H for High Yield: What Level of Compound Interest and What Levels of Passive Income Are Available on the Market?

The theoretical question of compound interest was covered in the first part. Applying this principle to real life is a far more interesting aspect, as it is now possible to study concrete investment vehicles. Therefore, from the perspective of an income-generating strategy, financial markets offer a whole plurality of income level possibilities, each category having its advantages and disadvantages. Whatever type of investment an investor chooses, they must know its pros and cons and be comfortable with them. Broadly, three major groups can be distinguished for an “income-oriented” investor:

- Growing Dividends: These are stocks offering low to moderate dividend levels, but whose characteristic is that the dividend is increased every year;

- Yield Stocks: These are typically yield sectors (energy, real estate, etc.) that offer a moderate dividend increase each year, which does not always compensate for the inflation rate;

- “High Yield”: These are stocks and financial products whose purpose is to generate income for investors, and which consider the growth of the invested capital as a secondary objective. This is a rather heterogeneous class containing both products close to a Ponzi-like scheme and products of excellent quality. It is better to be aware and do thorough research before investing in these products.

1/ 1% to 4% Income – The Growing Dividend Strategy: Low but Fast-Growing Income

This is a fairly homogeneous category of stocks that is particularly popular with investors in the United States. It adequately meets the need of long-term investors who give themselves time to let compound interest work by combining two mechanics: reinvesting dividends and the annual dividend increase.

These are the Dividend Aristocrats, and the US market lists 65 stocks in this group. What are the characteristics of these companies? They have quite simply paid and increased their dividend for 25 years. This group originated in the United States, but it is possible to find companies with similar behavior on all continents.

With these companies, you benefit from an annual increase in income (dividend) as well as long-term capital appreciation. It is, in a way, “the best of both worlds.” But the original income level is generally relatively low. Let’s take a few examples from August 2022, looking at the sector dimension.

Many companies belong to the consumer goods (defensive consumption) sector: Procter & Gamble, Coca-Cola, Colgate-Palmolive, Pepsi, Walmart (US supermarkets). The strengths of this business sector are numerous: stable demand, recognized brands, global availability of products. Their stock market behavior is therefore close to these characteristics: lower share price volatility, stable and continuously rising dividends. However, the dividend level is generally relatively low.

Others are in the healthcare sector, like Johnson & Johnson, Abbott Laboratories, or Medtronics. Again, this is a defensive sector, as these are products that consumers must buy, unlike those they want to buy (going to a restaurant can be postponed or avoided, not buying medicine or food). Industrial companies are also present, with companies having a dominant market position, like Caterpillar, Stanley Black & Decker, or 3M. Among other important sectors, the financial sector should not be forgotten, including, for example, S&P Global.

Companies in the Dividend Aristocrats group are market leaders, adopting very structured management modes that allow for a steady increase in revenue and profits. In Europe, companies like Nestlé, L’Oréal, Unilever, or Sanofi meet these criteria. In other financial markets, this census is still limited, but high-quality stocks can be selected.

Key Takeaways:

- Growing dividend stocks are ideal for protecting your income and capital from inflation;

- They allow you to hold high-quality, recognized companies;

- They only offer a limited dividend yield – 1% to 4% – which only allows reaching an interesting income level after 5 to 20 years depending on the case; if and only if the companies have been able to increase their dividends sufficiently well beyond inflation over a long period.

2/ 4% to 8% Income – The High Dividend Strategy: Yield Stocks

This group of companies is generally associated with yield stocks. Yield sectors are sectors benefiting from recurring revenue, favorable market configurations (captive customer base, oligopoly, etc.). They therefore offer a high dividend level, but their growth potential (and thus the rise in the share price) is more limited.

These companies typically operate in sectors like energy (TotalEnergies, Chevron), utilities (Veolia, Iberdrola), or real estate (Altarea, Icade, Nexity). They can also be part of the financial world with groups like Crédit Agricole or BNP Paribas or, in insurance, Axa. These various examples are only indicative but still give you an idea of the type of stocks to select.

The specific case of SCPIs (French REITs) deserves to be highlighted at this stage. These are not stocks, but these products offer undeniable advantages. Indeed, their yields are around 4% to 6% on average. They do not pay dividends but rental income, which can have tax implications depending on your household situation. A second advantage lies in their low volatility: the shares are not traded on financial markets but on a specific market for SCPIs, and the share value is set by the manager. However, this means these shares are theoretically less liquid.

Key Takeaways:

- Yield stocks offer a high dividend, but the potential for share price appreciation is less important than for other stocks. They are therefore perfectly suited for the investor focused on generating passive income;

- SCPIs can be integrated into this group – even if it’s somewhat artificial as they are not stocks. They offer a similar yield through rental payments, are less volatile but less liquid;

- In an income generation strategy, this category constitutes an essential pillar.

3/ Over 8% – Very High Yield Stocks and Funds: Immediate Income but Often Higher Risk

The natural reflex for any income-oriented investor should be to concentrate 100% of their investments in this category. It would indeed be simpler, but the fact is that these “abnormal” yields involve risks and specificities that lead one to think it might be preferable to use these investments more as a yield optimization tool.

This category is the most technical and the most difficult to grasp. It includes Closed-End Funds (CEFs), MLPs (Master Limited Partnerships), BDCs (Business Development Companies), and Mortgage REITs (Real Estate Investment Trusts). These terms may seem frightening and inaccessible. Behind the legal and financial technique, it is simply necessary to know that one must pay the “entry cost” in terms of knowledge to understand this category. But it is worth it.

We will focus in this subsection on closed-end funds, which we will call CEFs for simplicity. CEFs are distinct from open-end funds. Let’s take two fictional examples and imagine two funds (open-end and closed-end) each worth 100 euros. Each has invested in 10 ABC shares worth 10 euros each. Each of these funds has 10 investors who have each invested 10 euros. Now, an investor wants to sell their share. In the case of the open-end fund, the sale of 10 euros is made, and the fund returns its 10 euros to the investor. There are therefore only 9 shares of the open-end fund left. For a closed-end fund, the number of shares remains fixed. The investor looking to sell their share must then find a buyer. In a simple case, they find another buyer, and the closed-end fund still holds 10 shares of company ABC for 10 underlying shares; unlike the open-end fund, which holds 9 shares of company ABC for 9 shares of the open-end fund. The difference lies at this level: an open-end fund has variable capital (the number of shares can vary) while a closed-end fund has fixed capital (the number of shares cannot vary).

This seemingly minor difference has major consequences for the valuation of these assets. Indeed, the price of the underlying assets (in our example, company ABC) is not necessarily the same as the price of the shares of the closed-end fund. Let’s take the concrete case where an investor sells their share for 10 euros. They cannot sell it at this price and decide to offer it for sale at a price of 9 euros and find a buyer. The new market price of this closed-end fund is therefore 90 euros, while the price of the 10 shares of company ABC is 100 euros. In this case, financiers speak of a discount. The opposite phenomenon is called a premium. You must absolutely understand this phenomenon to understand the closed-end fund market and potentially profit from it.

The other characteristic of CEFs (let’s now only use this designation) is that they are overwhelmingly oriented towards income generation. These financial products were mostly built for investors seeking supplemental income or relying on their distributions to finance their daily lives. This is undoubtedly their original sin, as many of these products pushed this logic too far by over-distributing income relative to their ability to generate financial flows. Ultimately, they had to sacrifice the invested capital and the future of distributions along the way.

What techniques do CEFs use to generate high levels of income? The first is relatively easy to understand. We have seen that stocks return an average of 10% per year. Let’s imagine that the CEF manager estimates that they can then allocate 7% for distributions and retain some leeway for capital appreciation. In this scenario, the CEF allows you to delegate the transformation of capital gains into distributions to professionals. This is the philosophy of CEFs investing in the stock market.

There are other techniques used by CEF managers to optimize income. The most frequent is the use of leverage. Let’s take a concrete example: the CEF buys bonds that yield 6% for 100 euros and sells 10 shares at 100 euros. Then, the fund borrows 100 euros to buy another 100 euros of bonds. In short, the CEF then holds 200 euros of bonds yielding 12 euros. The capital remains at a level of 100 euros, and the CEF can pay out 12 euros of income, i.e., 12%. This theoretical scheme excludes, for simplicity’s sake, borrowing costs and manager fees. Without elaborating too much on this aspect, it is also interesting to know that some CEFs also use options to enhance income.

4/ Some thoughts about high yielders: the good, the « bad » and the ugly

The Good: Accidental High Yielders

Accidental high yielders are companies or assets that offer unusually high dividend yields, not because they are deliberately pursuing high payouts, but often due to temporary market mispricing or specific circumstances. These are typically fundamentally strong businesses experiencing short-term difficulties or sector-specific headwinds that temporarily depress their prices, resulting in higher yields. For investors who do their homework, these can represent excellent opportunities to capture sustainable income with potential capital appreciation as the market corrects.

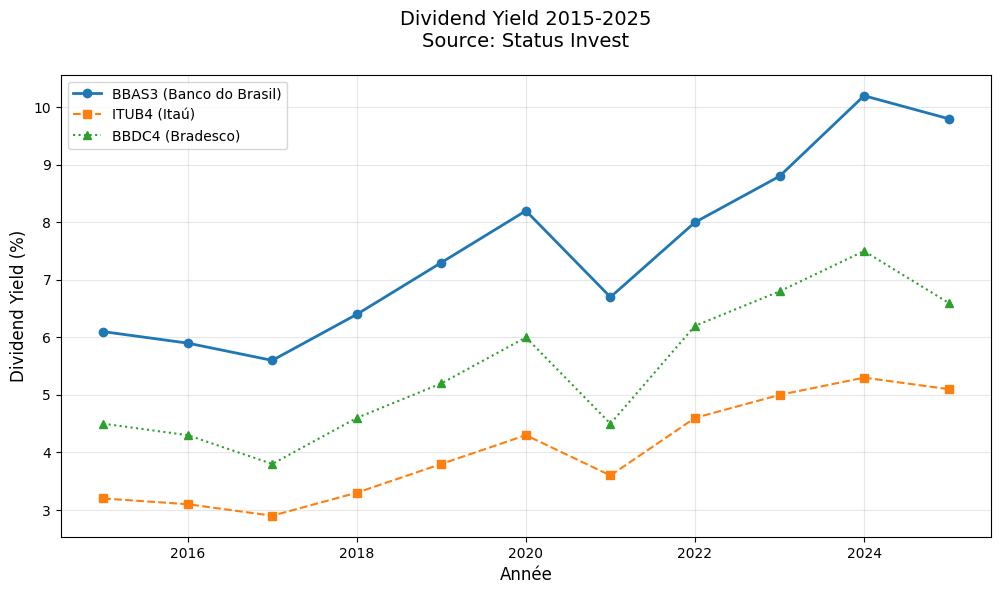

=> In my portfolio, I think that Icade and Banco do Brasil (see below) are two accidental high yielders, while Petrobras…is special.

The (Not So) Bad: Structurally High-Yielding Investments

This category includes investments that are designed to consistently provide elevated income streams, such as covered call ETFs or certain types of high-yield bonds. These instruments typically generate steady cash flows by either writing options premiums or focusing on income-generating securities. While they offer attractive yields and a relatively predictable income, they come with trade-offs, including capped upside potential in the case of covered calls or higher credit risk in some bond sectors.

They suit investors looking for regular income but who understand the structural nature and inherent risks of these assets. Attention here because many high yielders in the world of CEFS and high-yield ETFs (more recent ones) are simply capital destroyers (the net asset value is progressively eroded).

=> In my portfolio, I’ve opted for JEPQ and XYLD. The covered call ETFs are the only ones that reassure me at this stage and given market valuations, even though some CEFS interest me.

The Ugly: Yield Traps

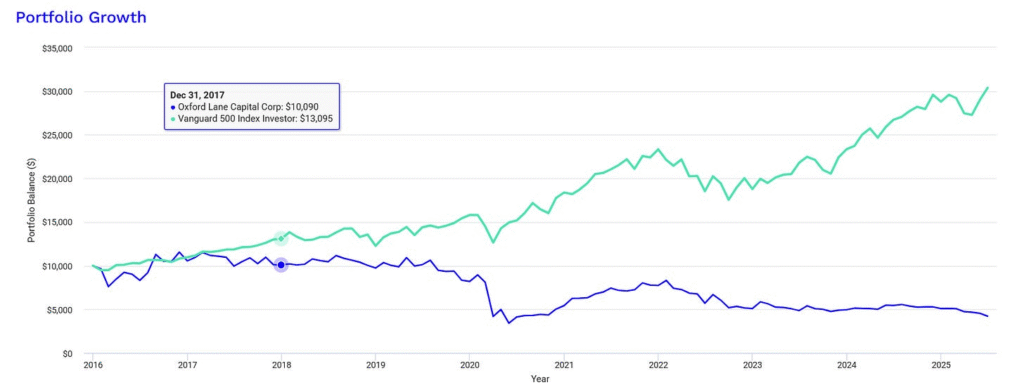

Yield traps are arguably the most dangerous category of high-yield investments. These are assets with high dividend yields that appear attractive on the surface but are actually unsustainable due to deteriorating fundamentals. Often, companies in financial trouble or sectors in decline maintain high payouts to lure investors, but eventually, they are forced to cut dividends, causing sharp price declines. Falling into yield traps can severely damage a portfolio, making it critical for investors to analyze the sustainability of income streams rather than chasing yields blindly. Below is an image of the NAV of a CEF specialized in CLOs over recent years. I’m not comfortable with this approach, so I’m sticking with my covered call ETFs at this stage. The whole challenge is to stay away from yield traps.