The Good, the Bad, and the Ugly

Jul 15, 2025

This article is a first milestone in managing my portfolio. For regular readers, you may have seen the basic principles of my portfolio management in the very first articles on megatrends, and in the focus pieces on XYLD, JEPQ, Petrobras, Icade, and Banco do Brasil. The portfolio has been very gradually built up over the first semester, and it is admittedly somewhat artificial to evaluate its performance from January to June, but I propose that we play along because, beyond these methodological clarifications, it’s worth it. It’s the perfect opportunity to revisit both the philosophy behind the portfolio and its actual performance.

I/ Let’s Review the Philosophical Principles of the Long-Term High-Yield Portfolio and the Path Ahead for the Decade to Come

A/ The Good, the Bad, and the Ugly High Yielders

The Good: Accidental High Yielders

Accidental high yielders are companies or assets that offer unusually high dividend yields, not because they are deliberately pursuing high payouts, but often due to temporary market mispricing or specific circumstances. These are typically fundamentally strong businesses experiencing short-term difficulties or sector-specific headwinds that temporarily depress their prices, resulting in higher yields. For investors who do their homework, these can represent excellent opportunities to capture sustainable income with potential capital appreciation as the market corrects.

=> In my portfolio, I think that Icade and Banco do Brasil (see below) are two accidental high yielders, while Petrobras…is special.

The (Not So) Bad: Structurally High-Yielding Investments

This category includes investments that are designed to consistently provide elevated income streams, such as covered call ETFs or certain types of high-yield bonds. These instruments typically generate steady cash flows by either writing options premiums or focusing on income-generating securities. While they offer attractive yields and a relatively predictable income, they come with trade-offs, including capped upside potential in the case of covered calls or higher credit risk in some bond sectors.

They suit investors looking for regular income but who understand the structural nature and inherent risks of these assets. Attention here because many high yielders in the world of CEFS and high-yield ETFs (more recent ones) are simply capital destroyers (the net asset value is progressively eroded).

=> In my portfolio, I’ve opted for JEPQ and XYLD. The covered call ETFs are the only ones that reassure me at this stage and given market valuations, even though some CEFS interest me.

The Ugly: Yield Traps

Yield traps are arguably the most dangerous category of high-yield investments. These are assets with high dividend yields that appear attractive on the surface but are actually unsustainable due to deteriorating fundamentals. Often, companies in financial trouble or sectors in decline maintain high payouts to lure investors, but eventually, they are forced to cut dividends, causing sharp price declines. Falling into yield traps can severely damage a portfolio, making it critical for investors to analyze the sustainability of income streams rather than chasing yields blindly. Below is an image of the NAV of a CEF specialized in CLOs over recent years. I’m not comfortable with this approach, so I’m sticking with my covered call ETFs at this stage. The whole challenge is to stay away from yield traps.

Source: https://www.portfoliovisualizer.com

B/ Core Principles: Long Term, High Yield, Global Stance

In my previous articles, I outlined a strategy for building a long-term income portfolio inspired by Steven Bavaria’s Income Factory philosophy and some others. But here, we clearly have a global perspective and wish to hold more stocks. The core principles center on generating consistent passive income through a diversified mix of assets, including high-dividend stocks, high-yield bonds, REITs, and other income-producing instruments. I emphasize diversification to mitigate market volatility risks while prioritizing relatively low-risk assets to ensure financial stability.

My approach advocates for a patient and disciplined investment strategy, focusing on reinvesting income to compound growth over time. This method aims to align investments with personal financial goals, striking a balance between immediate income and capital preservation for sustained wealth-building.

C/ Megatrends for the next decades

In my previous articles, I highlighted these key megatrends shaping the landscape for a long-term income portfolio.

- Energy Transition – The impact of massive (or insufficient) investments

- Demographic Shifts – Aging populations, interest rates, automation, robotics

- Geopolitical Risk – The rising probability of global conflicts

- Geo-Economic Shift – The shift of wealth creation toward Asia

- Currency Risk – How long will the USD remain the dominant global currency?

- Technological Disruption – The rise of artificial intelligence and automation

Persistent inflation is a driving force, making income-generating assets like dividend-paying stocks and REITs attractive for preserving purchasing power if we take these megatrends into account. For the energy transition as a significant trend, I focus on the oil and gas sector, capitalizing on global energy demand. Additionally, digitization and AI are transforming investment opportunities, favoring high-growth tech companies that also provide dividends. And they need energy. By aligning portfolio choices with these enduring economic and sectoral trends, I aim to optimize returns and ensure resilience in a dynamic market environment. At this stage, I’ve mostly concentrated on these two aspects. There’s still work to do. But let’s start by analyzing the first results after this lengthy first section.

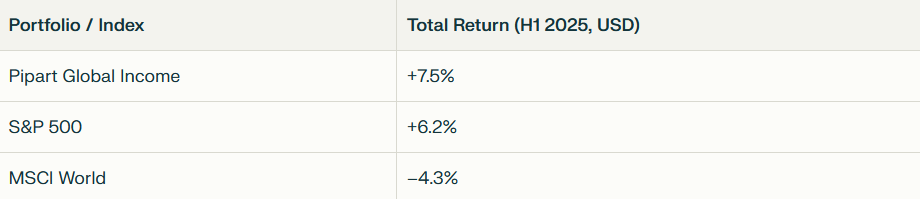

II/ Facts: Encouraging Initial Results in the First Semester: 7.5% Total Return and a 12% Annualized Yield

A/ A Respectable Total Return and a 12.41% Yield on Cost, 11.83% on Market Price

Since the portfolio was only gradually built from scratch in early 2025, this review has some limitations — but it’s time to start tracking progress and refining the method.

The total return is higher than that of the S&P 500 and the MSCI World. No need to specify that luck has been my main ally over such a short period. It’s impossible to draw conclusions, even hasty ones, and time will tell if the method holds up.

A note, by the way: my total return would be significantly worse if calculated in EUR, but we’ll come back to that in future articles. Let’s now look at the portfolio composition at this stage.

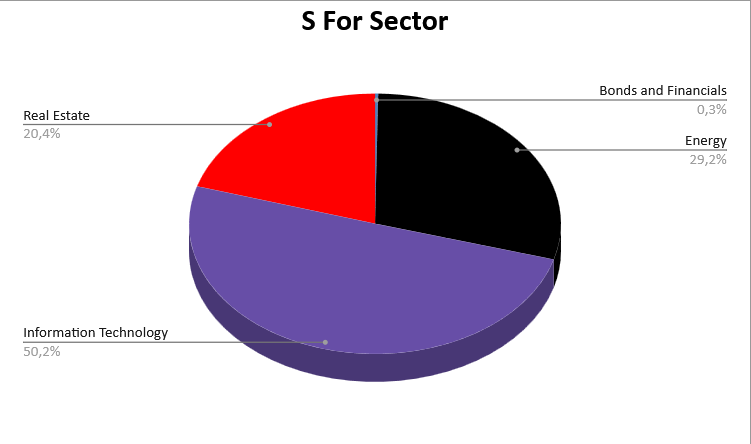

B/ A Portfolio Heavily Oriented Toward Tech and Energy

The image below is perhaps the most faithful representation of the Pipart Global Income portfolio composition: an oil well connected to a computer with a building behind.

Here’s the more technical version.

You’ll find my accidental high yielders: Icade, Banco do Brasil, and Petrobras, my structural high yielders (JEPQ and XYLD), and, I hope, no yield traps! Technology, oil, and real estate. As the graph below clearly indicates.

Each of these stocks has been the subject of an article. Honestly, go read them to get an idea. I’ll provide regular updates.

III/ Strategy and Tactics for the Next Decade: The I-CASH Method

Once again, we will rely on the I-CASH method to determine the next steps. At this stage, it’s fairly simple, as the portfolio is only in its early stages.Key takeaways and actionable steps from the I-CASH method:

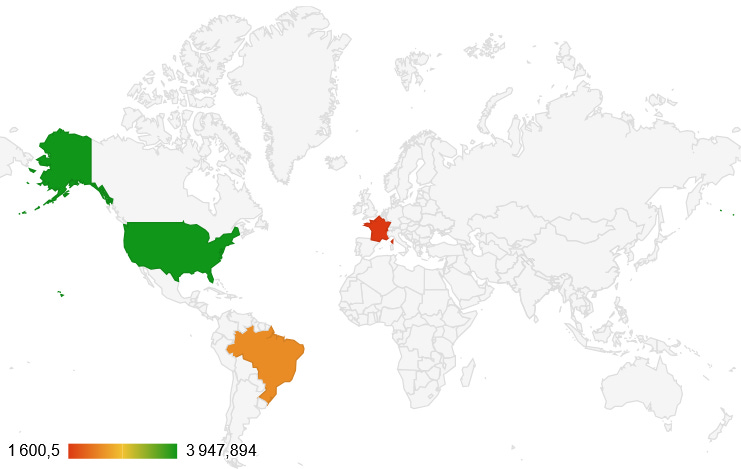

- International Diversification (I): Spread capital across multiple countries and continents, focusing not just on broad exposure but aiming to select specific, high-yielding investments in different local markets. This can help reduce country-specific risk and unlock new sources of income. The world map below is clear: the work of geographical diversification is still immense.

Currency Diversification (C): Invest in assets denominated in several currencies, preferably those undervalued relative to their historical averages. In the article’s case study, the Japanese Yen and Brazilian Real are highlighted as undervalued, suggesting they present potential for both income and future capital appreciation as currencies revert to mean values.

=> The conclusion is the same as before. Dividends will be used to buy stocks in other currencies.

Asset Class (A): Allocate capital among a range of income-generating asset classes: high-dividend stocks, preferred shares, bonds, REITs, and covered call ETFs. This reduces reliance on any single asset type for income stability.

=> I have far too many covered call ETFs. Again, this isn’t unusual during portfolio construction.

Sector Diversification (S): Invest across all 11 GICS sectors, paying attention to those sectors that are naturally more dividend-heavy, such as utilities, financials, and real estate, while also avoiding overconcentration in just a few sectors.

- => Too much tech for me. But it pays.

- High Yield (H): Maintain a strict filter: only consider investments with a yield above 9-10%. This ensures portfolio additions meaningfully contribute to the income objective. For this criterion, we’ll keep it simple: we need to search for other high-dividend companies. Stay tuned in the coming weeks for more on this.

Conclusion – Investment Takeaway

The portfolio is under construction. It’s keeping its promises in the very short term. I know my playing field is narrower than for classic growth or dividend growth investors, but the reward is, in my view, more appealing. And it comes faster.

In short, a 12% annualized yield with a 7.5% total return in one semester is respectable but doesn’t validate the method in any way. The coming years will be decisive. In the meantime, the cash flow is coming in, and that’s precisely the purpose of this portfolio. Subscribe to know what happens.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone. Building a global income portfolio.