Beyond the Cycle: Which Investing Megatrends Will Shape the Future?

1/ Megatrends

We identified 6 major megatrends for the next decade:

✅ Energy Transition – The impact of massive (or insufficient) investments

✅ Demographic Shifts – Aging populations, interest rates, automation, robotics

✅ Geopolitical Risk – The rising probability of global conflicts

✅ Geo-Economic Shift – The shift of wealth creation toward Asia

✅ Currency Risk – How long will the USD remain the dominant global currency?

✅ Technological Disruption – The rise of artificial intelligence and automation

These megatrends will impact economic growth, government policies, and financial markets—creating both risks and opportunities.

Key Megatrends and Their Investment Implications

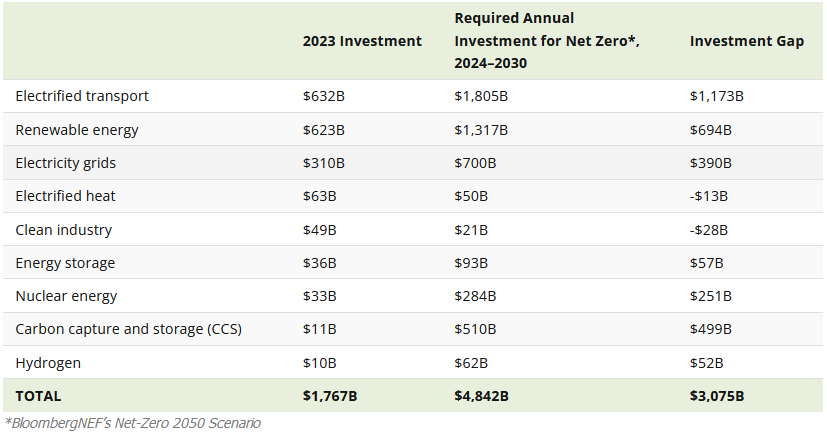

✔ Economic Stakes: The transition to clean energy requires unprecedented public and private investment. However, the funding gap remains massive, raising concerns about whether the shift to net zero is financially and politically viable.

Source : Visual Capitalist

✔ Macroeconomic Consequences: Even if investment accelerates, the risk of raw material shortages—especially copper and rare metals—could create inflationary pressures.

Source: zkb

✔ Investment Strategy: Oil & gas companies could remain profitable for longer than expected. Multi-energy players like TotalEnergies are also worth considering as they transition gradually.

Demographics & Aging

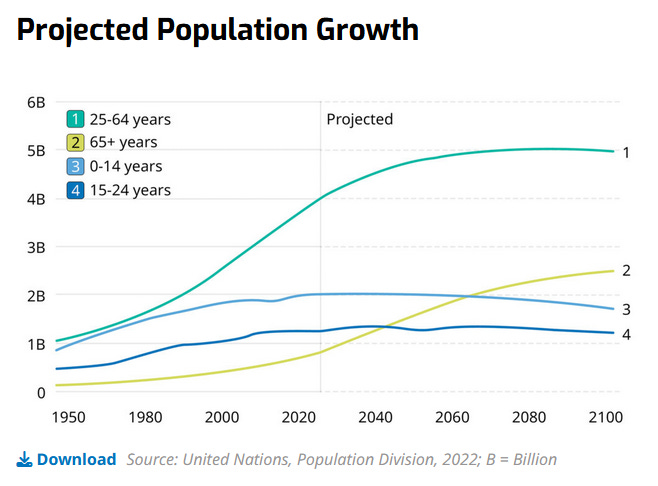

✔ Economic Stakes: A shrinking workforce means lower productivity growth, assuming no major technological breakthroughs.

✔ Consequences: Governments will face growing deficits to sustain pension and healthcare systems, fueling demand for financial assets.

✔ Investment Strategy: The healthcare sector presents stable income opportunities, even if high-dividend stocks are scarce.

Geopolitical Instability

✔ Economic Stakes: The rise of BRICS nations could lead to a multipolar world, increasing geopolitical instability.

✔ Macroeconomic Consequences: This shift could disrupt global supply chains, commodity markets, and monetary systems.

✔ Investment Strategy: Defense stocks can serve as a hedge, while commodities may offer income opportunities—but with increased volatility.

Currency Risk

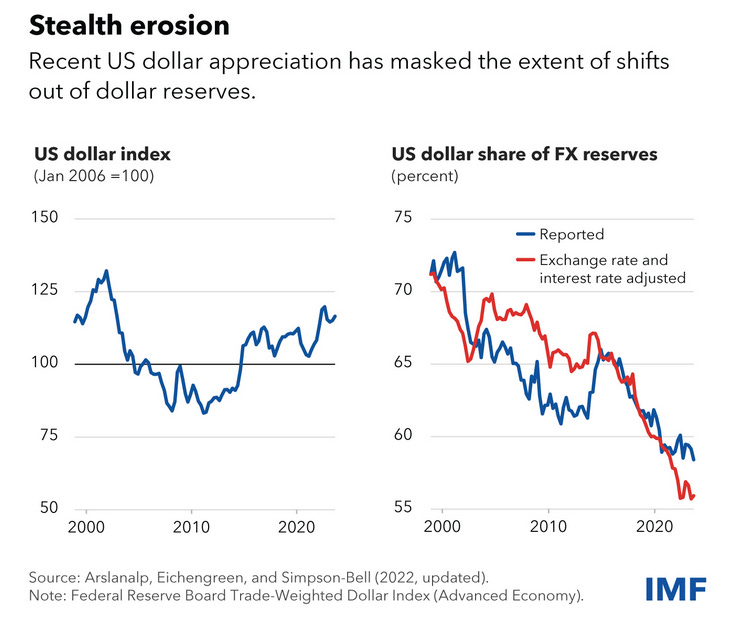

✔ Economic Stakes: If BRICS nations successfully reduce their reliance on the USD, the global monetary order could shift significantly.

Source : IMF

✔ Consequences: Historical precedents (such as the transition from GBP to USD) suggest that such shifts can create financial instability.

✔ Investment Strategy: A multi-currency approach can help protect purchasing power over the long term.

The Global Shift Toward Asia

✔ Economic Stakes: With demographic advantages and rapid technological adoption, Asia’s economic dominance will likely continue to grow.

Source : Visual Capitalist

✔ Consequences: Investors must tap into this growth to remain competitive.

✔ Investment Strategy: Geographic diversification is essential—focusing on Asian markets beyond just U.S. and European multinational companies.

Technological Disruption: AI & Automation

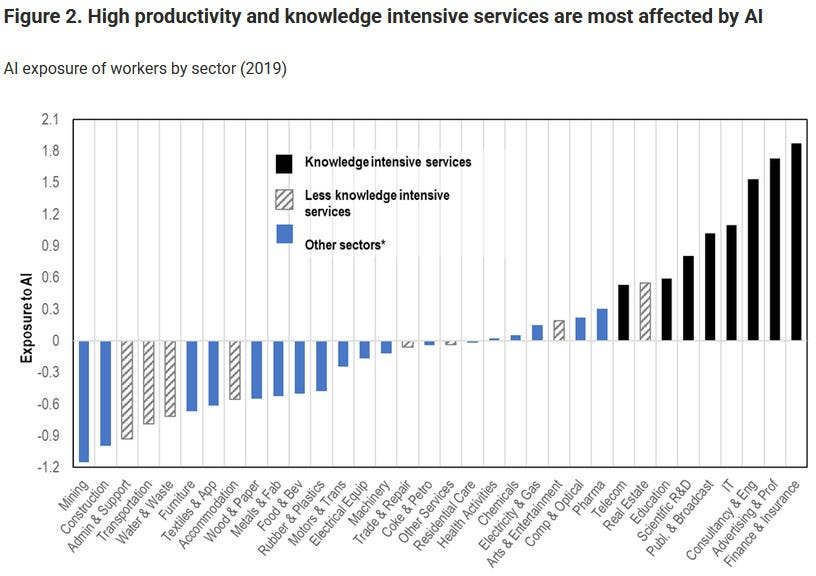

✔ Economic Stakes: The rise of artificial intelligence and robotics will reshape entire industries.

Source : OECD

✔ Macroeconomic Consequences: Will AI translate into significant productivity gains and sustained corporate profits?

✔ Investment Strategy: Identifying stable income-generating opportunities in AI and robotics will be key.

✅ Energy Transition: Oil & gas remain relevant; multi-energy firms are well-positioned.

✅ Aging Populations: Healthcare remains a defensive growth sector.

✅ Geopolitical Instability: Defense stocks provide a hedge, but commodities remain volatile.

✅ Asia’s Economic Rise: Exposure to Asian markets is increasingly essential.

✅ Currency Risk: A multi-currency income strategy protects against long-term depreciation.

2/ Energy transition

Navigating the global energy transition as an investor is a balancing act. Should we abandon oil as a relic of the past, or does it still hold untapped potential? In this article, we lay the foundation for a resilient income strategy amid shifting energy dynamics.

Charting the Course: Oil’s Future in a Shifting Energy Paradigm

In my previous article (insert link), I posed two pivotal questions:

- Can the world afford the financial toll of the energy transition?

- Even if we can, do we have the mineral resources necessary to see it through?

While these questions suggest their own answers, let’s inject some objectivity. The International Energy Agency’s (IEA) World Energy Outlook 2024 outlines three distinct scenarios. I’ll focus on the STEPS scenario, which I believe paints the most realistic picture. Here’s a quick recap:

- STEPS (Stated Policies Scenario): Projects the energy sector’s future based on current and announced policies, anticipating a 2.4°C temperature rise by 2100.

- APS (Announced Pledges Scenario): Assumes full and timely implementation of national climate pledges, resulting in a 1.7°C temperature rise by 2100.

- NZE (Net Zero Emissions Scenario): Envisions a pathway to net-zero CO₂ emissions by 2050, aligning with a 1.5°C warming limit.

Supply and Demand: Unpacking the Oil Equation

Realistically, a middle-ground scenario is likely, even within STEPS. Oil will remain a cornerstone of global energy, complemented by other sources to meet growing demand. Personally, I believe oil remains a viable investment, crucial for sustaining global economic growth.

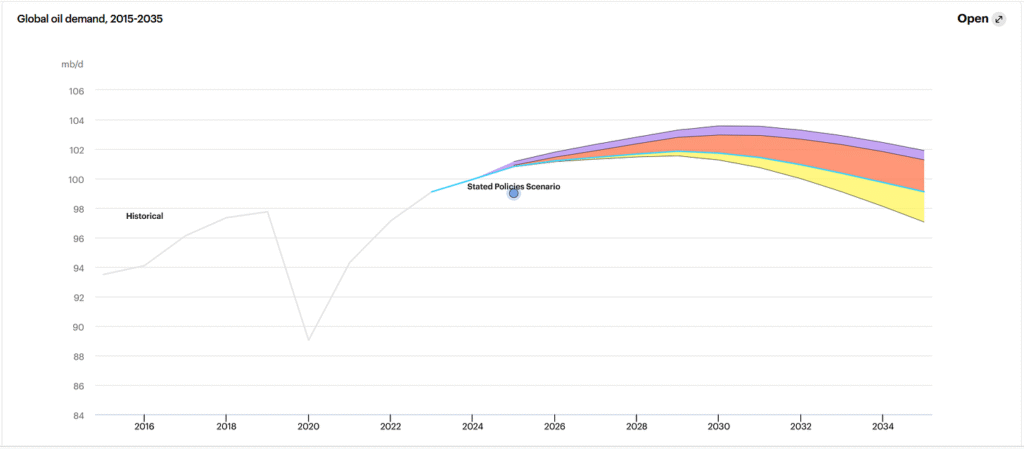

Consider this: even by 2035, oil demand is projected to hover around 99 million barrels per day, close to 2024 levels, despite the energy transition.

Source: IEA Report

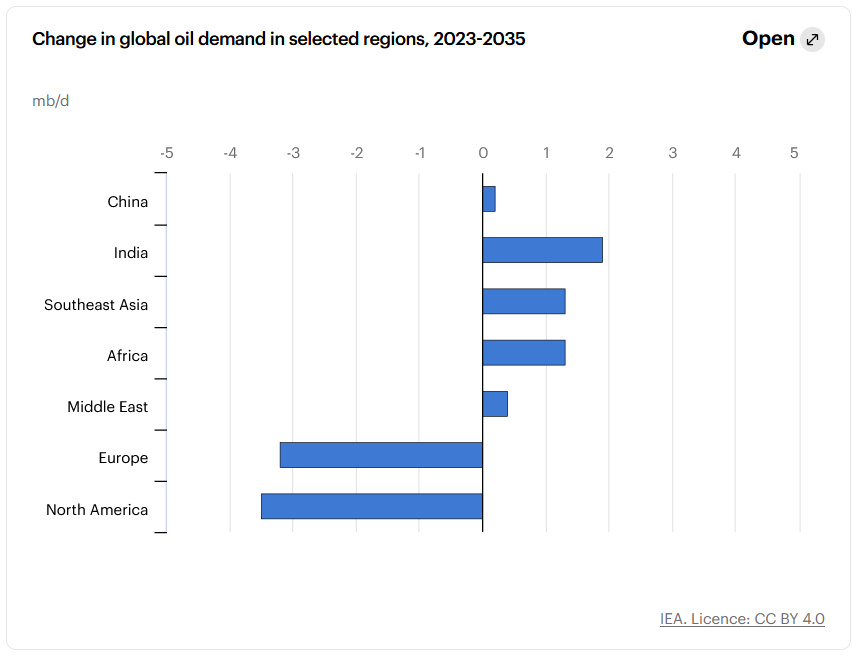

While Western nations reduce oil consumption through electrification and renewables, the developing world’s appetite for oil will continue to grow.

Source: IEA Report

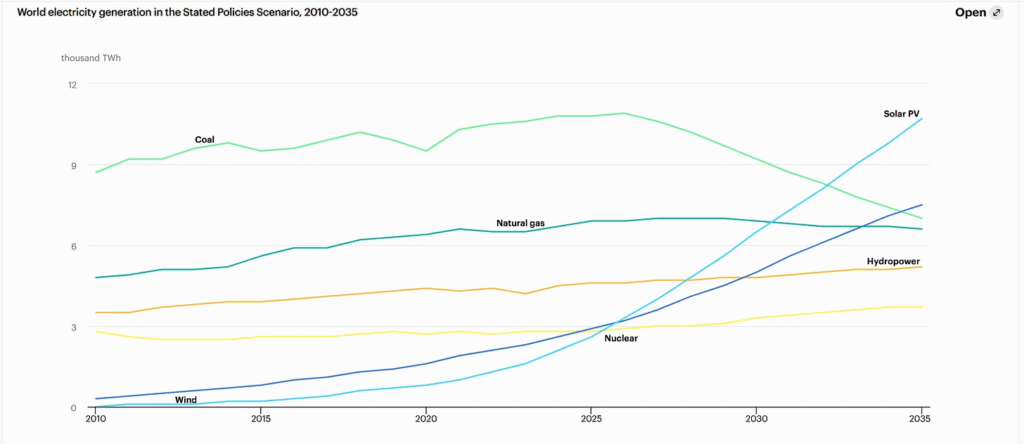

The IEA’s STEPS scenario might even be conservative. Solar and wind energy, being intermittent, face storage challenges. This suggests oil demand could stabilize, even if the scenario unfolds as predicted.

Source: IEA Report

What About Oil Supply?

This is where the investment thesis takes shape. Factors like ESG pressures, demand uncertainty, and funding constraints are slowing oil production investments. A Morgan Stanley study, citing the IEA, forecasts a potential supply shortfall by 2030, with global production dipping below 95 million barrels per day.

“Last year, the IEA estimated that the low level of oil investment could lead to global oil supplies falling below 95 million barrels per day by 2030, creating a potential shortfall if demand continues to grow.”

Source: Morgan Stanley Report

Long-term, this could mean sustained high oil prices. Short-term, current prices are sufficient for shareholder returns. This is a long-term play for steady dividends and potential future gains.

Investment Strategy: A Dual Approach

- Oil remains a viable long-term income investment.

- Investing in diversified energy companies alongside pure oil players is prudent.

- Renewables require careful analysis of raw material supply chains for income potential.

5. Portfolio Building: The I-CASH Method

Let’s apply my I-CASH method to identify suitable energy stocks:

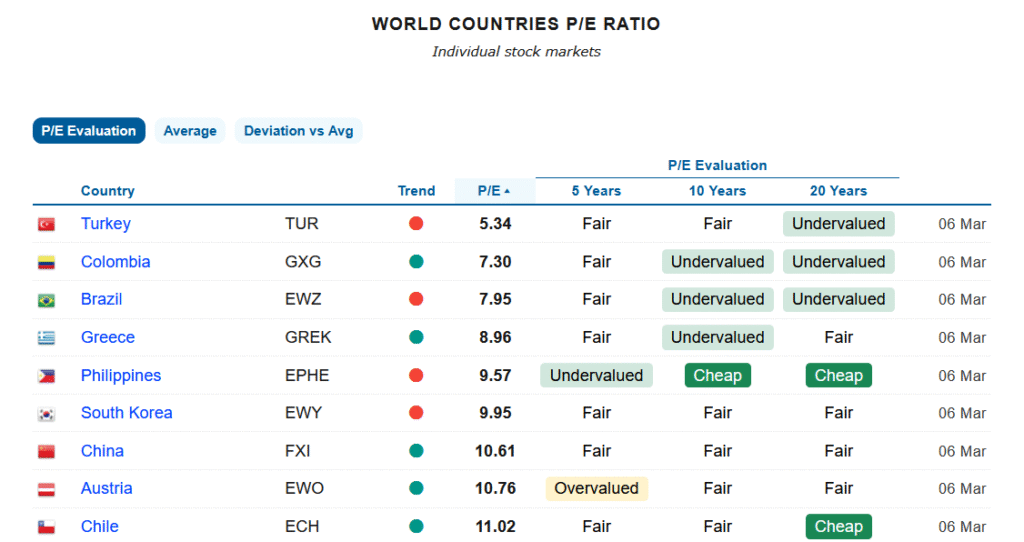

- I (International Diversification): Target undervalued international markets with high-yield opportunities, like Brazil and Colombia. Petrobras fits this criterion.

Source : https://worldperatio.com

- C (Currency Diversification): Consider undervalued currencies, like the Brazilian real, which can impact company costs.

Source : www.investing.com

The Road Ahead: Balancing Tradition and Transition

Despite the push for renewables, oil’s role remains significant. Its current undervaluation presents an attractive investment opportunity. I plan to balance my portfolio with both traditional and transitional energy investments.