Apr 29, 2025

A Seismic Shift You Can’t Ignore

The U.S. dollar has ruled the world since 1944, but its throne is starting to wobble. We’re entering a multipolar era where new currencies and systems are challenging its dominance. This isn’t just a financial trend—it’s a megatrend that could reshape your investments. In this post, we’ll dive into the history of dominant currencies, unpack the dollar’s slow decline, and show you why a multi-currency strategy isn’t optional anymore. The global economy is shifting fast, and if you want to stay ahead, you need to adapt now. Let’s break it down.

I/ Dominant Currencies Don’t Last Forever

History has a clear message: no currency stays on top forever. From the talent in ancient Greece to the Roman denarius, the Arab dinar, and the Florentine florin in the Middle Ages, every dominant currency eventually fades. The Venetian ducat, Spanish real, Dutch florin, and British pound all had their moment—until the U.S. dollar took over after 1945. Right now, the dollar still calls the shots globally, but cracks are showing, and a new world is coming.

These shifts don’t happen overnight. When a currency stumbles, like the Dutch florin in the 1700s, others—like the British pound and French franc—start fighting for the crown, but no one wins right away. Fast forward to 1918: the pound was fading, and the dollar and franc battled it out until Bretton Woods crowned the dollar in 1944. Ray Dalio calls these messy in-between periods “interstices”—the old power gets bogged down in debt, trust erodes, and a vacuum forms. “Guerre et paix entre les monnaies, written by French economist Jacques Mistral, portrays a geopolitical tug-of-war, where currencies like the German mark challenged the pound in the 1800s, coexisting in a tense standoff. The takeaway? A new currency emerges only after a slow, chaotic battle for global trust.

Let’s zoom in on Bretton Woods. It made the dollar king in 1944, backed by gold. But by the 1960s, it was crumbling under U.S. deficits and inflation. In 1971, Nixon ditched the gold standard, and chaos followed. Ray Dalio says this is classic: a dominant currency fades when its country overborrows and loses credibility. « Guerre et paix » points to the rivalries that erupted—Japan’s yen and Germany’s mark took shots at the dollar, and later the euro stepped up. Markets went wild, with competing currencies creating both risks and opportunities. Today, the dollar faces pressure from China’s yuan and even digital currencies. If you’re an investor, sticking to one currency during these shifts is a gamble. Spreading your bets across dollar, euro, yuan and other currencies isn’t just smart—it’s how you survive the uncertainty of a new global order taking shape.

II/ The Dollar’s Slow Decline Is Happening Now

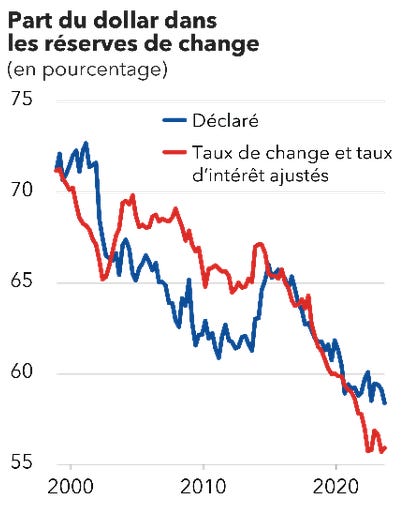

A/ The Dollar’s Grip on Global Reserves Is Slipping

The dollar has been the world’s go-to since 1944 but its share in global reserves is shrinking. The IMF says it dropped from 71% in 2000 to 58.2% by mid-2024. That’s a big shift. Central banks are diversifying into currencies like the Australian dollar, Canadian dollar, and China’s renminbi, which hit 2.14% in 2024. Countries like Russia are even stockpiling gold—25% of its reserves now—ditching the dollar. But let’s not overreact: the dollar still dominates, and this isn’t a collapse. Some blame U.S. sanctions for the shift, but the IMF Blog says it’s more about chasing better returns. The dollar’s losing ground, but it’s a slow burn.

Source : IMF Blog

B/ The Dollar Index Is Wobbling—But It’s Still Strong

The dollar index (DXY), which tracks the dollar against major currencies, tells a mixed story. It hit 103.4 at the end of 2022, but by early 2025, it fell 4.2%—its worst drop since 2008. Trump’s tariffs on Canada and Mexico spooked markets, boosting the euro by 4.5% in just a week. If your portfolio was all-in on dollars, that hurt. But zoom out: over five years, the DXY is up 7.4%, thanks to high U.S. interest rates and its safe-haven status. So, yes, there’s volatility—Europe’s rate cuts played a role—but the dollar’s still a heavyweight. For now, it’s a relative dip, not a knockout.

Source : Statista

C/ Payment Systems Are Shifting Away from the Dollar

The dollar’s losing ground in global payments, though it’s still the big player. In 2022, it handled 58% of payments outside the eurozone. But new systems are challenging that. China’s CIPS has exploded, with transaction volumes up 80% since 2022, linking over 160 banks, especially in BRICS countries. Projects like mBridge aim to bypass U.S.-dominated SWIFT. Meanwhile, 95% of China-Russia trade now uses roubles and yuan, and India’s buying Russian oil in rupees. Still, SWIFT is massive, and the dollar rules 88% of global forex trades in 2024 (Federal Reserve 2023). The decline is real, but the dollar’s financial roots run deep.

What’s the Big Picture? The dollar’s eroding in reserves, the DXY, and payment systems, but it’s not done yet. These trends signal a gradual shift—one you need to watch closely. A multi-currency approach isn’t just a hedge; it’s your ticket to staying ahead in the long term.

III/ Why You Can’t Afford to Ignore a Multi-Currency Strategy

A/ A Multipolar World Changes Everything

In today’s multipolar world, betting on one currency is like playing a soccer match with just one player on the field. The dollar’s still strong, but it’s slipping—its share of global reserves fell to 58.2% in 2024 (IMF), while the yuan climbed to 2.14%. This isn’t new: the dollar’s following the same path as past giants. New systems like China’s CIPS and mBridge are rewiring global finance, and 95% of China-Russia trade skips the dollar entirely. With multiple economic powers in play, sticking to the dollar means missing the bigger picture. You need a broader game plan.

B/ Grab Wealth Where It’s Happening

It’s time to go global and capture wealth where it’s being created. Asia’s leading the charge—China and India are set to drive 50% of global GDP growth by 2030 (IMF). Sticking to dollars leaves you exposed to risks like the DXY’s 4.2% drop in early 2025. But diversify into yuan or other currencies, and you’re in the game: Chinese bonds yield a steady 2.5% in 2024, and India’s NIFTY 50 has returned 15% annually over five years, outpacing the S&P 500’s 10%. A multi-currency strategy lets you tap into these hotspots. Why limit yourself when the world’s wealth is shifting?

C/ Protect Yourself from the Chaos

A multi-currency portfolio shields you from the turbulence of currency shifts. History shows these transitions—like the pound-to-dollar handover from 1918 to 1944—are messy, full of devaluations and crises. Today, geopolitical tensions, trade wars, currency wars and new systems like CIPS and mBridge are stirring the pot. If you’re all-in on dollars, a sudden swing—like the euro’s 4.5% jump in a week in 2025—can hit hard. Spread your bets across dollar, euro, and yuan, and you’ll smooth out the bumps. ETFs like the WisdomTree Emerging Currency Strategy Fund, which covers yuan, rupee, and Brazilian real, make it easy to diversify and cut your risk.

Let’s Wrap This Up

The dollar’s dominance is fading, and a multi-currency strategy isn’t optional. Going global lets you seize new opportunities and dodge the risks of a changing world. Act now, or your portfolio might get left behind in this economic shake-up. You can’t escape megatrends. Megatrends like these are unstoppable—act now to stay ahead.

For international investment ideas, subscribe here and share:

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.