Building a Long Term Income Portfolio from Scratch – Part 1

Watching my portfolio grow in value is great, but converting it into a reliable and growing income stream is even better! I’m in my mid-40s with over a decade of investment experience. My performance has been solid, but it’s time to restructure everything for the final stretch. This portfolio isn’t just about retirement—it’s about creating a lasting income stream that I can pass down to my children.

My goal? Within the next 10 to 15 years, I want to start drawing income while ensuring the portfolio remains a wealth-generating machine for the next 50 years. To achieve this, I must identify the major megatrends shaping the global economy and adjust my investment strategy accordingly. The key question: Which forces will drive markets for the next five decades? Build your Long-Term Income Portfolio from Scratch with this knowledge.

2. Which Megatrends Will Shape the Future?

✅ Energy Transition – The impact of massive (or insufficient) investments

✅ Demographic Shifts – Aging populations, interest rates, automation, robotics

✅ Geopolitical Risk – The rising probability of global conflicts

✅ Geo-Economic Shift – The shift of wealth creation toward Asia

✅ Currency Risk – How long will the USD remain the dominant global currency?

✅ Technological Disruption – The rise of artificial intelligence and automation

These megatrends will impact economic growth, government policies, and financial markets—creating both risks and opportunities.

3. Key Megatrends and Their Investment Implications

🌍 Energy Transition

✔ Economic Stakes: The transition to clean energy requires unprecedented public and private investment. However, the funding gap remains massive, raising concerns about whether the shift to net zero is financially and politically viable.

Source : Visual Capitalist

✔ Macroeconomic Consequences: Even if investment accelerates, the risk of raw material shortages—especially copper and rare metals—could create inflationary pressures.

Source : zkb

✔ Investment Strategy: Oil & gas companies could remain profitable for longer than expected. Multi-energy players like TotalEnergies are also worth considering as they transition gradually.

👵📉 Demographics & Aging

✔ Economic Stakes: A shrinking workforce means lower productivity growth, assuming no major technological breakthroughs.

✔ Consequences: Governments will face growing deficits to sustain pension and healthcare systems, fueling demand for financial assets.

✔ Investment Strategy: The healthcare sector presents stable income opportunities, even if high-dividend stocks are scarce.

🌍⚠️ Geopolitical Instability

✔ Economic Stakes: The rise of BRICS nations could lead to a multipolar world, increasing geopolitical instability.

✔ Macroeconomic Consequences: This shift could disrupt global supply chains, commodity markets, and monetary systems.

✔ Investment Strategy: Defense stocks can serve as a hedge, while commodities may offer income opportunities—but with increased volatility.

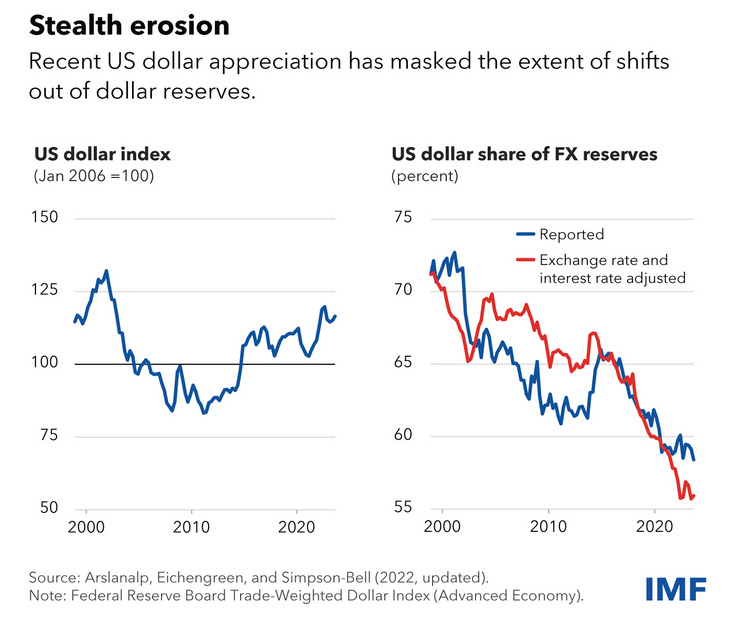

💵⚠️ Currency Risk

✔ Economic Stakes: If BRICS nations successfully reduce their reliance on the USD, the global monetary order could shift significantly.

Source : IMF

✔ Consequences: Historical precedents (such as the transition from GBP to USD) suggest that such shifts can create financial instability.

✔ Investment Strategy: A multi-currency approach can help protect purchasing power over the long term.

🇨🇳📈 The Global Shift Toward Asia

✔ Economic Stakes: With demographic advantages and rapid technological adoption, Asia’s economic dominance will likely continue to grow.

Source : Visual Capitalist

✔ Consequences: Investors must tap into this growth to remain competitive.

✔ Investment Strategy: Geographic diversification is essential—focusing on Asian markets beyond just U.S. and European multinational companies.

🤖📊 Technological Disruption: AI & Automation

✔ Economic Stakes: The rise of artificial intelligence and robotics will reshape entire industries.

Source : OECD

✔ Macroeconomic Consequences: Will AI translate into significant productivity gains and sustained corporate profits?

✔ Investment Strategy: Identifying stable income-generating opportunities in AI and robotics will be key.

4. Key Investment Takeaways

✅ Energy Transition: Oil & gas remain relevant; multi-energy firms are well-positioned.

✅ Aging Populations: Healthcare remains a defensive growth sector.

✅ Geopolitical Instability: Defense stocks provide a hedge, but commodities remain volatile.

✅ Asia’s Economic Rise: Exposure to Asian markets is increasingly essential.

✅ Currency Risk: A multi-currency income strategy protects against long-term depreciation.

Final Thoughts

These megatrends are just the beginning of my research. The next steps? Refining sector allocations, selecting investment vehicles, and identifying optimal entry points. Now I have to build my long term income portfolio.

🚀 This is just the start. If you found this article valuable, share it with someone who’s thinking about long-term investment trends!

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, or legal advice. The views expressed are personal opinions and should not be taken as specific recommendations. Investing involves risks, including the potential loss of capital. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author is not responsible for any financial losses or decisions based on the content of this article.