Legal and General as an income investment

Sep 23, 2025

For a 9% yield without venturing into excessive risk, exotic assets, or volatile emerging markets, Legal & General deserves a close look. This blue-chip company, with a nearly two-century history, offers a yield well above the FTSE 100 average. Its long and predictable cash flows are derived from stable sources like pensions and annuities, backed by one of Europe’s asset management giants. For income investors, the critical question shifts from generosity to sustainability: is this a genuine opportunity or a dividend trap? Here’s why, in my opinion, Legal & General’s strategic dividend appears to be the former.

Source: LG America

I/ A good long term business

A/ Soon a 200 year old lady

Legal & General was founded in 1836 in London by a group of lawyers under the name New Law Life Assurance Society, before soon becoming the Legal & General Life Assurance Society. Initially focused on serving legal professionals, the company quickly expanded its services to the wider public. Over the 19th and 20th centuries, it grew into a major player in life insurance, pensions, and financial services in the UK. Today, Legal & General is one of the country’s leading asset managers, with significant investments in pensions, real estate, and infrastructure. It continues to play a key role in promoting responsible finance and long-term investment. But a long history isn’t enough — what really matters today is how Legal & General makes money.

Source: Legal and General

B/ A Three-Pillar Business Model

Far from being a traditional insurer, the group now operates as a comprehensive financial platform, structured around three complementary engines that generate predictable cash flows.

Pillar 1: Retirement solutions

A company that must pay pensions over several decades can transfer this burden to Legal & General (L&G). In exchange for a premium, the group takes on these pension obligations and invests the funds in long-term assets—government bonds, loans to solid corporations, infrastructure projects—that generate steady income. This pension de-risking mechanism creates a close match between inflows and outflows, ensuring payment stability.

This activity, known as Retirement & Institutional Solutions, is at the core of L&G’s model. In 2023, the UK pension risk transfer market reached around £50 billion of liabilities, of which L&G managed £12 billion (nearly a quarter of the market). In 2024, the group signed a further £10 billion in new deals. Its total annuity portfolio stood at £86 billion at the end of 2023, a clear sign of corporate confidence in its strength.

This pillar is built on very long-term contracts, supported by structural trends such as an ageing population, corporate balance sheet pressures, and infrastructure needs. It highlights L&G’s ability to transform complex obligations into reliable and predictable cash flows, while channeling capital into the real economy. This pillar offers reliable income. If pensions provide stability, asset management brings scalability.

Source: https://group.legalandgeneral.com/en/about-us/our-strategy

Pillar 2 : Investment management

Legal & General Investment Management (LGIM) is one of Europe’s largest asset managers with more than £1.1 trillion in assets under management. Unlike traditional insurance activities, asset management is a capital-light business, generating recurring fees without requiring significant capital commitments. This makes it an important source of stable cash flow for the group.

LGIM’s strength lies first in its scale and client base. The majority of its mandates come from pension funds and institutional investors, whose long-term investment horizons translate into stable and sticky revenues. At the same time, LGIM has successfully diversified its offering beyond conventional equity and bond funds. It is active in passive index strategies, ESG-focused investments, real assets, and liability-driven investment (LDI), which directly supports pension schemes in aligning their assets with future obligations.

Thanks to this diversification and its institutional focus, LGIM has proven to be a resilient source of earnings, relatively insulated from market volatility. It acts as Legal & General’s capital-light growth engine, providing predictable and scalable income that balances the long-term commitments of the retirement business. Finally, beyond institutions, L&G also serves millions of everyday households — its Retail arm.

Pillar 3 – Retail division

Legal & General’s Retail division helps nearly 12.5 million people in the UK plan for life’s major financial needs through straightforward, reliable products. Its offerings include life insurance, personal pensions, annuities, equity release, and workplace savings plans, all designed to protect families, build retirement savings, and support home ownership. Using data and digital platforms, L&G provides tailored advice, quick quotes, and fast claims, making personal finance simple and accessible for a wide range of customers—not just the wealthy. Products like life insurance to cover debts or support children, pensions to grow a retirement pot, and annuities providing lifelong income illustrate how L&G translates financial complexity into practical solutions for everyday needs.

The Retail division is also a strong, stable contributor to Legal & General’s profits. In the first half of 2025, it generated £237 million in operating profit and collected over £1.1 billion in protection premiums. Its individual annuity portfolio totals nearly £20 billion, while workplace savings schemes now manage more than £100 billion for over 4 million employees. By combining wide accessibility, digital efficiency, and recurring revenue, the Retail segment not only delivers value to customers but also anchors the group’s long-term growth, supporting Legal & General’s strategy of inclusive, household-level finance. These three engines together make for a resilient model — but no business is without its risks.

C/ A resilient business model, but with UK risk and interest rate risk

Legal & General (L&G) operates a highly synergistic, three-pillar business model that generates strong, predictable cash flows, underpinned by market-leading scale. Its core strength lies in the powerful combination of its divisions: the Institutional Retirement segment, which contributed 58% (£618m) of H1 2025 operating profit, provides long-term income as the UK leader in pension risk transfer; LGIM, which contributed 19% (£202m), offers stable, capital-light fee revenue from its £1.1 trillion asset management platform; and the Retail division, which contributed 22% (£237m), delivers recurring premiums. This structure is supported by strategic advantages, including dominating nearly a quarter of the ~£50 billion UK pension risk transfer market.

However, this strength is tempered by significant and interconnected risks. The most critical exposure is to UK interest rates, as the core Institutional Retirement business is highly sensitive to rate movements. This risk is amplified by the group’s substantial geographic concentration, with approximately 70-80% of assets and revenues linked to the UK. In 2024, 37% of total revenues and 56% of AUM were tied to the UK, leaving it vulnerable to domestic regulatory changes, political shifts, and economic cycles.

Additional challenges include market volatility that can affect LGIM’s fee-based income and intense competition in the retail segment. Despite these vulnerabilities, L&G’s diversified model and robust cash generation provide a solid foundation to navigate this risk environment. In conclusion, while its diversified operations provide resilience, L&G’s fortunes remain intrinsically tied to the UK economic environment and the trajectory of interest rates.

II/ A quite good (long term) stock investment

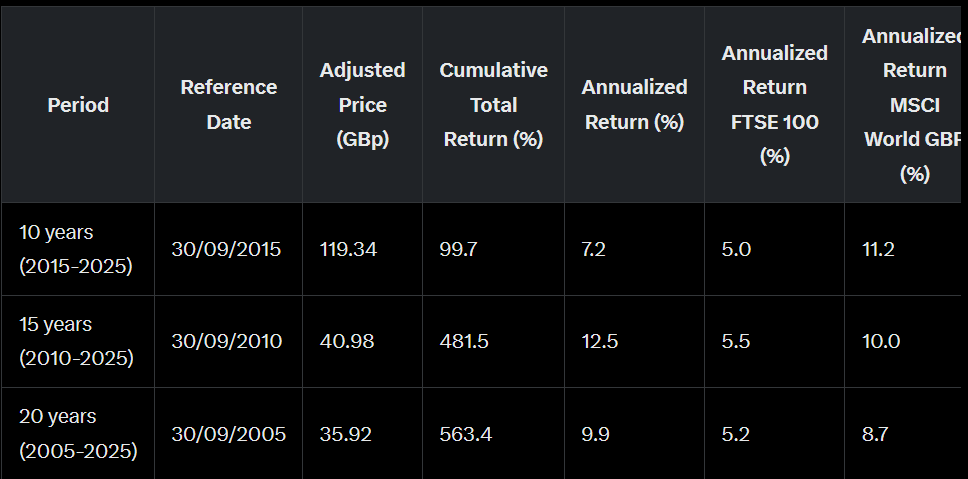

A/ A good total return

The long-term performance data for Legal & General tells a story of remarkable and consistent wealth creation, significantly outpacing its domestic benchmark. While the FTSE 100 has delivered respectable annualized returns between 5.0% and 5.5% across these periods, Legal & General has dramatically outperformed. Over the past 15 years, the company has achieved an exceptional annualized return of 12.5%, turning an investment into nearly six times its original value (a 481.5% total return). Even more impressive is its 20-year track record, generating a 9.9% annual return and a cumulative gain of over 560%. This demonstrates a powerful ability to compound growth over decades, firmly establishing it not just as a reliable income stock, but as a formidable engine for long-term capital appreciation.

B/ NAV : a growing share price, except for the last ten years

An examination of Legal & General’s long-term share price performance shows a significant appreciation over time. Historical data indicates that the value of the shares has increased substantially since the company’s initial public offering. This long-term trend, which spans several decades, illustrates the company’s growth through various economic periods. The consistent upward trajectory appears to be correlated with the company’s established position and operational history within the financial services sector. This historical performance is often examined by market observers as an example of long-term value creation within the industry. Capital gains are great, but for income investors, dividends tell the real story.

C/ A slow dividend grower

Legal & General’s dividend history demonstrates a strong overall growth trajectory over the long term, rewarding shareholders with increasing payouts throughout most of the last two decades. However, a closer look reveals a notable event for income-focused investors: the dividend was significantly cut following the 2008 financial crisis. As shown in the chart below, this break in the trend clearly distinguishes the company from so-called ‘Dividend Aristocrats’ that have unbroken payment records. While the dividend was subsequently rebuilt and has grown substantially since, this historical event underscores that its payout, though often reliable, cannot be classified as ‘rock-solid.’ It remains subject to severe economic stress, a vital risk consideration for any portfolio dependent on dividend income.

In summary, Legal & General presents itself as a solid long-term investment, combining robust total returns, historical capital appreciation, and a growing dividend policy—albeit one marked by the notable risk of the 2008 cut. While its profile does not match that of an unquestionable “Dividend Aristocrat,” it reveals a resilient enterprise, capable of rebounding and continuing to reward its shareholders.

Beyond these past performances, it is precisely this combination of growth, income, and resilience that makes Legal & General particularly compelling for my personal portfolio. This leads me to examine in detail how this stock concretely aligns with my current objectives and structure.

III/ Why it fits my global income portfolio

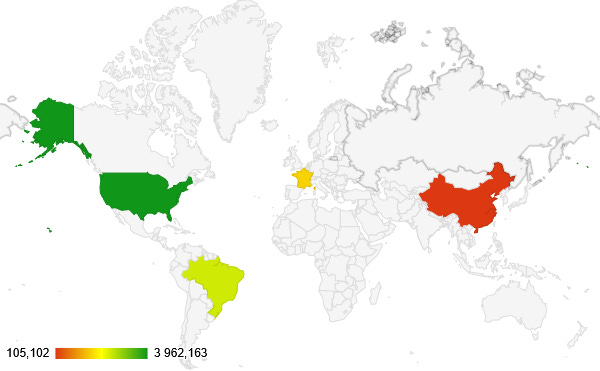

International point of view

Let’s use the I-CASH method now to see if this portfolio is a good fit for my current global holdings. From an international diversification standpoint, it’s perfect. I have no exposure to Great Britain and only a single holding in Europe (in France, to be specific). This might seem like a minor point, but as you can see on the map below, my global footprint is still too small. Legal & General allows me to add a British flavor to my portfolio. This is ideal for the ‘I’ (International) component of I-CASH.

C for currency diversification

Once again, the exercise is very straightforward since I have no direct exposure to British pounds (GBP). As the portfolio becomes more diversified, the challenge will lie in choosing which currency is the most performant. But we will deal with that later, and benchmarks will aid in the decision-making process. This is ideal for the ‘C’ (Currency) component of I-CASH.

A for asset class

At this stage, my portfolio remains too unbalanced, as the income is excessively derived from ETFs. The allocation to individual stocks is far too low. This is ideal for the ‘A’ (Asset Class) component of I-CASH.

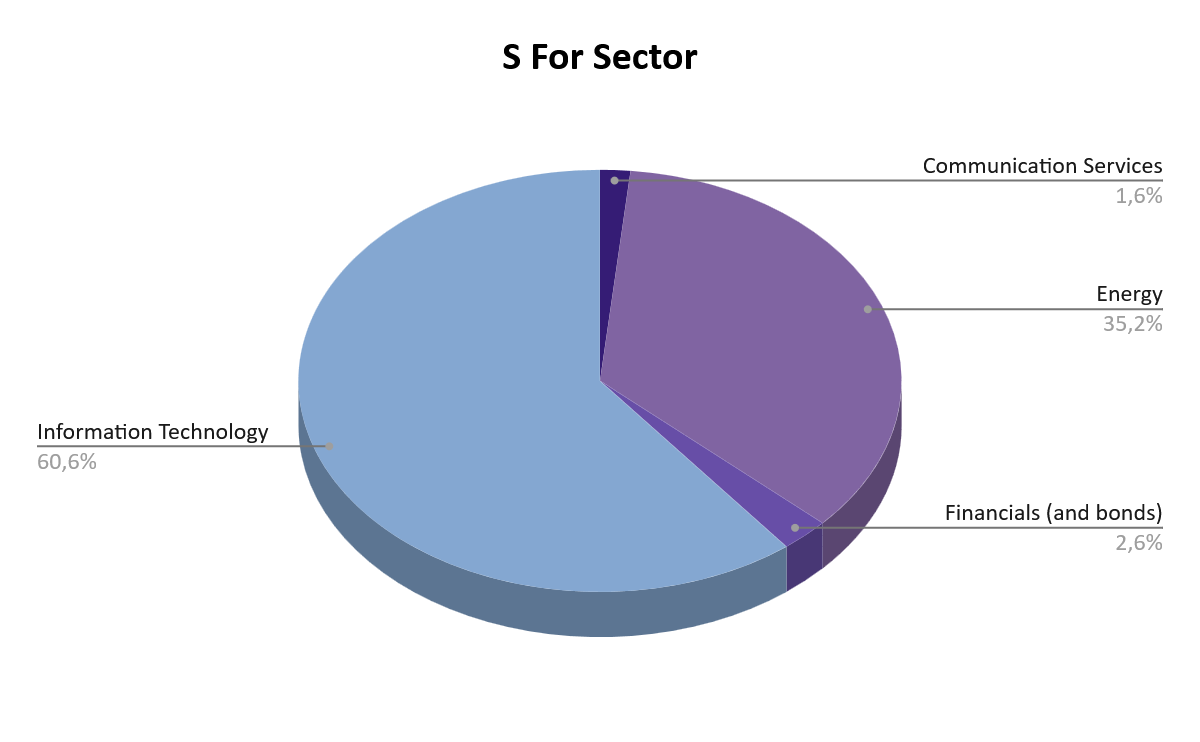

S for sector diversification

I am not at all comfortable with my overconcentration in the Information Technology sector (60.6%). The 35.2% weighting in Energy doesn’t worry me unduly; I would even be prepared to increase it if opportunities arose. The Financials sector (to which Legal & General belongs) is under-represented. Ideally, I should invest in new sectors, but that is not the immediate priority. This is acceptable for the ‘S’ (Sector) component of I-CASH.

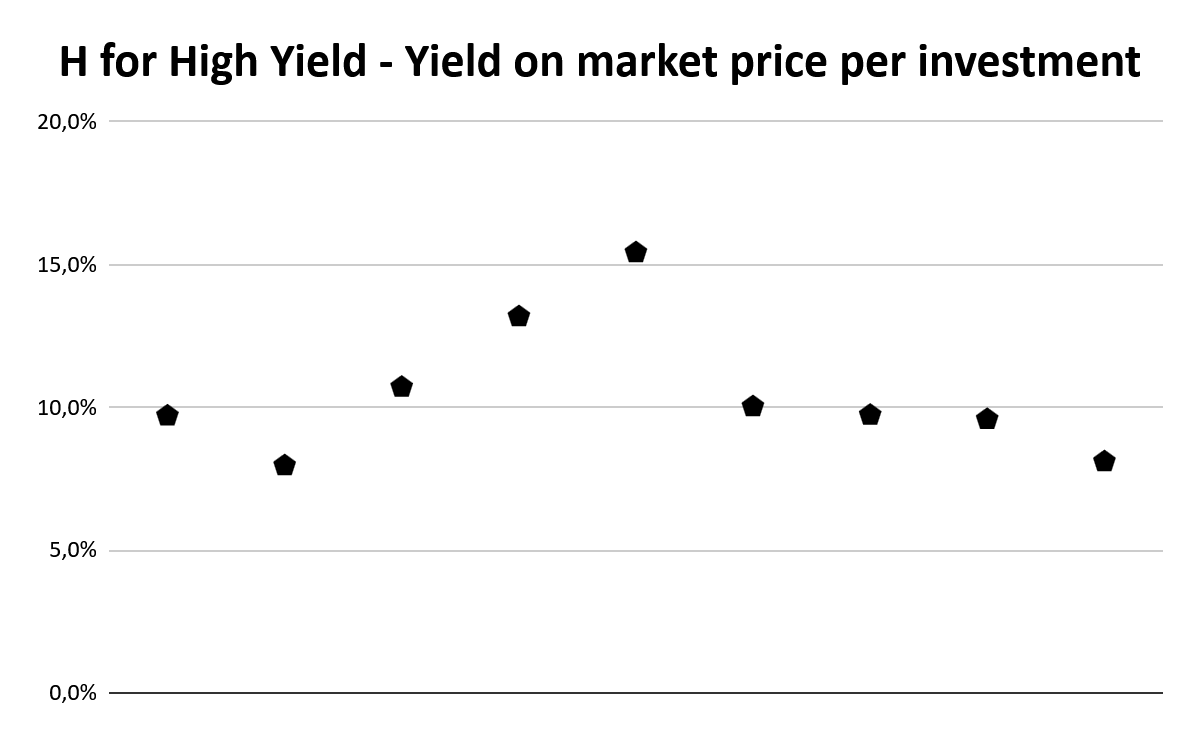

The dividend yield for Legal & General Group plc (LGEN.L) as of September 20, 2025 is 9.05%, based on the trailing twelve months (TTM) figure. This is calculated using the annual dividend rate of 21.36 pence per share divided by the current share price of 238.30 pence. This dividend yield is in the lower range of my portfolio but it is growing almost each year. So a growing 9 % dividend yield is on my short list, as I target double digit dividend yield. This is acceptable for the ‘H’ (High yield) component of I-CASH.

In conclusion, this is a stock that I like. It’s not a revolutionary pick, but it has a business model I understand; it’s predictable and doesn’t carry any major risk—at least, no more risk than the financial markets as a whole. The only significant risk is a dividend cut, like the one in 2008. I am prepared to live with that risk and would actually love to invest in this stock if its price were to fall, allowing me to acquire an asset with a 10% yield.

Investment takeaway

Legal & General is on my watch list. I am attracted by its high dividend, its history of rewarding shareholders, and its predictable business model, and I intend to hold it for decades. However, I plan to invest progressively, using the current dividends generated by my portfolio to fund the position.

Ideally, it will diversify my holdings and provide me with substantial dividend payments twice a year (in June and September).

There is no urgent need to invest in this company, but I am going to open a position and start building it as soon as my next dividend payments arrive, within the next two weeks at the latest.

If you enjoy these deep dives and want to follow how the portfolio performs, hit subscribe — I share one new idea every week.”

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.