Surviving in a Low Oil Price Environment

Sep 02, 2025

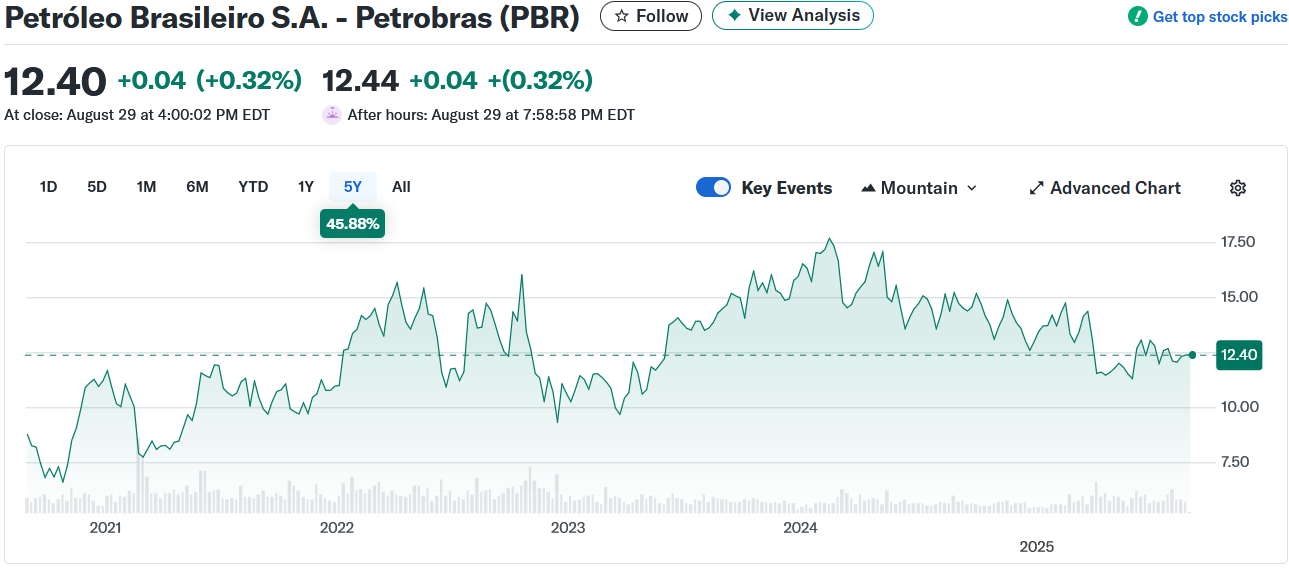

High yield, high drama — Petrobras offers both. But now that Q2 2025 results are in, the question arises: can this dividend darling still deliver? Since early June, I’ve been following one of the market’s most polarizing stocks — a high-yield, high-risk play that thrives when oil prices remain elevated, political interference is contained, and the Brazilian real stays relatively stable. That’s a lot of moving parts, but the potential rewards remain significant. With the second quarter behind us, it’s time to assess how these risks materialized and what they imply for PBR’s performance from an income investor’s perspective.

I. Recap of Previous Episodes and New Development

I.A.1. Petrobras Weaknesses

Petrobras continues to grapple with structural challenges primarily linked to its majority state ownership. The Brazilian government controls more than 50% of voting rights and retains a golden share, allowing it to exert significant influence over strategic decisions. This often leads to policies driven by government agendas rather than shareholder value, such as delayed domestic fuel price adjustments and politically motivated executive appointments. Such interference undermines corporate governance, restricts management autonomy, and creates uncertainty for investors.

Financially, Petrobras remains exposed to currency and leverage risks. Around 70% of its revenues are in Brazilian reais, while roughly 70% of its debt is denominated in U.S. dollars. This currency mismatch means that when the BRL depreciates, debt servicing costs rise sharply, squeezing profitability and cash flows. By 2025, Petrobras carries net debt of about $59 billion, approximately 65% of annual revenues — significantly higher than peers like ExxonMobil, TotalEnergies, or Shell. This constrains its ability to fund growth projects or absorb oil price volatility when USDBRL is high.

Operationally, earnings remain highly sensitive to oil price swings, increasing volatility. The refining segment underperforms compared to upstream, hindered by lower utilization rates and compressed margins, which drag overall profitability. Large-scale project execution remains challenging: in 2024, cost overruns and supply chain disruptions increased project budgets by 8–10%. Additionally, regulatory, environmental, and ESG pressures intensify, exposing Petrobras to legal risks, potential fines, and strategic constraints amid the global energy transition.

I.A.2. Petrobras Strengths

Despite these weaknesses, Petrobras maintains significant strategic advantages. It ranks among the top 10 global oil producers, with output near 2.78 million barrels per day (more in Q2), supported by proven reserves of almost 11 billion barrels. Its primary competitive edge lies in technological leadership in deepwater and ultra-deepwater exploration, particularly in Brazil’s pre-salt basin, which holds about 60% of the nation’s reserves. Petrobras operates some of the industry’s most advanced floating production storage and offloading (FPSO) units and leverages technologies such as autonomous underwater vehicles and predictive maintenance. Its R&D division, comprising over 2,000 researchers and more than 1,000 patents, strengthens Petrobras’ offshore efficiency and cost competitiveness.

Source: Agility effect

Financially, the company has committed to a $111 billion capex plan from 2025–2029 to expand exploration, increase production, and enhance refining. Production targets aim for 3.2 million barrels of oil equivalent per day by 2029, focusing on high-value, low-cost pre-salt assets. Petrobras is also investing in low-carbon initiatives — biorefineries, carbon capture, and green hydrogen — though these account for only 2–3% of revenues, highlighting continued hydrocarbon dependence.

Long-term oil demand fundamentals remain supportive despite decarbonization trends. Growth in developing economies, renewable intermittency, and rising energy consumption tied to AI, automation, and data centers should sustain crude demand into the 2030s. Petrobras’ technological prowess, scale, and pre-salt position provide resilience and growth potential, though risk exposure remains high.

Key sensitivities for investors include:

- Political interference from the Brazilian government,

- Currency exposure due to USD-denominated debt versus BRL revenues, and

- Global oil price volatility.

B. New Events

1. Risks Materialized: Politics, USDBRL, and WTI

During President Lula’s third term (2023–present), political interference intensified, creating risks for income investors. Leadership instability is notable: three CEOs in three years, with Jean Paul Prates ousted in May 2024 and replaced by Magda Chambriard, a Lula ally. In March 2024, the state-controlled board blocked an $8 billion extraordinary dividend, redirecting it to government-driven investments, causing a 10% share price drop.

Lula’s job-creation agenda, including accelerated refinery and shipyard projects, resulted in 8–10% cost overruns in 2024. The $111 billion 2025–2029 capex plan prioritizes local employment over efficiency. Fuel pricing below parity had a manageable but noticeable effect: gasoline prices were cut ~5.6% in June 2025, and diesel remains ~18% below import parity, pressuring refining margins. Goldman Sachs estimates such underpricing could lower consolidated downstream EBITDA by ~7% per quarter. However, strong upstream performance largely offsets this, sustaining overall resilience, though long-term dividend sustainability remains a concern if pressures continue.

The USDBRL exchange rate, a second risk factor due to debt structure, has stabilized recently, a positive development for Petrobras.

Source: Yahoo Finance

Source: Yahoo Finance

Oil prices, however, have declined from 2022 peaks, with WTI near $64 per barrel, affecting profitability, stock performance, and dividends.

Source: Trading view

2. Financial Consequences on Stock

WTI declines correlate with PBR share price drops, while BRL stabilization eases debt pressure.

Source: Yahoo Finance

Dividends have fallen quarter-over-quarter but remain high.

II. Still a Good Investment for an Income Investor?

A. Q2 2025 in a Nutshell: Operational Performance, Financial Resilience, Dividend Pressure

Petrobras achieved record output in 2Q25, driven by new offshore units. Average oil and gas production reached 2.91 MMboed, up 5% from 1Q25, with total operated production at 4.19 MMboed. Highlights include the Alexandre de Gusmão FPSO start-up. Refining utilization stood at 91%. Commissioning these facilities caused a 7% rise in greenhouse gas emissions in 1H25.

Source: https://api.mziq.com/mzfilemanager/v2/d/25fdf098-34f5-4608-b7fa-17d60b2de47d/6fd34d30-e522-1527–9040-c4d6c40f1382?origin=1

Financially, revenues slightly declined to $21.037 billion due to lower oil prices and currency effects, while adjusted net income rose 1.8% QoQ, showing resilience. Adjusted EBITDA fell 4% due to downstream margin pressures, and free cash flow dropped 24%, reflecting higher capex.

Net debt increased to $58.6 billion, with leverage at 1.53x. Yet Petrobras maintained a dividend of R$8.7 billion (~$1.6 billion), balancing returns with exposure to volatile oil and operational costs.

Source : Petrobras Q2 report

Thanks for reading! This post is public so feel free to share it.

Doubts about dividend policy sustainability : in Q2 2025, the company generated US$21.0 billion in revenue (down 0.2% QoQ) and posted US$4.7 billion in net income, but free cash flow fell 24% to US$3.4 billion as capital spending rose 9% to US$4.4 billion. At the same time, gross debt increased 5.5% to US$68.1 billion and net debt climbed to US$58.6 billion, pushing leverage to 1.53x. Despite these pressures, Petrobras approved R$8.7 billion (about US$1.6 billion) in dividends. While the payout is covered by current earnings, its sustainability is questioned given falling cash generation, rising debt, and persistent low oil prices around $64 per barrel.

Source : Petrobras Q2 report

B. My Perspective as an Income Investor: Accepting Risk, Holding, and Getting Paid

I won’t dwell: debt doesn’t worry me. Political interference is already priced in. Oil prices may cause short-term pain, but as a long-term investor, I’m comfortable with that. High yield/high risk is accepted — I recognized it when I invested my first dollars.

Peter, in a June commentary, highlighted an incomplete point in my earlier analysis: debt is not the problem. For offshore drillers, debt/levered cash flow is the right metric. Petrobras, with 95% offshore production, demands higher capex but delivers superior margins and stable cash flow once online. Its 5-year average EBITDA margin remains high (~39% versus ~21% for Exxon and ~22% for Chevron), and its levered free cash flow margin reaches 21% (versus 9% for Exxon and ~11% for Chevron), illustrating a clear structural advantage. The net debt / levered free cash flow ratio is 7.39, lower than Exxon’s (8.35) and Chevron’s (7.86), effectively countering “overleveraged” narratives.

Investment Takeaway

Petrobras is high-risk, high-reward. Investors aren’t dumb — they’re brave, embracing volatility for potential outsized returns. For a global high-yield portfolio, it’s compelling long-term despite price swings or dividend risks. I purchased 1,770 PBR.A preferred shares between March and May 2025, prioritizing yield over voting rights. Robust reserves, technological leadership, and enduring oil demand make Petrobras unique. This analysis should help determine whether it aligns with your investment strategy — share your thoughts in the comments.

Since first buys this year, I’ve endured volatility, reinvested dividends, and remain long-term bullish on Petrobras. It remains a good company at an attractive price for me. As Petrobras is my second holding, I reinvest dividends in other holdings until now.

Petrobras Q2 2025 – Quick Hits

- High Yield, High Drama – Big dividends, volatility baked in.

- Record Production – Offshore output up 5%, refineries 91% utilized.

- Cash & Debt – Free cash flow down 24%, leverage 1.53x, but Debt/FCF = 7.39 (better than peers).

- Political & Market Risks – Fuel pricing & WTI at $64 impact margins, largely priced in.

- Long-Term Edge – Tech leadership, pre-salt reserves, resilient oil demand.

- Investor Strategy – Hold, reinvest dividends in my global income portfolio, embrace volatility for outsized returns.

Liked this Deep-Dive? Buy Me a Coffee!Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.

Your article helped me a lot, is there any more related content? Thanks!