High Income REIT Q3 2025 Update: High yield, High nerve, High potential

Test your nerves

If there’s one area where AI will never replace human beings, it’s in emotional management. With volatile investments like this one, it’s the essential skill for turning an investment into a good investment. We will see over time if that’s the case with Icade.Today, it’s time for an update on this REIT, my “high yield & deep value” bet on French real estate, following the publication of its 9-month 2025 results. As a reminder, I still hold my 485 shares purchased in March at €20.50. The goal? To verify if the “double-digit dividend and massive discount” cocktail is still as potent, or if it’s starting to turn sour.

I/ Investor Experience: The High-Yield Rollercoaster

The journey since March has mirrored the anticipated turbulence of a deep-value, income-focused REIT play, amplified by persistent macroeconomic headwinds like elevated interest rates and French political uncertainty. Yet, the income stream has provided a robust buffer, underscoring the asymmetric reward profile.

Source: Icade Site

Dividend Windfalls

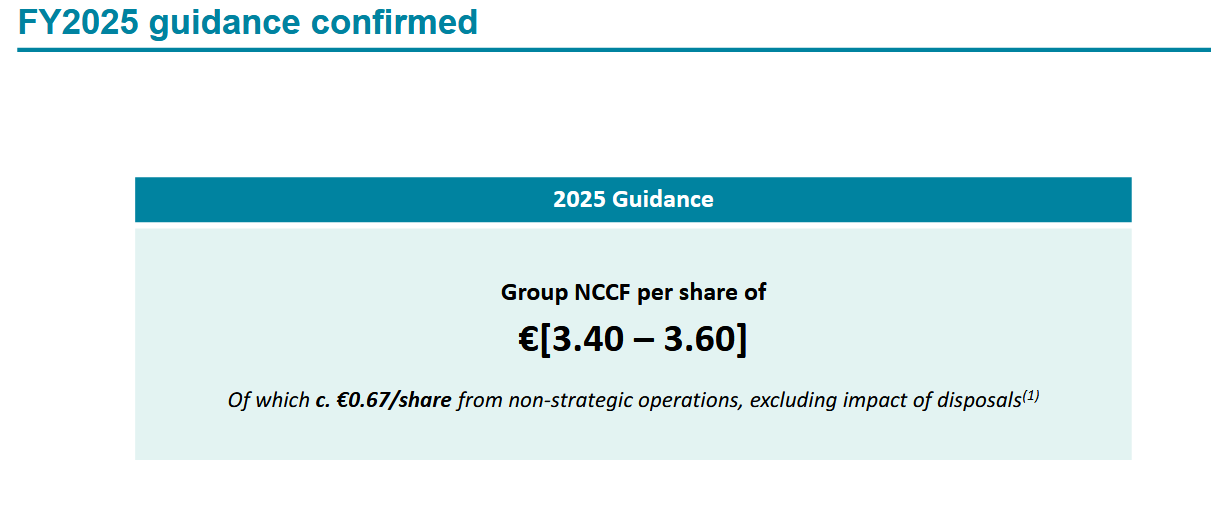

The Compelling Payoff. Missing the March ex-dividend by a narrow margin, I captured the full July payout. Even with a projected 2025 dividend of €3.10 per share (down from €3.98 in 2024, al

igning with reaffirmed NCCF guidance of €3.40–€3.60), the trailing yield at my cost basis exceeds 15.1%. This isn’t mere speculation; it’s cash flow reality. At least, this is my personal bet!

Over the holding period, annualized income has outpaced inflation by a wide margin, effectively paying investors to endure the wait for re-rating. In a peer context, this dwarfs the ~4-7% yields of diversified European REITs like Unibail-Rodamco-Westfield or Klépierre highlighting Icade’s unique “distressed yield” appeal.

Volatility Tax: The Inevitable Cost

Price action has oscillated wildly between €18.50 and €24.50 year-to-date, a ~32% swing reflective of broader office sector anxieties and rate sensitivity. This isn’t idiosyncratic; French office vacancy rates hover at 7.5% nationally, with Paris at risk of further polarization. Daily portfolio checks? A recipe for regret. Instead, a quarterly review cadence, anchored in fundamentals, mitigates the noise—much like ignoring short-term NAV writedowns (down ~5% YoY in H1) in favor of execution milestones.

Source: Yahoo.fr

Net: A classic high-conviction hold—lavish cash returns amid episodic drawdowns

The ~62% discount to the primary EPRA NTA benchmark (€56.6 per share as of June 2025), alongside more conservative floors at 64% (EPRA NDV) and 65% (EPRA NRV), underscores the persistent deep-value opportunity—though notably narrower than at my March purchase (€20.50 entry, implying ~67%+ to then-estimated NAV) due to asset valuation pressures eroding the NAV base. This sustains the asymmetric value case amid volatility, but demands steel nerves. This is still an interesting perspective, as there are some improvements about operational momentum.

II/ Operational Momentum: Executing the ReShapE Strategy Amid Headwinds

The 9-month results aren’t fireworks, but they evidence disciplined progress under the ReShapE strategic plan—a multi-year blueprint to reshape Icade into a leaner, more resilient player focused on sustainable mixed-use developments and high-quality income assets. Launched in 2023, ReShapE targets portfolio diversification away from legacy exposures (e.g., healthcare, non-core offices) toward “future-proof” segments like light industrial and prime offices, with deleveraging as the linchpin. Q3 underscores tangible advancement, blending liquidity generation with quality enhancements.

Core Portfolio Resilience: Quality Over Quantity

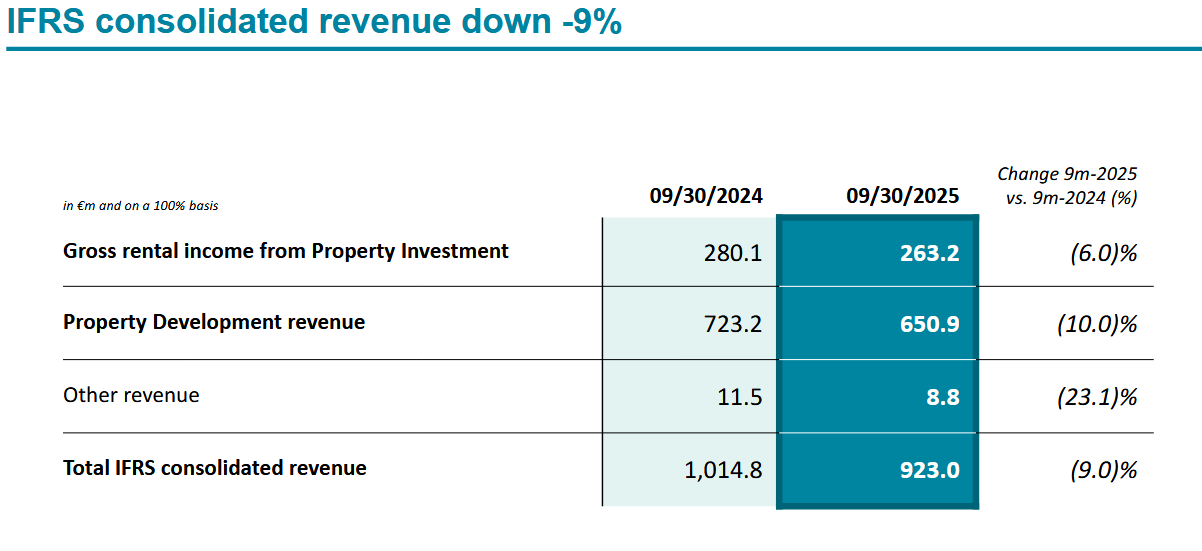

Amid a -6% rental income dip to €263.2 million, the underlying strength emerges in occupancy gains. Financial occupancy climbed to 88.8% for prime offices (up 0.8 pps vs Dec 2024) and 90.4% for industrials (up 1.5 pps), driven by 166,000 sqm in leases YTD (including 125,000 sqm of new leases)—securing €29 million in annualized rents at a solid WALB of 6.8 years. The KPMG renewal (41,000 sqm in La Défense’s EQHO Tower, to 2031) is emblematic: 70% of activity was new lettings, signaling demand for ESG-compliant, transit-oriented assets. In short, the group achieved around €430m in disposals, maintained strong leasing activity with improved occupancy rates, stable property development trends, and confirmed its 2025 guidance.

Source: Icade Q3 Report

Deleveraging Acceleration: Building Financial Fortitude

The headline act in Q3: €430 million in disposals completed or under firm agreement year-to-date—a deliberate, ReShapE-fueled push to shed non-core weight and fortify the balance sheet. Far from haphazard fire sales, this is precision engineering: the €173 million Italian healthcare portfolio (spanning 23 assets, set to close by year-end) anchors a broader €210 million carve-out of legacy healthcare holdings, freeing up capital to extinguish intra-group loans and streamline operations. Layered on top, €220 million from other non-strategic sales commanded an average yield of 6.1%, handily topping December 2024 NAV valuations and proving Icade’s assets still draw premium bids in a skeptical market.

Source: Icade Q3 Report

This firepower directly bolsters financial resilience

With LTV (Loan-to-Value) already dialed back to 38.1% as of H1 2025 and momentum carrying toward a mid-30s target by December, refinancing headwinds from the ECB’s cautious rate regime feel far less daunting. Liquidity? A €2.6 billion net fortress (as of September 2025, with maturities secured through 2029), further extended by savvy moves like the recent €500 million green bond issuance at a 4.375% coupon. Stack that against peers like Covivio (clocking ~40% LTV in their latest) or those mired at 40-45%, and Icade’s playbook screams proactive edge—poised to slash borrowing costs and unlock reinvestment firepower as early as 2026. In a word: from this standpoint, perspectives brighten considerably.

Development Adaptation: Stabilizing the Pipeline

The Pinel tax incentive sunset slashed individual orders -43% in volume, yet total units held flat at 2,815, with value down -5% to €722 million. Bulk/institutional sales surged +11% to 1,530 units (51% of volume), diversifying away from retail sensitivity. Backlog resilience supports visibility, though commercial softness tempers optimism.

Source: Icade Q3 Report

III/ Very well, but what about the dividend’s sustainability?

Optimism tempered

Revenue erosion and market fragility underscore why Icade isn’t a “set-it-and-forget-it” play. A balanced view demands stress-testing the income engine.

Revenue Pressures: Operational Strain

The -9% topline contraction to €923 million reflects a bifurcated market—rental -6% from tenant churn and negative reversions (-2.7 pps), development -10% from Pinel fallout and subdued commercial demand (take-up -8% in Greater Paris). Even post-disposals, recurring EBITDA faces ~5-7% compression, pressuring the €2.73–€2.93 NCCF from strategic ops (ex-non-core €0.67). Absent acceleration, 2026 could see further 5-10% erosion if rates linger above 3%.

Source: Icade Q3 Report

NCCF Trajectory: Dividend Anchor Under Scrutiny

As the main ‘truth dividend indicator’ NCCF’s (Net Current Cash Flow) reaffirmed but lowered guidance signals caution—payout coverage slips to 86-90% at midpoint, vs. 100%+ in 2024. Non-strategic contributions (e.g., full €37 million Praemia dividend) provide a floor, but core stabilization is pivotal. A sustained downtrend could force a 10-15% cut in 2026, eroding the yield moat. Strategically, ReShapE’s disposal proceeds (€500 million net post-debt) offer a war chest for selective reinvestment, but execution risk looms if cap rates stay elevated (5.5-6.5% for offices). I still maintain my bet on a €3.10 dividend, but I definitely feel (a little bit) more stressed than before.

Sector Fragility: instability and interest rates

Total occupancy stagnates at 84.0% (-0.7 pps), with “to-reposition” offices at a dismal 52.8%. NAV pressures persist, sustaining the 62% discount amid still-elevated LTV (38%). Broader risks—French political gridlock, slowing inflation (~1.2% CPI), and 2026 macro uncertainty—could delay recovery, contrasting peers like Segro (industrial focus, ~+11% TSR YTD) that sidestep office woes. Icade’s ESG edge (GRESB 92/100) aids adaptation but can’t fully insulate.

Investor takeaway : Personal Thesis Intact

This Q3 snapshot reaffirms my initial personal investment thesis: Icade endures as a high-risk, high-reward convexity play, where strategic grit meets undervaluation.

- Yield Magnet Persists: At 15%+, dividends dwarf peers, compensating for risks while funding transformation— a rare income-value hybrid in Europe’s €420 billion REIT market.

- Psychological Fortitude Essential: Volatility is baked in; success hinges on tuning out noise for milestones like LTV compression and 90%+ core occupancy. But it is still easier to say!

- ReShapE Gaining Traction: €430 million disposed, leasing momentum, and backlog stability evidence a proactive pivot to resilient assets, positioning for 2027 recovery (projected office rents +3-5% annually).

My personal stance holds: Accumulate income, monitor execution, and await discount convergence. The road remains bumpy, but with €2.6 billion liquidity, a 60%+ discount and a double digit dividend yield even after the projected dividend cut, it still looks compelling.

In short, Icade’s 15% yield remains unmatched in Europe, but the patience tax is real. Execution on ReShapE and debt reduction are the key catalysts. High yield, high nerve, high potential. Not made for everyone.

It fits my temperament — shaped by decades in finance and nearly 15 years of investing.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.