What if you could invest in the global energy transition while earning a steady 8%+ dividend yield? Engie, a French multinational energy leader, might just be the opportunity you’re looking for. With a bold goal of carbon neutrality by 2045, Engie is navigating a complex energy market, balancing cyclical challenges, infrastructure investments, and regulatory shifts. Having evolved from a state-owned entity to a publicly traded company, Engie offers a diversified portfolio and an attractive dividend. But is it the right fit for a high-income portfolio? Let’s dive in.

I. Engie in a Complex and Cyclical Energy Market

A. The Cyclical Nature of the Energy Market

The energy sector is inherently cyclical. Building large-scale projects like hydroelectric dams, solar farms, or biomethane plants requires massive capital and years of development. While supply grows slowly, demand fluctuates with economic activity—industrial slowdowns during recessions can slash energy consumption, leading to price volatility.

Source: https://www.macrotrends.net/2478/natural-gas-prices-historical-chart

Renewable energy adds another layer of complexity. Solar and wind are intermittent: solar panels don’t produce at night, and wind turbines depend on weather. To keep electricity grids stable, flexible sources like nuclear, gas, and battery storage are essential. Engie operates across the energy value chain:

- Production: Generating electricity and gas.

- Transport: Long-distance transmission (think “energy highways”).

- Distribution: Delivering energy to consumers (like local roads).

Engie is particularly strong in gas transport and distribution, a key part of its business.

Source: https://www.encyclopedie-energie.org/des-reseaux-electriques-aux-smartgrids/

B. From Public Entity to Private Multinational

Engie was born in 2008 from the merger of Gaz de France (GDF) and Suez. GDF, founded in 1946, was a public entity focused on post-war energy independence, while Suez evolved from managing the Suez Canal to energy production. Today, Engie is a publicly traded company, though the French government retains influence with 23.64% of shares and 34.50% of voting rights.

Source: https://www.engie.com/actionnaires/action-engie/structure-de-lactionnariat

Engie’s revenue streams are diverse, as shown in its 2024 results:

- Gas transport and distribution (Infrastructures): €7.1 billion.

- Energy sales to businesses (GEMS): €39.3 billion.

- Retail energy sales to households: €18.0 billion.

- Flexible energy production (FlexGen): €6.9 billion.

- Renewables: €6.2 billion.

- Energy transition consulting (Energy Solutions): €10.2 billion.

II. Engie’s Strategy: A Bold Energy Transition in a Turbulent World

A. Carbon Neutrality by 2045: The “Molecule and Electron” Approach

Engie aims to be carbon-neutral by 2045, focusing on gas (“molecule”) and electricity (“electron”). It’s aggressively expanding renewables, targeting 80 GW of capacity by 2030, with €4 billion invested annually.

Source: https://www.engie.com/sites/default/files/assets/documents/2024-02/Rapport%20d%27activit%C3%A9%20et%20Etats%20financiers%20co nsolid%C3%A9s%20annuels%202023.pdf

To address the intermittency of solar and wind, Engie is developing:

- Biomethane: Targeting 10 TWh by 2030.

- Hydrogen: Aiming for 4 GW by 2030.

- Battery storage: Expanding to 10 GW by 2030 to stabilize grids.

Engie also promotes energy efficiency through initiatives like building insulation. - Source: https://www.engie.com/sites/default/files/assets/documents/2023-02/MU%20Feb%20%202023%20VDEFF.pdf, page 76

B. Political, Economic, and Financial Challenges

Engie’s transition faces several hurdles:

- Political and Regulatory Landscape

-

- source: https://www.statista.com/statistics/269908/revenue-by-region-of-gdf-suez/

- Public investment (1-2% of GDP annually) is critical for renewable infrastructure.

- Geopolitical Risks

- The Ukraine conflict disrupted gas supplies, spiking prices. Engie sources gas from Norway (36%), the Netherlands, Algeria, Nigeria, Qatar, and the U.S.

- Dependence on LNG increases exposure to maritime trade risks.

- Economic and Financial Considerations

- Engie balances heavy investments with shareholder returns, paying out 65-75% of profits as dividends.

- Gas and electricity price volatility impacts profitability.

- A prolonged price downturn could slow its transition efforts.

III. Investment Perspective: Risks and Rewards

A. Strengths

- Stable Business Model

- Engie’s diversified portfolio reduces sector-specific risks, spanning production, transport, and distribution.

- Attractive Dividend Stock

- Engie offers a high dividend yield of 8-10%, making it a strong income play despite market cycles.

- Long-Term Growth via Energy Transition

- Rising demand for clean energy aligns with Engie’s renewable expansion and EU climate goals.

B. Risks

- Political Risk

- The French government’s influence (34.50% voting rights) may lead to unpredictable decisions.

- Regulatory changes in Europe could impact profitability.

- Cyclical Energy Prices

- Revenues fluctuate with gas and electricity prices.

- A prolonged downturn could limit investment capacity.

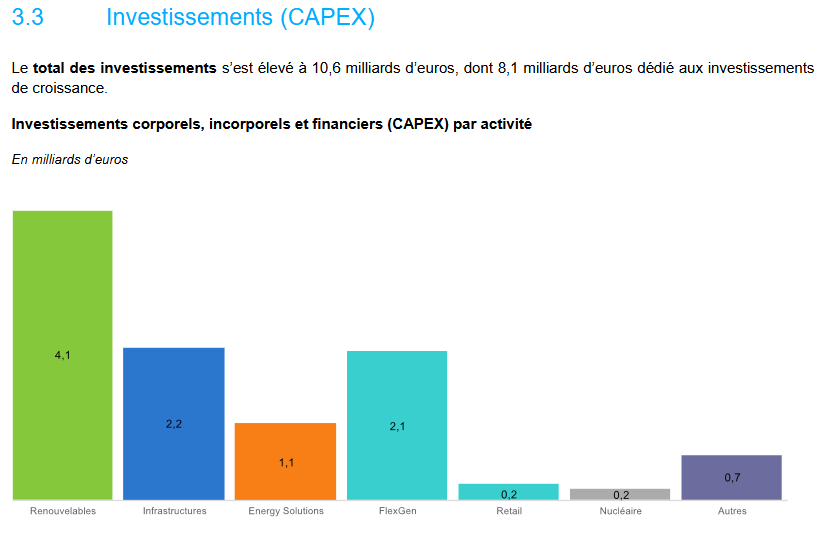

- High Capital Expenditures (CapEx)

- Significant funding is needed for energy transition projects.

- Rising interest rates could strain Engie’s debt (net debt rose to €29.5 billion in 2024).

- Reputational Risk

- Three fatal accidents in 2024 could harm Engie’s reputation.

C. 2024 Annual Results and Outlook

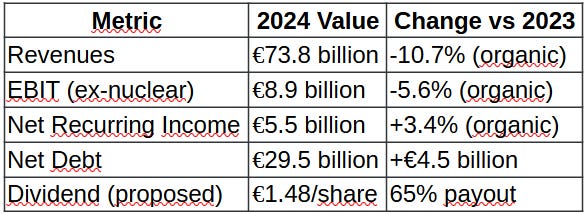

Engie’s 2024 revenues fell 10.7% to €73.8 billion due to lower energy prices. EBIT (ex-nuclear) reached €8.9 billion (-5.6% organically), and net recurring income (NRIgs) grew 3.4% to €5.5 billion, both at the high end of guidance. Net debt rose to €29.5 billion (+€4.5 billion) due to investments.

Operationally, Engie added 4.2 GW of renewables (total: 46 GW), with 6.8 GW under construction. Battery storage hit 5 GW, and power purchase agreements (PPAs) grew 59% to 4.3 GW, with clients like Meta and Google. Engie also secured 1,200 km of transmission lines in Brazil and Peru. Emissions dropped 55% since 2017 to 48 million tons.

A €1.48 dividend per share (65% payout) is proposed for 2024, pending approval on April 24, 2025. For 2025, Engie raised its guidance: NRIgs at €4.4-5.0 billion and EBIT (ex-nuclear) at €8.0-9.0 billion. A nuclear dip is expected in 2026, with recovery in 2027.

Investment takeaways

- Engie is a resilient, income-generating stock with a clear vision for the energy transition. It navigates a complex market, balancing government influence, price cycles, and heavy investments. Its diversification, EU policy support, and 8-10% dividend yield make it a compelling choice for long-term investors.

- However, risks like regulatory changes, economic slowdowns in Europe, and the French government’s stake (34.50% voting rights) warrant a discount.

- For my high-income portfolio—already holding stocks like Icade (15 % yield) and Petrobras (12%+ dividend yield)—Engie fits well, but only at a 10% yield. With a proposed dividend of €1.48 and an expected drop to €1.2-1.3 in the coming years (due to nuclear challenges and high CapEx), I’d wait for a share price of €12-13 (based on €1.2 / 10% = €12). As of March 23, 2025, Engie trades at €17.55, so I’ll wait for a dip to initiate a position.

- Engie as an investment case.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.