S for Sector Diversification: Prioritizing, and Determining the Relative Weight of Each Sector

At every level of the I-CASH model, it is essential to consider the degree of diversification and concentration within a passive income portfolio. In this regard, the question of business sectors is paramount, as it represents the most significant form of risk mitigation: different sectors experience unique cycles and are exposed to distinct risks. In the first part of this book, we observed that the various “super-sectors” exhibit their own behaviors, which are often relatively independent of the broader market. Let’s revisit the defensive super-sector, focusing specifically on the Consumer Defensive sector.

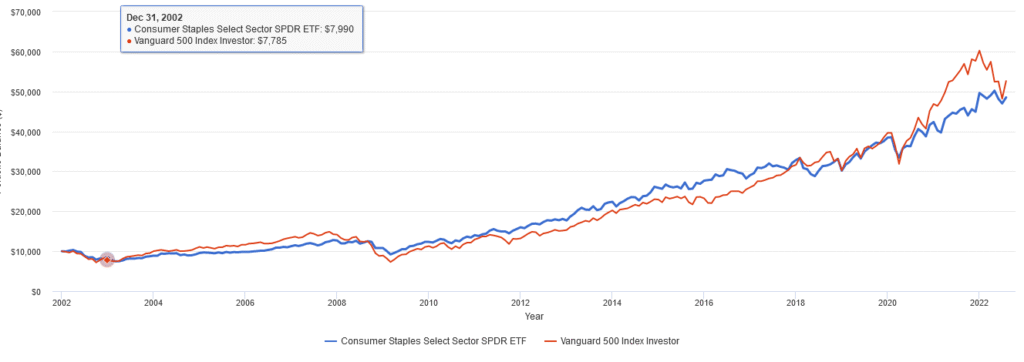

The chart below clearly illustrates the specific characteristics of this sector. Overall, investing in this sector allows you to achieve performance that is close to that of the overall market (in this case, the S&P 500), while exposing you to significantly less volatility. From 2002 to 2022, the results are quite comparable—the S&P 500 did perform slightly better, but the Consumer Defensive sector experienced far less dramatic swings. Let’s examine the maximum drawdown—the peak-to-trough decline during a specific record period. For the Consumer Defensive sector, the max drawdown was 28.12%. For the S&P 500, it was a much more severe 50.97%.

This practical data confirms the theoretical premise: volatility is lower, while performance remains relatively similar. The psychological cost of investing in this sector is significantly reduced, making it a cornerstone for a resilient passive income portfolio.

Source : www.portfoliovisualizer.com

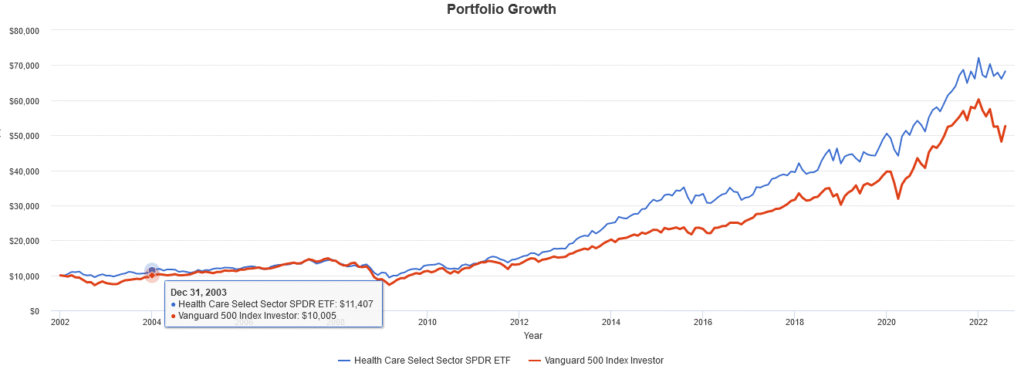

The same exercise can be conducted with the Healthcare sector. The results further reinforce the defensive characteristics of certain super-sectors. While the broader market (S&P 500) experienced its significant drawdown of -50.97%, the Healthcare sector demonstrated greater resilience, with a substantially lower maximum drawdown of -35.5%. This again illustrates a powerful dynamic for an income investor: the potential to achieve competitive long-term performance while being exposed to less severe downdrafts, thereby lowering the portfolio’s overall psychological burden.

Source : www.portfoliovisualizer.com

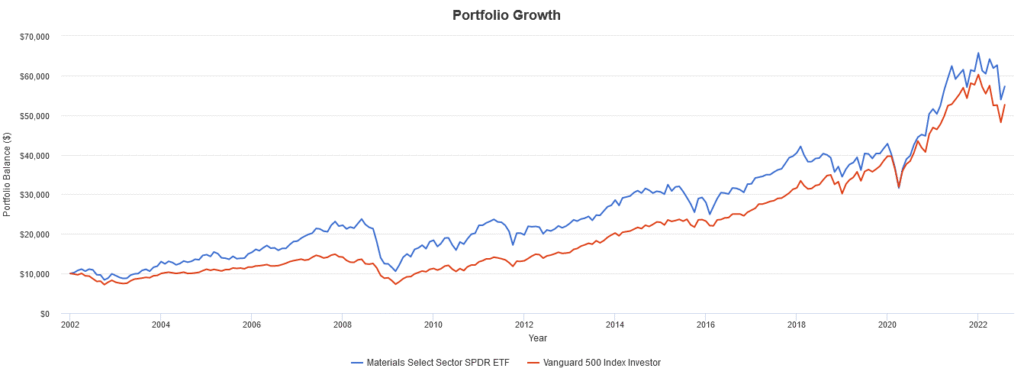

At the opposite end of the spectrum, the Cyclical super-sector offers vastly different financial and psychological perspectives for the investor. The valuations of companies within this sector are typically far more volatile than the broader market. This is clearly demonstrated by the performance of the Materials sector, a key component of the cyclical group. While the overall market (S&P 500) experienced a severe maximum drawdown of -50.97%, the Materials sector endured an even deeper decline of -55.49%. This underscores the higher risk and potentially greater emotional fortitude required when investing in cyclical industries, which are more sensitive to economic expansions and contractions.

Source : www.portfoliovisualizer.com

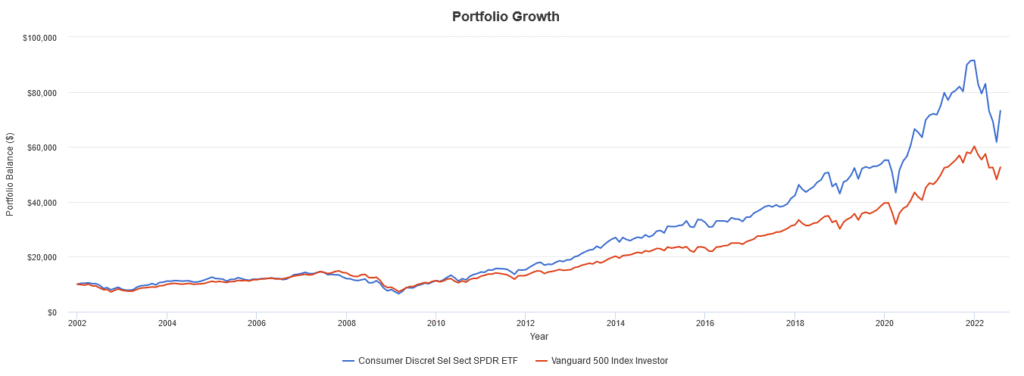

The same pattern repeats itself with the Consumer Cyclical sector (also known as Consumer Discretionary). The story remains consistent: while the broader market’s (S&P 500) maximum drawdown was -50.97%, the Consumer Cyclical sector experienced a more pronounced decline of -55.09%.

It is noteworthy that over this specific period, the sector’s overall performance was superior, but this came at the cost of significantly greater volatility. This perfectly encapsulates the classic risk-reward trade-off. Once again, the psychological cost for the investor is very high.

This recurring evidence makes it pertinent to examine whether the Sensitive super-sector (which is sensitive to the economic cycle but not as extremely as the Cyclical group) might offer a more favorable compromise for a portfolio focused on sustainable income.

Source : www.portfoliovisualizer.com

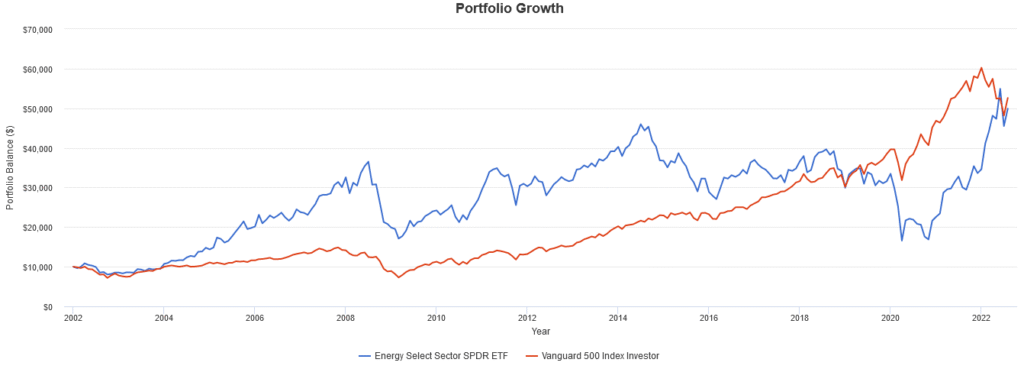

The Sensitive super-sector is best examined first through the lens of the Energy sector. The associated chart clearly illustrates the inherent risk of this sector, which remains a central issue within the context of the ongoing energy transition. Volatility is exceptionally high, and any investor must account for this reality before choosing to allocate capital here.

However, it is crucial not to overlook a defining characteristic: the Energy sector is particularly generous in terms of income distributions. This makes it a particularly compelling, if not essential, component of any strategy focused on generating passive income. The psychological cost associated with its price valuations is high, but the security provided by its substantial income stream can offer a powerful and balancing counterweight for the disciplined investor.

Source : www.portfoliovisualizer.com

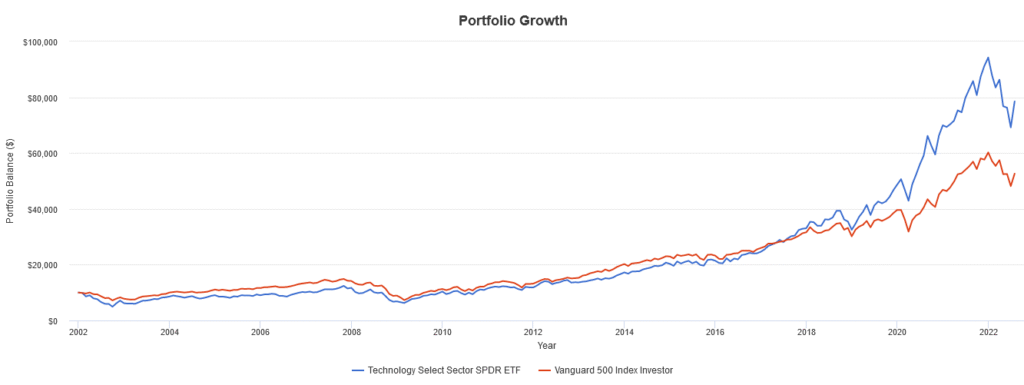

From the perspective of income generation, the Technology sector sits at the opposite end of the spectrum. This is because company profits are most often reinvested into growth initiatives rather than paid out to shareholders. Investing here is, therefore, primarily a bet on capital appreciation and corporate expansion, not on immediate income.

Historically, the sector exhibited periods of underperformance relative to the broader market before ultimately experiencing a dramatic and powerful surge to the upside, fundamentally reshaping its long-term return profile.

Source : www.portfoliovisualizer.com

Key Takeaways:

- Empirical evidence from the last 20 years of sector performance solidly confirms the core theoretical principles.

- The Defensive sector delivers compelling performance while subjecting the investor to significantly lower volatility. The psychological cost of investing in these sectors is markedly reduced.

- The Cyclical sector exhibits the opposite behavior, and investors must be acutely aware of its higher associated psychological cost.

- The Sensitive sector offers an intermediate yet heterogeneous profile. It includes segments like Energy (high volatility but high income), Technology (low income but high growth), and Telecoms & Utilities, which have a risk/return profile closer to the Defensive sector.

- Your individual risk aversion (psychological tolerance for potential declines) and income objectives are paramount. This empirically-backed intellectual framework provides the foundation for deciding which sectors to prioritize during the portfolio construction phase.