Jun 03, 2025

Petrobras: Why Its double-digit Dividend Yield Is a Risky but irresistible Bet

This article marks the first installment in a comprehensive analysis of Petrobras, the Brazilian state-controlled oil company that has long attracted dividend-oriented investors with its unusually high yields. As a long-term investor in Petrobras, I have been intrigued by its consistent undervaluation and impressive dividend payouts. However, with yields consistently exceeding 10%, one must ask: is this an overlooked opportunity or a classic value trap? This piece examines Petrobras’ structural vulnerabilities with a critical lens. As a Petrobras shareholder with a generally optimistic outlook, I recognize the risk of bias—and this analysis is my attempt to critically examine the company despite that.

I. State Ownership and Political Interference

Petrobras is not merely a commercial enterprise; it is a partially state-owned entity in which the Brazilian government controls 50.26% of voting rights and retains a golden share, enabling it to veto major corporate decisions. This degree of political influence is not a peripheral issue—it is central to understanding the company’s strategic direction and investment risks.

Source : Petrobras

When oil prices rise, the government’s priority may shift toward controlling domestic fuel prices rather than maximizing shareholder value. This tension frequently results in delayed pricing adjustments, politicized executive appointments, and a general erosion of corporate governance. Such interference undermines investor confidence and limits the company’s agility.

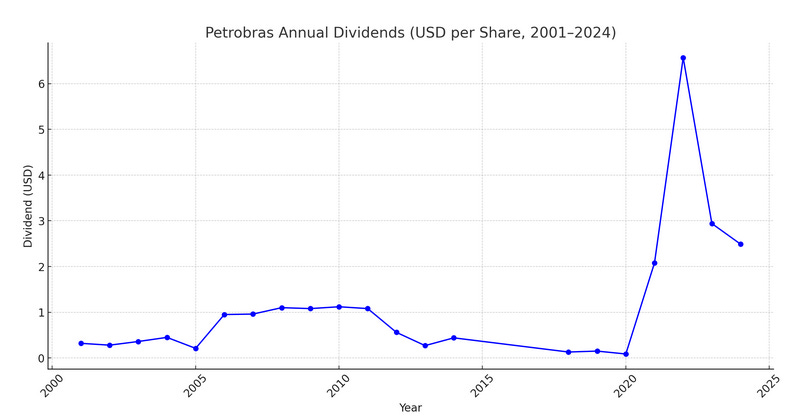

II. Dividend Volatility

While Petrobras’ dividend yields—often ranging between 15% and 16%—are undeniably attractive, their inconsistency raises concern. For investors seeking reliable income, such volatility diminishes the utility of these payouts. For example, the unusually high dividends distributed in 2022 (see chart below) are unlikely to represent a recurring event.

Moreover, the share price exhibits significant volatility, as shown in the chart below. Engaging in margin investing under such conditions would be, at best, audacious—at worst, a cardiovascular stress test in disguise.

Thanks for reading! This post is public so feel free to share it.

Source : Macrotrends

III. Structural Financial Risks

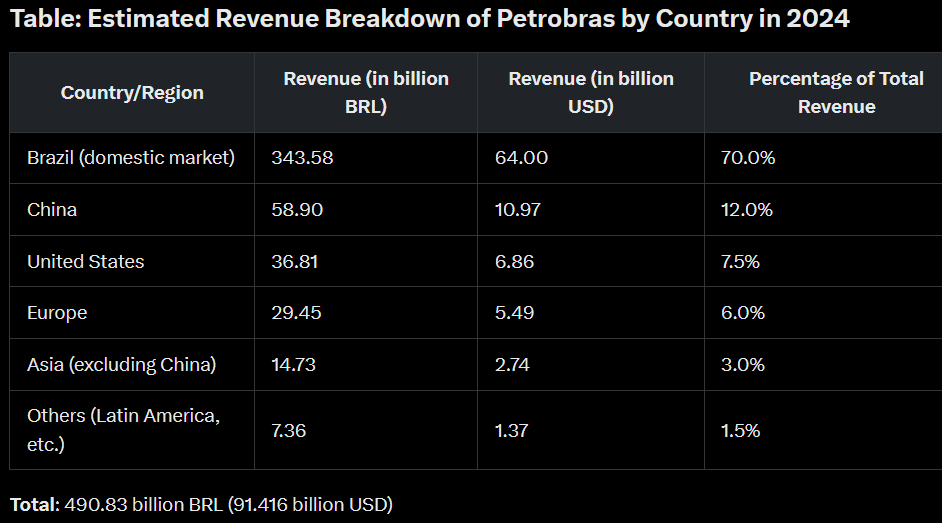

Petrobras operates in a complex macroeconomic environment. Its business model—extract and sell crude oil—is straightforward, yet its financial structure exposes it to several vulnerabilities. Approximately 70% of Petrobras’ revenue is generated domestically in Brazilian reais, while the majority of its debt obligations (around 70%) are denominated in U.S. dollars. This currency mismatch presents a significant financial risk, particularly during periods of exchange rate volatility.

IV. A Constellation of Additional Challenges

Beyond its structural issues, Petrobras faces a range of other risks:

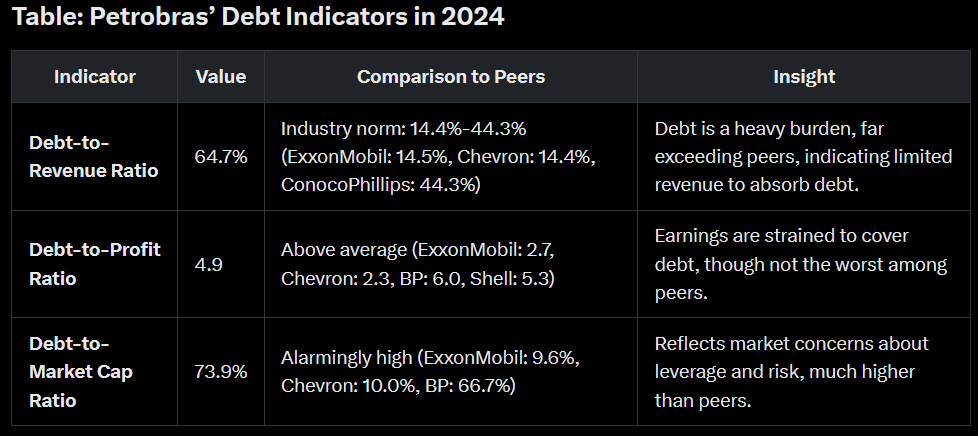

• Debt Burden: With a total debt of $59.1 billion, Petrobras’ leverage equates to 64.7% of its annual revenue, a figure significantly above industry norms. Its debt-to-market-cap ratio (73.9%) far exceeds that of its peers such as ExxonMobil (9.6%) and Chevron (10.0%).

• Geopolitical Exposure: Approximately 12% of Petrobras’ revenue is derived from China and 7.5% from the United States. Trade tensions, geopolitical instability, or sanctions could disrupt these critical markets.

• Regulatory and Legal Risk: Petrobras continues to grapple with environmental fines, labor disputes, and the residual effects of the Lava Jato corruption investigation, all of which contribute to potential cash flow disruptions and reputational harm.

• ESG Considerations: The company’s carbon-intensive operations increasingly conflict with global ESG expectations. New regulatory frameworks—such as the European Union’s proposed carbon taxes—could impose further financial burdens.

Taken collectively, these factors underscore Petrobras’ risk profile and highlight the necessity for careful due diligence.

Conclusion: High Dividends, High Risk

Petrobras offers dividend yields that are difficult to ignore. However, those returns are accompanied by significant political, operational, and financial risks. The company’s susceptibility to government intervention, volatile dividend policy, and structural inefficiencies—particularly its currency exposure and mounting debt—demand a cautious approach.

Investors are not necessarily dumb in allocating capital to Petrobras, but they must be brave and acknowledge the elevated level of risk involved.

In Part 2 of this series, I will evaluate the counterargument—namely, whether Petrobras’ intrinsic value, technological advantages in pre-salt oil extraction, and discounted share price compensate for these substantial risks.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.