Navigating the global energy transition as an investor is a balancing act. Should we abandon oil as a relic of the past, or does it still hold untapped potential? In this article, we lay the foundation for a resilient income strategy amid shifting energy dynamics.

1. Charting the Course: Oil’s Future in a Shifting Energy Paradigm

In my previous article, I posed two pivotal questions:

- Can the world afford the financial toll of the energy transition?

- Even if we can, do we have the mineral resources necessary to see it through?

While these questions suggest their own answers, let’s inject some objectivity. The International Energy Agency’s (IEA) World Energy Outlook 2024 outlines three distinct scenarios. I’ll focus on the STEPS scenario, which I believe paints the most realistic picture. Here’s a quick recap:

- STEPS (Stated Policies Scenario): Projects the energy sector’s future based on current and announced policies, anticipating a 2.4°C temperature rise by 2100.

- APS (Announced Pledges Scenario): Assumes full and timely implementation of national climate pledges, resulting in a 1.7°C temperature rise by 2100.

- NZE (Net Zero Emissions Scenario): Envisions a pathway to net-zero CO₂ emissions by 2050, aligning with a 1.5°C warming limit.

2. Supply and Demand: Unpacking the Oil Equation

Realistically, a middle-ground scenario is likely, even within STEPS. Oil will remain a cornerstone of global energy, complemented by other sources to meet growing demand. Personally, I believe oil remains a viable investment, crucial for sustaining global economic growth.

Consider this: even by 2035, oil demand is projected to hover around 99 million barrels per day, close to 2024 levels, despite the energy transition.

Source: IEA Report

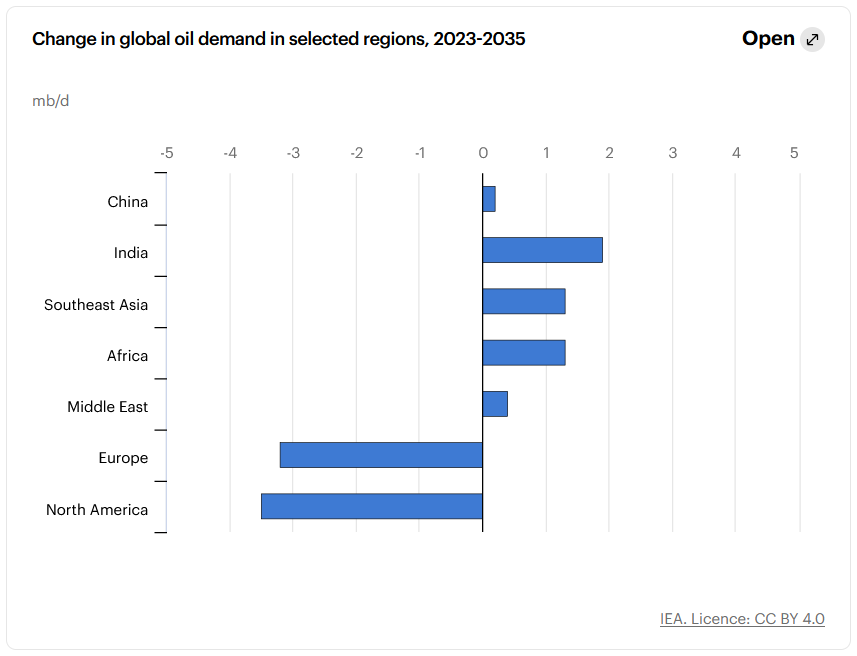

While Western nations reduce oil consumption through electrification and renewables, the developing world’s appetite for oil will continue to grow.

Source: IEA Report

The IEA’s STEPS scenario might even be conservative. Solar and wind energy, being intermittent, face storage challenges. This suggests oil demand could stabilize, even if the scenario unfolds as predicted.

Source: IEA Report

3. What About Oil Supply?

This is where the investment thesis takes shape. Factors like ESG pressures, demand uncertainty, and funding constraints are slowing oil production investments. A Morgan Stanley study, citing the IEA, forecasts a potential supply shortfall by 2030, with global production dipping below 95 million barrels per day.

“Last year, the IEA estimated that the low level of oil investment could lead to global oil supplies falling below 95 million barrels per day by 2030, creating a potential shortfall if demand continues to grow.”

Source: Morgan Stanley Report

Long-term, this could mean sustained high oil prices. Short-term, current prices are sufficient for shareholder returns. This is a long-term play for steady dividends and potential future gains.

4. Investment Strategy: A Dual Approach

- Oil remains a viable long-term income investment.

- Investing in diversified energy companies alongside pure oil players is prudent.

- Renewables require careful analysis of raw material supply chains for income potential.

5. Portfolio Building: The I-CASH Method

Let’s apply my I-CASH method to identify suitable energy stocks:

- I (International Diversification): Target undervalued international markets with high-yield opportunities, like Brazil and Colombia. Petrobras fits this criterion.

Source : https://worldperatio.com/

- C (Currency Diversification): Consider undervalued currencies, like the Brazilian real, which can impact company costs.

- Source : investing.com

- A (Asset Class): While equities are the primary focus, I prioritize preferred shares (PBR.A), which can offer more stable dividends and protection during downturns.

- S (Sector Diversification): While this is a first position, the oil sector’s long-term prospects are promising.

- H (High Yield): Petrobras offers attractive dividends, supported by government needs and its strategic plan (2025-2029).

- I-CASH validates an investment that rewards me with 12%+ dividends. We’ll see later if this high yield is sustainable. I am quite optimistic about the long run.

6. The Road Ahead: Balancing Tradition and Transition

Despite the push for renewables, oil’s role remains significant. Its current undervaluation presents an attractive investment opportunity. I plan to balance my portfolio with both traditional and transitional energy investments.

In future articles, we’ll explore opportunities in renewables and strategic raw materials.

What’s Your Take for a High Yield Portfolio from Scratch?

Do you see oil as a long-term investment, or is the future all about renewables? Share your thoughts in the comments, and stay tuned for our deep dive into renewable energy stocks next!

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.