The brave buy Petrobras

Jun 10, 2025

Petrobras is a high-stakes investment, offering generous dividends alongside significant risks. In Part 1, published on June 3, 2025, on Pipart Global Income, we examined Petrobras’ structural challenges, which temper its alluring 15–16% dividend yield. State ownership—holding 50.26% of voting rights and a golden share—exposes the company to political interference, such as delayed fuel price adjustments and governance issues. Currency risk (70% of revenues in reais versus 70% of debt in dollars) and substantial debt ($59.1 billion, or 64.7% of revenues) heighten uncertainty. Geopolitical dependencies (notably on China and the U.S.), environmental fines, the fallout from Lava Jato—Brazil’s massive corruption scandal—and ESG pressures further complicate the outlook. Yet, can Petrobras’ strengths, like its attractive valuation and technological prowess, outweigh these risks? In Part 2, we explore the opportunities this controversial company presents.

I. In June 2025, Petrobras Remains a Major Player with Strong Technical Expertise

A. A Robust Industrial and Financial Position

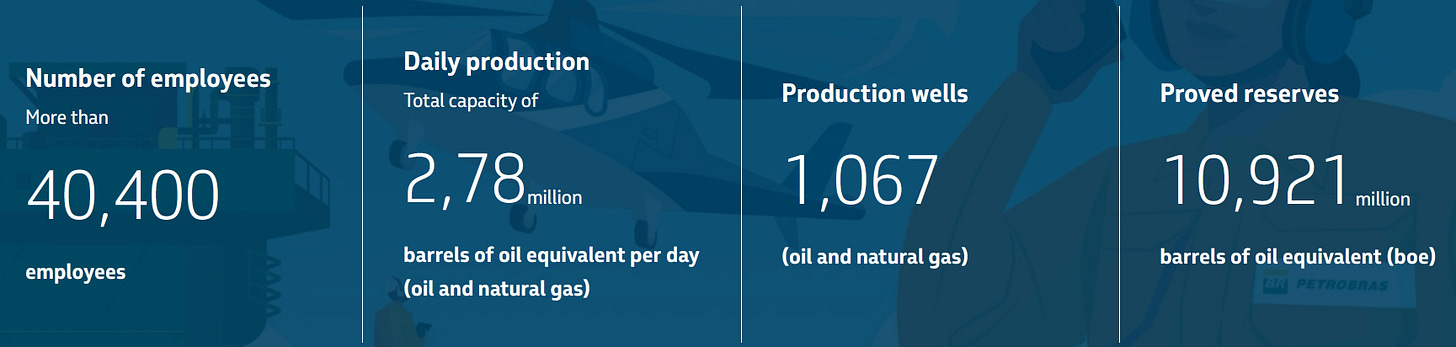

Petrobras may not be classified as a traditional oil major—likely due to its state-owned status—but it ranks among the world’s top producers, pumping 2.78 million barrels per day, or roughly 3% of global production.

Source : Petrobras

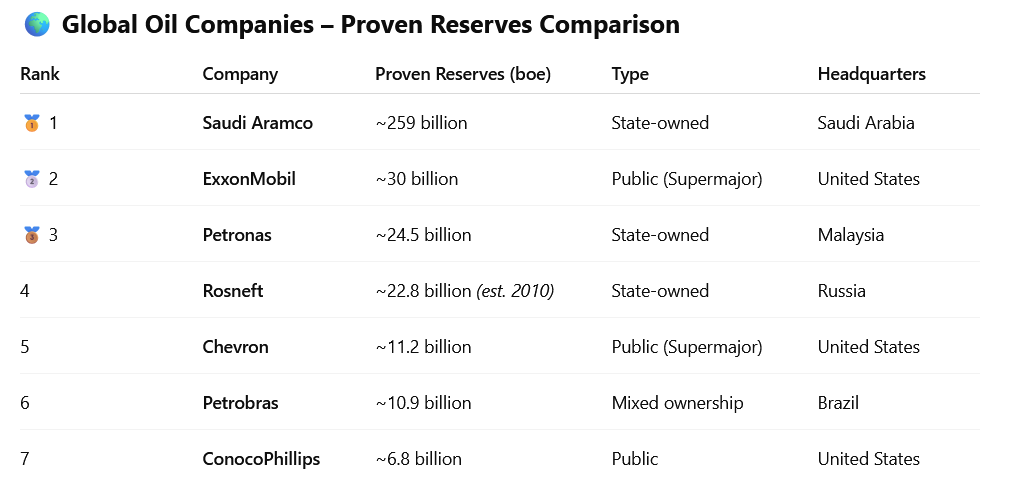

Its proven reserves of 10.921 billion barrels place it in the global top 10 among oil companies.

The dividend yield, though volatile, consistently exceeds 10%, far outpacing other oil sector stocks.

Petrobras’ revenue mix mirrors North American majors like ExxonMobil and Chevron, with a heavy emphasis on exploration and production (E&P). However, it lags behind European peers like Shell and TotalEnergies, which are investing more aggressively in low-carbon energy.

B. Proven Technical Expertise

Petrobras is a global leader in deepwater and ultra-deepwater oil extraction, particularly in Brazil’s pre-salt basin. Discovered in 2006, this reservoir holds about 60% of the country’s proven reserves (9.7 billion barrels of oil equivalent). Its pioneering technology for drilling at depths exceeding 2,000 meters, beneath a thick salt layer, sets global standards.

The company deploys advanced systems like FPSOs (Floating Production Storage and Offloading), with units like the P-74 producing up to 150,000 barrels daily, showcasing cutting-edge engineering.

Source: https://www.offshore-technology.com/news/petrobras-new-platforms-2027/

At its Cenpes research center in Rio de Janeiro, Petrobras employs over 2,000 researchers and holds more than 1,000 patents. Key innovations include autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs), which enhance safety and efficiency in subsea operations, alongside systems for monitoring equipment performance.

Source: https://www.oedigital.com/news/506056-nauticus-inks-deal-with-petrobras

Petrobras boasts a strong industrial, financial, and technological foundation. But does its strategy ensure it remains a global oil powerhouse?

II. Financial and Industrial Strategy: Discipline and Ambition

A. Capital Discipline and Shareholder Returns

Petrobras’ 2025–2029 strategic plan, approved on November 21, 2024, allocates $111 billion for investments—a 9% increase from the prior plan. This includes $98 billion for ongoing projects and $13 billion for projects under evaluation, pending feasibility and financing studies.

Source: https://petrobras.com.br/en/quem-somos/estrategia

The company prioritizes strict capital discipline, greenlighting only projects with strong Net Present Value (NPV) based on rigorous scenario analysis. Its flexible capital structure aims to generate cash flows beyond investment and debt obligations.

For shareholders, the plan guarantees at least $45 billion in ordinary dividends, with up to $10 billion in potential extraordinary dividends. However, limited transparency on annual CAPEX and exposure to macroeconomic risks, like Brent oil prices and exchange rates (estimated at BRL 5.05/USD in 2024), raise concerns.

Source: https://petrobras.com.br/en/quem-somos/estrategia

B. Industrial Focus: Pre-Salt Dominance with Limited Diversification

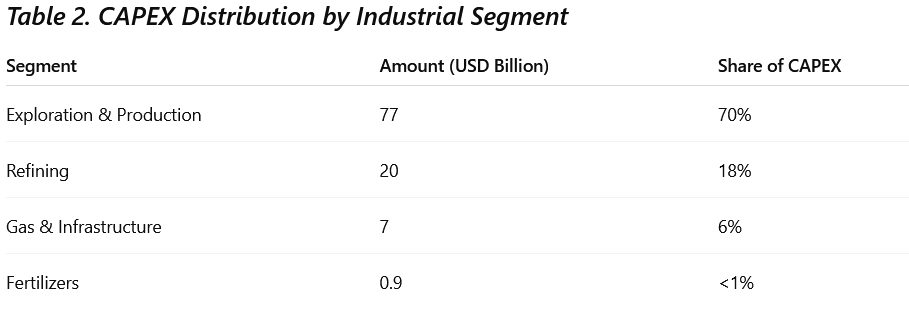

Petrobras channels 70% of its CAPEX ($77 billion) into Exploration & Production (E&P), targeting 3.2 million barrels of oil equivalent per day by 2029, including 2.5 million barrels of crude oil (±4% tolerance). The company plans to deploy 10 new production systems (nine already contracted), primarily in the pre-salt layer, where it leads operations except for the Raia field (operated by Equinor).

Refining will receive $20 billion to boost capacity by 225,000 barrels/day, notably through projects like Trem 2 at RNEST. The Rota 3 project, delivering 21 million m³/day, will strengthen gas supply. Additionally, Petrobras is re-entering fertilizer production with a $900 million investment.

C. Technological Strategy: Performance and Green Transition

Petrobras’ 2025–2029 technological agenda balances two goals: reinforcing its leadership in deepwater oil and gas production and advancing its energy transition through low-carbon investments.

- Strengthening Core Technologies

Petrobras optimizes offshore operations with innovations like digital twins, predictive maintenance algorithms, and integrated control centers, which boost asset reliability and minimize downtime. Autonomous underwater vehicles (AUVs) and subsea robotics enhance safety and cost-efficiency. The company also refines its deepwater expertise with advanced riser systems, high-pressure drilling, and proprietary seismic imaging for precise reservoir management.

- Low-Carbon Transition: Playing Catch-Up

Petrobras is investing $16.3 billion in low-carbon initiatives, including:

- Biorefining to produce low-emission fuels like R5 diesel, hydrotreated vegetable oil (HVO), and sustainable aviation fuel (BioQav).

- Carbon capture and storage (CCUS), with $1.3 billion allocated for CO₂ reinjection into pre-salt reservoirs.

- Early-stage studies on green hydrogen and offshore wind.

Despite these efforts, low-carbon businesses account for only 2–3% of revenues, trailing global peers in diversification. Their message is quite clear:

Source: https://petrobras.com.br/en/quem-somos/estrategia

III. Encouraging Long-Term Prospects for Oil

A. Oil’s Enduring Relevance

In my view, oil shortages are likely in the coming decades, making a pure-play oil company like Petrobras a strong fit for my strategy. The global energy transition requires balancing oil’s decline with its persistent demand. The IEA’s World Energy Outlook 2024 projects oil demand at 99 million barrels per day by 2035 under its STEPS scenario (2.4°C rise by 2100), driven by growth in developing nations despite Western electrification. Solar and wind intermittency may sustain this demand. Meanwhile, ESG pressures and funding constraints could reduce supply below 95 million barrels per day by 2030, per a Morgan Stanley study citing the IEA, potentially driving price increases. This positions oil—and Petrobras—as a compelling long-term investment for dividends and growth.

Source: IEA Report

B. Rising Energy Demand from AI and Automation

As of June 2025, artificial intelligence (AI) and robotics are fueling a structural surge in global energy demand. AI-powered data centers, critical for machine learning and large language models, are projected to consume 3–4% of global electricity by 2030, up from 1–2% today, per the IEA. Robotics in manufacturing, logistics, and healthcare further amplifies this trend, with automated systems requiring constant power. The computational intensity of AI training and expanding robotic fleets could increase energy consumption by 15–20% over the next decade, especially in tech hubs like Asia and North America. This underscores the need for scalable energy solutions, reinforcing oil’s role in the energy mix.

Conclusion

As outlined in Part 1 , Petrobras is a high-risk, high-reward investment. Its investors aren’t dumb—they’re brave, embracing volatility for the potential of outsized returns. For my global high-yield portfolio, it’s a compelling long-term bet, despite the likelihood of nerve-wracking moments from stock price swings or dividend cuts. I purchased 1,770 PBR.A preferred shares between March and May 2025, prioritizing the higher dividend yield over voting rights. Petrobras’ robust reserves, technological leadership, and enduring oil demand make it a unique opportunity. I hope this analysis helps you decide if Petrobras fits your investment strategy—share your thoughts in the comments!

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.