered 41.7%—a substantial difference. But this underperformance is a direct consequence of the covered call strategy: investors swap some upside for steady, high monthly income. In strong bull markets, this trade-off always sees the ETF lag behind, but it’s an intentional feature, not just a flaw.

Source: JP Morgan Site

Source: JP Morgan Site

B/ Dividend Yield: Reliable Payouts, But Highly Variable

While JEPG has consistently paid out dividends on a monthly basis since launch, the distributions have been highly variable – ranging from below 5% to above 16% annualised – highlighting both the reliability of income and the inherent fluctuations of a covered call strategy.

As the chart shows, the annualised yield oscillates significantly from month to month, underlining that investors can rely on regular payouts but not on a stable income level.

Taking the simple average of the monthly annualised yields since inception gives about 7.5%. This figure, however, should be read with caution: it does not represent the actual annualised yield of a buy-and-hold investor, but rather the average of the yield snapshots published each month. In practice, the true realised income depends on the cumulative cash distributions over time relative to the ETF’s price.

Since its inception at a purchase price of $25.52, JEPG has offered investors a reliable stream of dividends with an effective annualized yield slightly below 8%. In 2024, distributions totaled $1.69 per share, corresponding to a 6.63% yield, while over the last twelve months (Sept 2024 – Sept 2025) payouts increased to $2.30 per share, or a 9.02% yield. Notably, the yield tends to rise during more turbulent market periods, as elevated volatility enhances the fund’s income generation. This counter-cyclical feature makes JEPG particularly attractive for investors seeking resilient cash flows in uncertain environments.

Source: Yahoo Finance

Behind the enticing promise of an ~8% monthly yield, JEPG investors face a fundamental trade-off: the target yield is an annual average, not a guarantee of stable monthly payments. This is the price of its options strategy, which generates high but irregular income, resulting in distribution volatility far greater than that of a traditional dividend aristocrats fund.

C/ Portfolio Strategy: A Blend of Stability and Growth Blue Chips

Don’t let the name fool you. While the JP Morgan Global Equity Premium Income ETF (JEPG) is designed for income, its portfolio cleverly blends traditional stability with growth potential.

Its foundation is built on predictable, dividend-rich defensive sectors like Health Care (14.3%) and Consumer Staples (11.0%). However, diverging from a purely conservative approach, its largest allocations are actually to growth and cyclical engines: Information Technology (19.2%) and Financials (15.8%). This strategic balance allows it to harness the upside of sectors like tech and banking, using the reliable dividends from defensives as a stable base for its option-writing strategy.

Geographically, the fund is a concentrated bet on developed-market stability. While global by design, it’s anchored by a strong core in the United States (66.2%), with deliberate diversification from major economies like Japan (10.2%), Germany (5.4%), and France (5.1%). This sharp focus on established markets prioritizes lower volatility and reliable dividend streams, making it a play on the world’s most advanced large-cap companies—not a gamble on emerging market growth.

Source: JP Morgan Site

The takeaway? JEPG’s portfolio is a strategically balanced portfolio that aims to have its cake and eat it too: earning high yields from options while maintaining exposure to both defensive and growth-oriented equities. But the level of monthly income is unreliable and this is a real problem for many income investors.

Source: JP Morgan Site

III/ Role in my portfolio: A Strategic Income Satellite, Not a Core Holding

A/ A global Diversifier, Not a Foundation

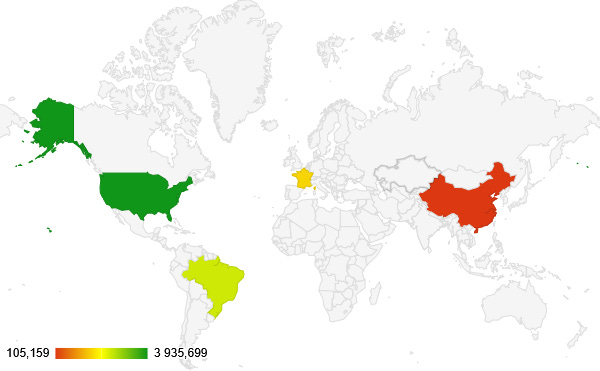

Geographical aspects: my portfolio (see the map below) was overly concentrated in the US, Brazil, France, and China. JEPG adds instant exposure to Germany, Japan, and other developed markets.

Currencies: while USD-dominated, JEPG provides a welcome hedge with its exposure to the Japanese Yen and Euro. For my portfolio (see below), it allows yen diversification.

Sectors: its blend of defensive staples and growth-oriented tech/financials complements my existing holdings. The long-term goal? Building a portfolio robust enough to deliver high, reliable income—even when individual bets fail. JEPG is a strategic piece of that puzzle.

B/ A Counter-Cyclical Income Hedge

The fund’s most compelling attribute is its counter-cyclical income potential. As we’ve seen, its yield spikes during periods of market stress and higher volatility—precisely when the dividends of more traditional companies might be at risk. This makes it an excellent hedge. While my core equity holdings might see their dividends fall in a downturn, JEPG has the potential to generate more income, providing cash for income or to reinvest at lower prices. It’s not a substitute for bonds, but it adds a unique layer of income resilience that behaves differently from both stocks and traditional fixed income.

The Verdict: A Niche Tool for Yield-Hungry Europeans, a good tool for my portfolio

For my portfolio, JEPG earns its place as a strategic allocation for enhanced, diversifying yield. It answers the European investor’s plea for income, but it does so with a specific set of rules. You don’t buy it for excitement; you buy it for its disciplined, “boring” ability to generate cash flow from a blended portfolio of global giants, especially when the market gets rough. This disciplined, “boring” approach perfectly complements my overall strategy. I will buy some this week, even if I already have invested in JEPQ and XYLD before. JEPG completes my portfolio alongside JEPQ (Nasdaq-focused) and XYLD (S&P 500-focused) by targeting MSCI World for global diversification.

For other European investors, JEPG is a powerful tool, but it’s not for everyone. It could be interesting for:

- European investors seeking a rare, UCITS-compliant global income solution.

- Those in the distribution phase (e.g., retirement) who need monthly cash flow.

- Investors who understand and accept the trade-off: swapping steady, predictable dividends (like those from a Dividend Aristocrats fund) for a higher, but variable, average yield and lower overall portfolio volatility.

- Those looking for a diversifying source of income that can perform well when traditional growth stocks stall.

But some won’t like it:

- Investors seeking maximum long-term capital growth.

- Those who require perfectly stable and predictable monthly cash flow to cover essential expenses.

- Anyone who does not understand or want the upside cap that comes with a covered call strategy.

Next week’s pick: higher yield, predictable cash. Subscribe and follow the journey as I turn this portfolio into a global income machine.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.