The Global Dividend Clock

My greatest pleasure in life is seeing my dividends come in. Like J. D. Rockefeller, I love receiving dividends. Actually, it’s the common trait of all income investors. The following question is simple: how often? Because the pleasure should be regular. And more prosaically, receiving dividends frequently is very reassuring, as it simply allows you to pay the bills.

My strategy is to build a portfolio that can deliver income every month — steady, predictable, and globally diversified. The key is understanding how dividend calendars differ around the world. By aligning payout seasons across the U.S., Europe, and Asia, I built what I call my Homemade 10% Monthly ETF — a strategy that turns regional dividend cycles into a continuous cash flow.

I/ USA: the dividend investor paradise

A/ What are we talking about? Payment date matters

Source: https://www.investopedia.com/terms/e/ex-dividend.asp

The dividend timeline is a sequence of key dates that determines who receives a payment. It begins with the Declaration Date, when the company’s board officially announces the upcoming dividend. The most critical date for investors is the Ex-Dividend Date; if you buy the stock on or after this day, you are not entitled to the declared dividend. To qualify, you must be a shareholder on the Record Date, which is set by the company, typically one business day after the ex-dividend date. Finally, the Payment Date is when the company distributes the dividend funds to all eligible shareholders of record.

For the long-term income investor, only the payment date is truly relevant. My strategy as a global investor is therefore built on an efficient dividend calendar, designed for retirement to require minimal maintenance while delivering the recurring pleasure of dividend income as often as possible.

B/ The American Quarterly Dream

For an income investor building a monthly income portfolio, understanding the rhythm of payment dates is crucial. The vast majority of U.S. companies that pay dividends do so on a quarterly basis, and these payments are not randomly distributed throughout the year. They follow a distinct and concentrated seasonal pattern—much like Rockefeller’s steady checks, but with predictable “lumps” that demand smart diversification.

The Three Main Quarterly Payment Cycles

U.S. companies tend to cluster their dividend payments into three primary cycles, often referred to by the first month of their quarterly sequence (based on S&P 500 data from 2023-2025):

- The Jan/Apr/Jul/Oct or 1/4/7/8 Cycle (JAJO): This is the leanest cycle, favored by some fiscal-year-end reporters. Examples: Procter & Gamble (PG, consumer staples) and Johnson & Johnson (JNJ,). Payments often hit mid-to-late month, providing a bridge but not the flood.

- The Feb/May/Aug/Nov or 2/5/8/11 Cycle (FMAN): The powerhouse, aligning with many calendar-year filers’ earnings cadence. Heavy hitters like JPMorgan Chase (JPM, financials) and Verizon (VZ, telecom) dominate here. This is your “dividend deluge” months—expect the biggest cash influx.

- The Mar/Jun/Sep/Dec Cycle or 3/6/9/12 (MJSD): A solid mid-tier, peaking in quarter-ends for tax and reporting reasons. Think ExxonMobil (XOM, energy, yield ~3.8%) and Coca-Cola (KO, consumer staples, yield ~3%). December often feels festive with year-end bonuses in dividends.

The Distribution Between the Three Cycles

While exact splits fluctuate annually (e.g., influenced by sector shifts), data from S&P 500 constituents shows a clear skew (per S&P Dow Jones 2024 report). This lopsided setup means FMAN months can generate 2-3x the income of JAJO—great for reinvestment, but a headache for bill-paying smoothness.

Key Implications for the “Monthly ETF” Strategy

This seasonality isn’t a bug; it’s your blueprint for U.S. allocation:

- Natural Imbalance: Pure U.S. plays can’t deliver flat monthly income—FMAN will bulge your wallet, while JAJO leaves gaps. Aim for 40-50% U.S. in your homemade ETF, overweighting FMAN/MJSD for yield, but padding JAJO with reliable payers like utilities (e.g., Duke Energy, DUK in JAJO).

- The “January Gap”: JAJO’s slimmer size creates a classic drought in Q1. Counter it globally—European semi-annual payers (e.g., Unilever in May/Nov) or Asian ad-hoc flows can fill January, turning lumpiness into liquidity.

- Focus on the “Heavy” Cycles: Build your core around FMAN/MJSD (e.g., 60% of U.S. sleeve), then cherry-pick 10-15 JAJO names for balance. Pro tip: Use filter tools to screen for aristocrats or income plays (25+ years of increases) with good yields. For scale, layer in monthly ETFs like JEPI or JEPQ to smooth intra-quarter.

In essence, the U.S. is your high-power engine—reliable, growing, but a little bit bumpy. That’s why your Global Dividend Calendar shines: blending these cycles with Europe/Asia rhythms crafts that Rockefeller-level monthly joy, paying bills and fueling reinvestment.

The Case for Monthly dividend payers

For the ultimate smoothing of income, the U.S. market offers a brilliant solution: monthly dividend payers. This elite group, including iconic names like Realty Income (O)—”The Monthly Dividend Company”—and supplemented by monthly ETFs like JEPQ, acts as the fine-tuning mechanism of the portfolio. They provide the psychological and practical comfort of a paycheck-like cadence, ensuring that even during the leaner weeks of the JAJO cycle, the cash flow never fully abates. While their yields can be compelling, they are best used as strategic “mortar” to fill the gaps between the larger “bricks” of the quarterly powerhouse cycles.

Ultimately, the U.S. segment of global income investing is a sheer pleasure compared to the rest of the world, precisely because its calendar possibilities are immense. The sheer volume of companies, the clarity of the quarterly cycles, and the very existence of a robust monthly-paying ecosystem provide an unrivalled playground for engineering a seamless income stream. The innovation is so advanced that for those seeking an even more granular approach, the market has now ushered in the era of weekly dividend ETFs, pushing the logic of frequent, compounding pleasure to its absolute extreme. This is the dividend investor’s paradise in action. However, as we have seen in our 27 previous articles (archive is here), we cannot place all our income eggs in the U.S. basket, and it is essential to diversify the income portfolio. And that is where the puzzle begins.

II. The Global Dividend Calendar: A Four-Season Puzzle

A Geographical Reading of Time

Dividend income does not flow continuously across the world. Each region follows its own fiscal rhythm, legal framework, and reporting tradition. From Tokyo to Frankfurt, from Sydney to São Paulo, global dividends form a temporal mosaic—abundance in spring and autumn, droughts in summer and early winter. Understanding this uneven flow is the foundation of any true global income strategy.

A/ Asia-Pacific: The Dual Pulse of Spring and Autumn

Asia’s dividend rhythm beats twice a year. Each market has its own fiscal calendar, yet most Asian payments cluster around March and September. These months define the region’s income tides.

Japan – The March Fiscal Clock

January 🔴 | February 🔴 | March 🟢🟢🟢🟢 | April 🟠 | May 🟠 | June 🔴 | July 🔴 | August 🔴 | September 🟠 | October 🔴 | November 🔴 | December 🔴

Japan anchors Asia’s calendar. Roughly 70% of listed companies close their fiscal year in March, with dividend payments concentrated between mid- and late-March.

A small second wave appears in April–May, but the rest of the year remains quiet.

Japan’s fiscal timing drives the global spring peak in dividend flows.

Australia – The September Counterpoint

January 🔴 | February 🔴 | March 🟠 | April 🟠 | May 🟠 | June 🟠 | July 🟠 | August 🟠 | September 🟢🟢🟢🟢 | October 🟠 | November 🟠 | December 🔴

Australia’s calendar mirrors Japan’s. With fiscal year-end in June, most Australian firms pay final dividends in August–September. This creates the second Asian high tide, complementing Japan’s spring cycle and filling part of the U.S. summer lull.

China & Hong Kong – The Irregular Flow of Conglomerates

January 🔴 | February 🟠 | March 🟢 | April 🟠 | May 🟢🟢 | June 🔴 | July 🟠 | August 🟠 | September 🟢🟢 | October 🟠 | November 🟢 | December 🟠

Companies listed in Hong Kong and mainland China usually pay semi-annually, with interim dividends in May and finals in September or November. Activity drops sharply in December–January, as the Lunar New Year halts board meetings and settlement schedules.

Singapore – The Semi-Annual Balance

January 🟠 | February 🟠 | March 🟢 | April 🟠 | May 🟢 | June 🔴 | July 🟠 | August 🟠 | September 🟢 | October 🟠 | November 🟢 | December 🔴

Singaporean blue chips tend to distribute two to four times a year, with concentrations around May and November. This pattern smooths Asia’s extremes, offering steadier cash flows than Japan or Australia.

India – The Bi-Annual Cadence

January 🔴 | February 🔴 | March 🟢🟢 | April 🟠 | May 🟠 | June 🔴 | July 🟠 | August 🟠 | September 🟢🟢 | October 🟠 | November 🟠 | December 🔴

Indian companies generally pay twice per year, after their March and September closings. The country aligns closely with the overall Asia-Pacific pulse: spring and autumn peaks, with thin months in between.

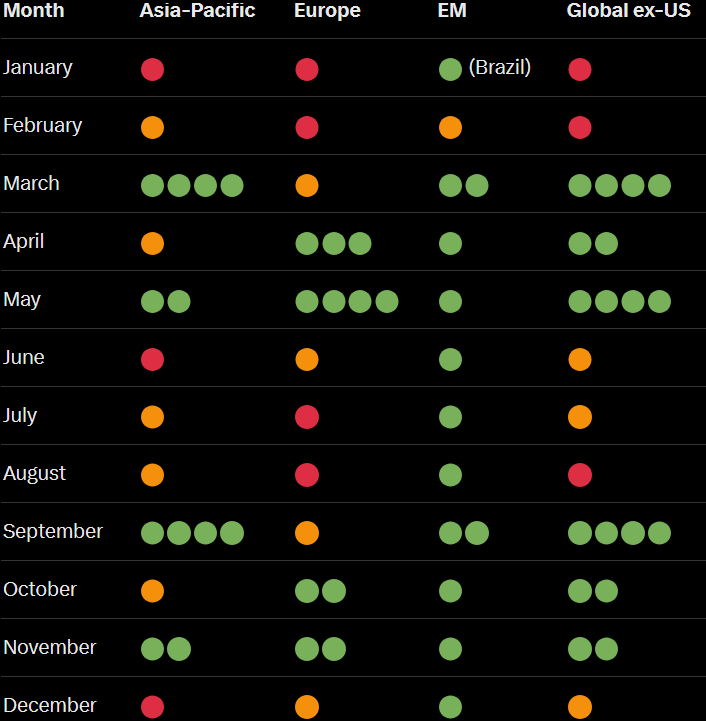

Asia-Pacific Summary

January 🔴 | February 🟠 | March 🟢🟢🟢🟢 | April 🟠 | May 🟢🟢 | June 🔴 | July 🟠 | August 🟠 | September 🟢🟢🟢🟢 | October 🟠 | November 🟢🟢 | December 🔴

Across Asia, two powerful waves dominate:

- March, driven by Japan and India’s fiscal closings.

- September, led by Australia and India’s second payments.

The region’s weakest months are June and December–January—clear structural voids in the income calendar.

B/ Europe: The Seasons of the Annual Meeting

European dividends follow the calendar of Annual General Meetings (AGMs).

Most companies pay shortly after their AGMs in April–May, and a smaller number issue interim payments in October–November.

United Kingdom – The Quasi-Quarterly Exception

January 🟠 | February 🟠 | March 🟢 | April 🟢 | May 🟢🟢 | June 🟠 | July 🟠 | August 🟢 | September 🟠 | October 🟢 | November 🟢 | December 🟠

UK corporates, especially banks and utilities, often distribute several instalments per year. This pattern creates a more continuous flow, with major peaks in May and October–November.

Germany – The Spring Tradition

January 🔴 | February 🔴 | March 🟠 | April 🟢 | May 🟢🟢🟢 | June 🟢 | July 🔴 | August 🔴 | September 🟠 | October 🟠 | November 🟠 | December 🔴

German firms overwhelmingly hold AGMs (Annual General Meeting) in April–May and pay immediately afterward. Dividend activity is thus heavily concentrated in the second quarter, with a long quiet stretch over the summer.

France – The Fiscal Twin of April–May and October

January 🔴 | February 🔴 | March 🟠 | April 🟢🟢 | May 🟢🟢🟢 | June 🟠 | July 🔴 | August 🔴 | September 🟠 | October 🟢 | November 🟢 | December 🟠

Most French companies pay in May following AGMs, while a few (LVMH) issue an autumn interim. This produces a dual-season rhythm—dominant in spring, very modest in fall.

Switzerland – The Binary Pattern

January 🔴 | February 🔴 | March 🟠 | April 🟢🟢 | May 🟢 | June 🟠 | July 🔴 | August 🔴 | September 🟠 | October 🟢🟢 | November 🟢 | December 🟠

Swiss corporates (Nestlé, Roche, Novartis) mainly distribute in April, with occasional October payments. A consistent, AGM-driven structure.

Nordics and Netherlands – The Spring Regulars

January 🔴 | February 🔴 | March 🟠 | April 🟢🟢🟢 | May 🟢🟢 | June 🟠 | July 🔴 | August 🔴 | September 🟠 | October 🟠 | November 🟠 | December 🔴

Northern Europe amplifies the same trend: a heavy spring focus and minimal activity in the summer.

Europe Summary

January 🔴 | February 🔴 | March 🟠 | April 🟢🟢🟢 | May 🟢🟢🟢🟢 | June 🟠 | July 🔴 | August 🔴 | September 🟠 | October 🟢🟢 | November 🟢🟢 | December 🟠

Europe runs on a two-peak AGM rhythm:

- Spring (April–May–June) is the dominant season.

- Autumn (October–November) brings smaller interim flows.

The main droughts are January–February and July–August, when few companies are active.

C/ Emerging Markets: Irregular but Continuous

Emerging-market dividends are less synchronized, but their irregularity provides natural diversification.

Three regional pillars shape the pattern:

- Brazil, with frequent or quarterly payouts.

- India and South Africa, both semi-annual.

- China-EM, scattered and unpredictable.

Brazil – The Steady Quarterly Flow

January 🟢 | February 🟢 | March 🟢 | April 🟢 | May 🟢 | June 🟢 | July 🟢 | August 🟢 | September 🟢 | October 🟢 | November 🟢 | December 🟢

Brazilian companies (Petrobras, Vale, Itaú) pay quarterly or even monthly.

It is one of the few markets with truly year-round income. That’s why I love this market.

South Africa – The March and September Semi-Annuals

January 🔴 | February 🔴 | March 🟢🟢 | April 🟠 | May 🟠 | June 🔴 | July 🟠 | August 🟠 | September 🟢🟢 | October 🟠 | November 🟠 | December 🔴

South African firms typically pay in March and September, mirroring India’s cadence.

The mid-year and end-year gaps remain significant.

Emerging Markets Summary

January 🟠 | February 🟠 | March 🟢🟢 | April 🟢 | May 🟢 | June 🟢 | July 🟢 | August 🟢 | September 🟢🟢 | October 🟢 | November 🟢 | December 🟢

Thanks to Brazil, emerging markets deliver a near-continuous baseline flow.

Although smaller in size, these payments fill gaps left by the more cyclical developed markets.

D/ Global ex-U.S. Overview

January 🔴 | February 🟠 | March 🟢🟢🟢🟢 | April 🟢🟢 | May 🟢🟢🟢🟢 | June 🟠 | July 🟠 | August 🔴 | September 🟢🟢🟢🟢 | October 🟢🟢 | November 🟢🟢 | December 🟠

Across all regions outside the United States, three strong peaks dominate:

- March, led by Japan and India.

- May, powered by Europe’s AGM season.

- September, driven by Australia and emerging markets.

Three months stand out as global troughs: January, February, and August—periods when Ex-US income nearly vanishes.

E/ Global Diagnosis

The global dividend cycle is structurally discontinuous. Even broad diversification cannot smooth the rhythm entirely. Income outside the U.S. arrives in bursts, not in streams.

The three recurring weak points are:

- January–February: post-holiday and pre-AGM inactivity.

- August: the European vacation blackout.

These three months together account for roughly one-third of the year’s income drought. They define the central constraint of global income investing: the calendar itself is cyclical, not linear.

Investment takeaway – The Time of Income

The global dividend calendar flows like a tide, not a clock. March, May, and September bring surging rivers of cash. January, June, and August expose dry beds. Recognizing this temporal map is the first step toward mastering global income—not to chase yield, but to understand the rhythm of return.

Global income investing is, admittedly, more complex. It involves more calendar constraints and more currency risk. However, it is fundamentally more secure than single-currency investing for those with a long-term perspective. I count myself among them. With a few basic tools, I can significantly reduce the monetary, fiscal, and calendar complexity. It’s a modest intellectual effort in exchange for a far greater securing of my income.

Do you feel safe with a portfolio tied to a single country and a single currency? I don’t. That’s why I accept the added complexity; the reward is enjoying dividends every month – from different parts of the world, in different currencies. This is my path.

The Homemade 10% Monthly ETF isn’t a product you buy — it’s a discipline you build. Each month’s dividend is a page in your personal cash-flow calendar.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

If this deep-dive into the global dividend calendar saved you hours of research, consider buying me a coffee.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.