May 13, 2025

This week, I’m exploring the JEPQ ETF, a distinctly different fund from XYLD, which I analyzed last week.

I. The Theoretical Features of Covered Call ETFs: More Income, Less Volatility, Less Capital Growth

A. Covered Call for Dummies

A covered call fund like JEPQ buys stocks (e.g., those in the Nasdaq 100) and sells call options on them to earn a payment called a premium. Selling a call means signing a contract that gives the buyer the right to purchase those stocks at a set price (the strike price) before a specific date (the expiration). The fund collects the premium immediately, and this cash is included in the income distributed to investors as regular distributions. If the stock stays below the strike price at expiration, the fund keeps both the stocks and the premium; if the stock exceeds the strike price, the fund must sell the stocks to the buyer at the agreed price. JEPQ sells call options on stocks within the Nasdaq 100 index.

B. Theoretical Advantages

- High Income Generation: Covered call funds deliver attractive yields. JEPQ boasts an annual yield of 11% as of May 11, 2025.

- Lower Volatility: The premiums from selling call options cushion losses during market dips.

- Simplicity and Accessibility: JEPQ automates the covered call strategy, selling out-of-the-money options on Nasdaq 100 stocks. This makes the fund accessible to investors without options trading expertise while providing exposure to the U.S. market.

- Diversification Potential: By incorporating option premiums, these funds add a source of return that’s not fully tied to direct market movements, potentially improving a diversified portfolio’s risk/reward profile.

C. Theoretical Drawbacks

- The Big One – Capped Upside Potential: Selling out-of-the-money options limits gains during a strong Nasdaq 100 rally. If the market surges, JEPQ will lag, as the underlying stocks may be “called away” or the premiums won’t offset the missed appreciation. Novice investors may mistakenly view the high yield as a guarantee of capital growth.

- High Management Fees: With an expense ratio of 0.35%, JEPQ is pricier than standard S&P 500 ETFs (0.03% to 0.10%) but cheaper than XYLD (0.60%). These fees eat into net returns, especially over the long term.

- Dependence on Volatility: Option premiums are higher during periods of high volatility. In low-volatility environments (e.g., a low VIX in 2023), JEPQ’s yields can shrink as premiums become less lucrative.

- Tax Complexity: Monthly distributions may include dividends, capital gains, and return of capital, complicating tax management, especially for investors in high-tax regions.

Some investors call covered call ETFs like JEPQ “scams” due to misaligned expectations and occasionally misleading marketing. The high yields, like JEPQ’s 11% annual distributions, attract those hoping for both steady income and Nasdaq 100-like growth. Yet, the strategy caps gains in bull markets, leading to significant underperformance, frustrating poorly informed investors. Additionally, high fees (0.35%) and tax complexity, often understated, contribute to the “scam” perception, particularly when claims of “protection” against downturns prove inadequate. Let’s dig into the reality.

II. In Reality

A. JEPQ’s Method

This ETF functions quite differently from XYLD, which I analyzed in the previous article (here). JP Morgan’s website is quite educational and clearly outlines the investment process: portfolio managers select companies from the Nasdaq 100 and sell out-of-the-money calls (at a price slightly above the market) with a one-month horizon. The goal is to reduce volatility at the cost of capping upside potential, as discussed above. This is a good tradeoff for income-focused investors.

Source: JP Morgan JEPQ Fund Story

JP Morgan’s team has done an excellent job of simplifying and clarifying the strategy. Annual returns are shown in the visual below: yields are expected to range from 9% to 11%, excluding share price appreciation, depending on volatility levels. This is a very attractive return on investment.

Source: JP Morgan JEPQ Fund Story

The promise is clear: less volatility, fewer capital gains, more income.

B. The Results

The ETF managers provide initial results for the 12-month period from April 2024 to March 2025, which align with the stated objectives. The primary limitation is the lack of long-term performance history, as the ETF was launched in May 2022. However, we can look back to May 2022 for some insights.

Source: JP Morgan JEPQ Fund Story

Testing returns since inception (May 2022), the results meet expectations. The total return is strong (21.05%) but lower than the Nasdaq 100’s total return (28.91%). For context, this return is better than the S&P 500’s, though this isn’t particularly meaningful over such a short period. I also note that the maximum drawdowns (the largest peak-to-trough decline in value) are quite similar to those of the Nasdaq 100. This is worth keeping in mind for those considering leverage with these products. As for standard deviation, it is lower than the Nasdaq 100’s (21.05% vs. 28.91%).

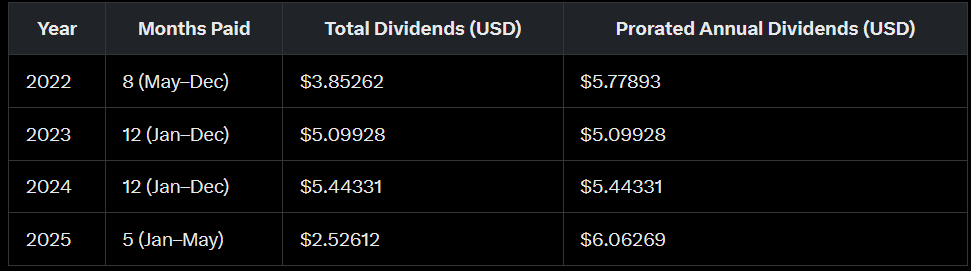

Since 2022, JEPQ has paid annual distributions (including dividends and option premiums), which, when averaged over 12 months, amount to $5 to $6.

My Investment Take

Over this short period, the ETF appears to deliver on its promises: monthly income of approximately 10%, limited upside, and slightly reduced volatility. I wish there were a longer performance history, but that’s how it is. I appreciate this product, particularly as a European investor, because I can access its UCITS version, which adopts a similar approach but is slightly constrained by European risk management regulations. I purchased an initial position during the tariff-related dip and am currently monitoring its performance. As an income investor, I seek regular income without sacrificing invested capital (no yield traps!), and this ETF fits my needs.

Thanks for reading! This post is public so feel free to share it.